Context:

Rare Earth Elements (REEs) are a group of 17 minerals that have become vital for modern industries and national security. They are used in a wide range of applications, including clean energy technologies, advanced electronics, defence systems, and medical equipment. Although these elements are not truly rare, they are difficult and costly to extract in pure form. China currently dominates global production and refining, creating concerns over supply chain dependence and strategic vulnerabilities. India has the third-largest reserves of REEs in the world, mainly found in coastal states like Andhra Pradesh, Odisha, Tamil Nadu, and Kerala. However, despite this potential, India produces less than one per cent of the global output. This situation highlights the need for effective policies, technological advancements, and sustainable practices to unlock the country’s resources and reduce reliance on imports.

What Are Rare Earth Elements?

Rare Earth Elements are a group of 17 elements, including 15 lanthanides plus scandium and yttrium. They share unique properties such as high density, magnetic strength, and the ability to conduct electricity. Despite the name, they are not truly rare in Earth’s crust. The main challenge is that they are rarely found in rich concentrations, making mining and processing expensive and technically demanding.

Sources:

The main minerals containing REEs are bastnasite, monazite, and loparite. In India, monazite is the primary source, especially in coastal sands. Monazite is also rich in thorium, a radioactive element, creating environmental and safety challenges during extraction.

Types of REEs:

Based on atomic number, REEs are categorised into:

- Light REEs (Cerium Group): Lanthanum, cerium, praseodymium, neodymium, samarium.

- Heavy REEs (Yttrium Group): Gadolinium, terbium, dysprosium, and others.

Light REEs are more abundant and easier to extract, while heavy REEs are scarcer and vital for high-technology uses.

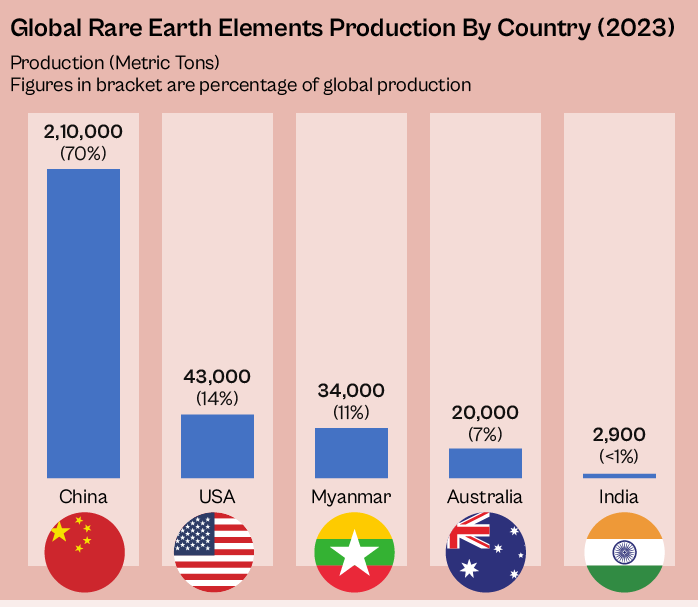

Global Production and China’s Dominance:

China has been the dominant player in the REE market since the 1990s. The Bayan Obo deposit in Inner Mongolia is the largest known reserve. In the 1980s, the US was the leading producer, mainly through mines in California. However, due to cheaper production costs, environmental laxity, and large-scale refining, China rapidly increased its share.

According to the United States Geological Survey (2025):

- China holds about 44 million metric tons of reserves.

- Brazil has 21 million metric tons.

- India has about 6.9 million metric tons.

- The US holds 1.9 million metric tons.

In 2024, China accounted for about 69% of global mining and over 90% of refining. However, projections suggest that by 2030, mining dominance will fall to 51% and refining to 76% as other countries ramp up production. This trend reflects international efforts to develop resilient, diversified supply chains due to geopolitical tensions and the strategic use of REE exports as leverage.

Why Are REEs So Important?

REEs are often described as the “seeds of modern technology.” Their unique properties make them critical in several sectors:

- Clean Energy: They are used in magnets inside wind turbines, electric vehicles, and smart batteries.

- Electronics: REEs are essential for smartphones, computer screens, televisions, and audio systems.

- Defence: They are used in precision-guided weapons, radars, avionics, and aircraft engines.

- Medical Equipment: MRI contrast agents, X-ray machines, and cancer treatment devices rely on REEs.

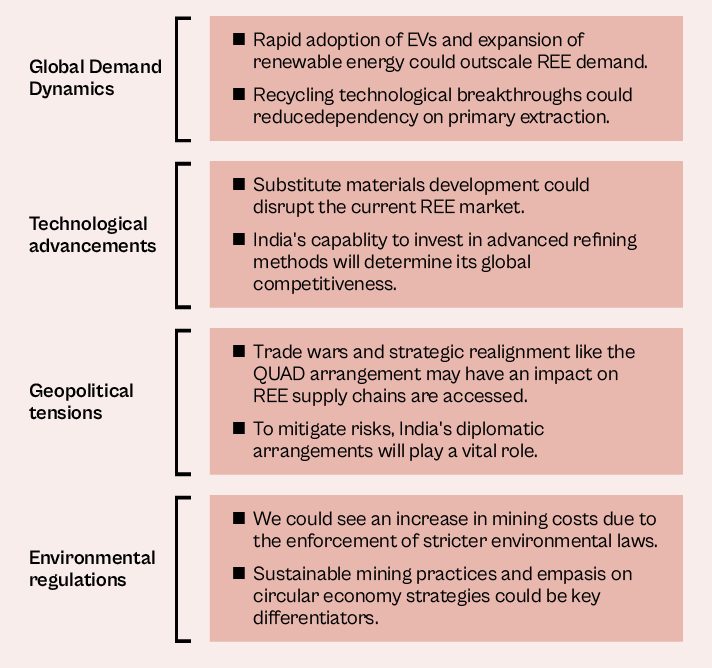

With the global push for renewable energy, digitalisation, and advanced military capabilities, the demand for REEs is set to grow sharply over the next two decades.

India’s Reserves and Production:

India has the third-largest reserves of REEs in the world. According to the Indian Minerals Yearbook (2023):

- Monazite resources are estimated at 12.73 million tonnes.

- Andhra Pradesh has the highest reserve, followed by Odisha, Tamil Nadu, and Kerala.

- Most Indian deposits are rich in light REEs such as cerium and lanthanum.

- Heavy REEs are limited in quantity, leading to reliance on imports for advanced technologies.

Despite this resource base, India produces less than 1% of global REEs. Extraction is mainly done by Indian Rare Earths Limited (IREL), a public sector undertaking. The private sector has played almost no role so far, mainly due to regulatory restrictions and complex processing requirements.

Policy Changes and the National Critical Mineral Mission

Recognising the strategic importance of REEs, India has begun reforming its policies. In 2023, the Mines and Minerals (Development and Regulation) Act was amended to classify REEs as “Critical Minerals.” This classification aims to prioritise exploration and streamline approvals.

In 2025, the government launched the National Critical Mineral Mission (NCMM) to increase self-reliance. The mission focuses on:

- Accelerating exploration and mapping of resources.

- Building domestic processing and refining capacity.

- Attracting private sector participation.

- Fostering international partnerships, especially with countries like Australia and the US.

- Developing recycling systems to recover REEs from e-waste.

International Developments

India is not alone in seeking alternatives to Chinese dominance. The US Department of Defense has invested over $439 million since 2020 to build domestic supply chains. However, refining remains a bottleneck—much of the ore extracted in the US still goes to China for processing. Similarly, the European Union and Japan are investing heavily in alternative supply chains.

India’s partnerships with Australia and the US aim to share technology, improve mining efficiency, and secure supplies of heavy REEs that are scarce domestically.

Challenges Facing India:

1. Environmental and Health Concerns: Monazite mining generates radioactive waste and toxic by-products. Strict environmental controls are essential but often slow down approvals.

2. Technological Limitations: India lacks advanced refining facilities and the expertise needed to process heavy REEs.

3. Infrastructure Gaps: Transport, storage, and processing infrastructure are underdeveloped, making scaling difficult.

4. Regulatory Hurdles: Multiple clearances and complex processes have discouraged private companies from entering the sector.

5. Global Competition: Even as India develops capacity, established suppliers will retain cost advantages and market relationships.

The Way Forward:

For India to become a significant player in the REE sector, a balanced approach is needed:

- Strengthen domestic production by attracting investment and modern technology.

- Develop refining and value-added manufacturing within the country.

- Encourage public-private partnerships and simplify regulations to ease entry barriers.

- Invest in research for safer and cleaner extraction techniques.

- Promote e-waste recycling as a supplementary source of REEs.

- Deepen international cooperation to secure technology transfers and diversify supply.

Conclusion:

Rare Earth Elements are indispensable to the technologies driving modern economies and national security. India’s substantial reserves place it in a strong position to reduce dependence on imports and contribute to global supply chain diversification. However, to unlock this potential, the country must overcome environmental, technological, and regulatory challenges. Recent reforms, such as the National Critical Mineral Mission, mark an important step forward. Success will depend on sustained investment, innovation, and a clear focus on sustainable and efficient development of these critical resources.

| Main question: Discuss the strategic significance of Rare Earth Elements (REEs) for India’s economic and security interests. What are the major constraints inhibiting India from becoming a leading producer despite having significant reserves? |