Context:

Recently, NITI Aayog has unveiled a landmark report titled “Chemical Industry: Powering India’s Participation in Global Value Chains”, setting the vision for India to emerge as a global chemical manufacturing powerhouse by 2040. The report provides an in-depth roadmap to harness the untapped potential of the sector and address key structural challenges through strategic interventions.

Key goals under the vision report:

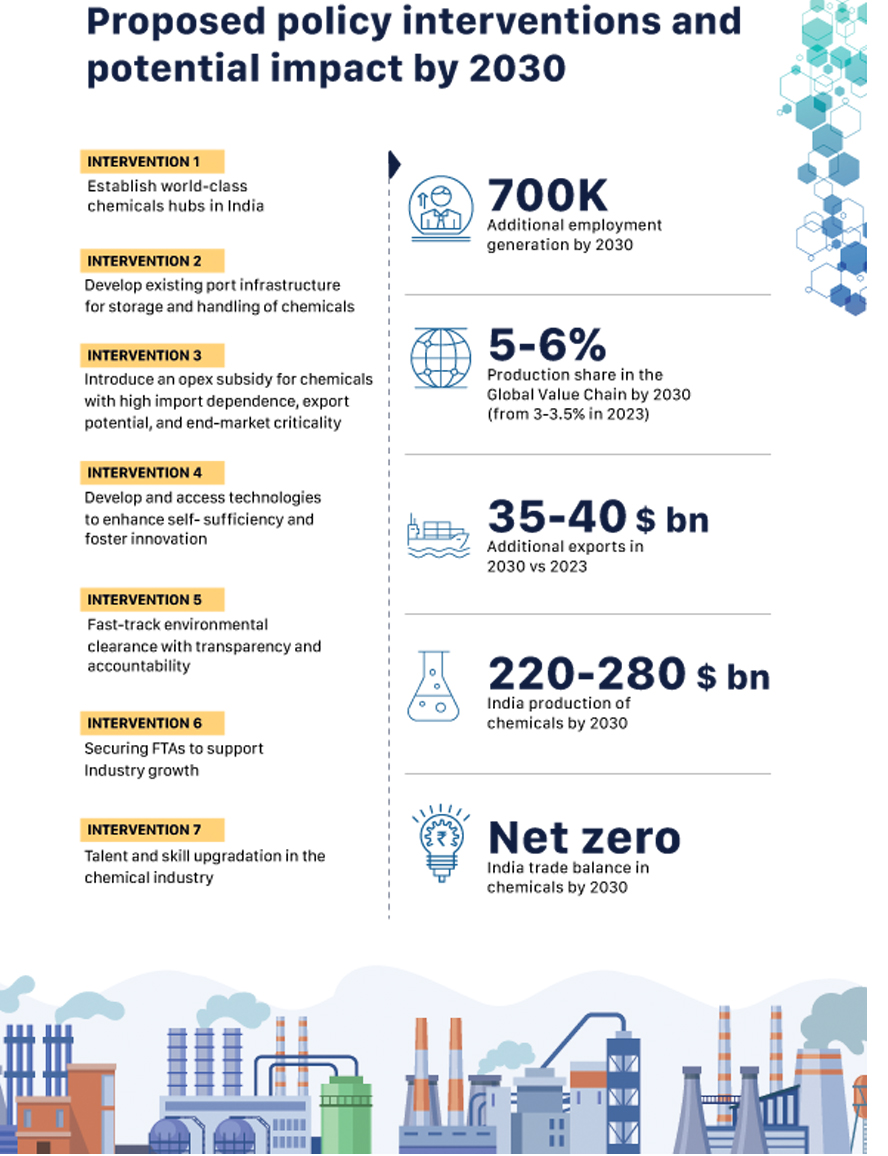

Key Goals by 2030:

- 5–6% share in global chemical GVCs

- 7 lakh new skilled jobs

- Net Zero chemical trade balance

- USD 35–40 billion in incremental exports

Vision for 2040:

By 2040, India aims to:

- Achieve a USD 1 trillion chemical industry

- Capture up to 12% of global chemical value chains

- Generate millions of skilled jobs

- Become a top-tier exporter in specialty and green chemicals

India currently accounts for 3.5% of the global chemical value chain (GVC) .The sector aims to reach USD 1 trillion in output by 2040, while closing the trade deficit of USD 31 billion recorded in 2023.

Challenges Hindering Growth

Despite its size and importance, India’s chemical industry faces critical bottlenecks that limit its global competitiveness:

- High Import Dependence: India relies heavily on imported feedstock and specialty chemicals, driving a trade deficit of USD 31 billion (2023).

- Weak Infrastructure: Outdated clusters, high logistics costs, and port inefficiencies raise production costs.

- Low R&D Spending: At just 0.7% of total investment, India lags behind the global average of 2.3% in chemical R&D.

- Regulatory Delays: Environmental clearance bottlenecks slow down project execution.

- Skilled Manpower Deficit: A 30% shortfall in trained professionals, especially in green chemistry and process safety, undermines sectoral growth.

Strategic Interventions Proposed by NITI Aayog:

NITI Aayog’s report outlines a streamlined set of reforms to boost India's chemical sector competitiveness through fiscal, infrastructural, regulatory, and talent-based initiatives:

1. Chemical Hubs

o Upgrade existing clusters, develop new parks

o Set up a central Chemical Fund and local administrative bodies

2. Port Infrastructure

o Form a Chemical Port Committee

o Enhance 8 high-potential clusters for exports

3. Opex Subsidy Scheme

o Incentivize key chemical production

o Focus on reducing imports and boosting exports

4. R&D & Innovation

o Strengthen industry-academia linkages via dedicated interface

o Partner with MNCs for advanced technologies

5. Regulatory Reforms

o Fast-track environmental clearances via DPIIT audit committee

o Improve transparency and monitoring

6. FTAs for Growth

o Secure chemical-specific trade provisions

o Simplify FTA access and compliance for exporters

7. Skill Development

o Expand training institutes and vocational programs

o Introduce industry-focused courses and teacher upgrades

Conclusion:

Achieving these goals requires coordinated action from central and state governments, industry stakeholders, academic institutions, and investors. The scale and speed of implementation will determine India's transformation into a global value chain leader in chemicals by 2040