Context:

On August 27, 2025, the United States implemented an additional 25% tariff on Indian goods, bringing the total tariff burden to 50% on several key Indian exports. The move, justified under national security concerns due to India’s purchase of Russian crude oil, marks a significant escalation in the ongoing US-India trade tensions. According to a report by SBI Research, these tariffs are expected to reduce US GDP growth by 40–50 basis points (bps) in FY2025 and intensify inflationary pressures.

Key Observations from SBI Report:

- US GDP Growth Halved: Economic growth slowed from 2.5% in H1 2024 to 1.2% in H1 2025, coinciding with the first five months of the Trump administration and tariff escalation.

- Rising Inflation: US inflation surged to 2.7% in July 2025, a sharp rise of 202 basis points from June, driven by pass-through effects of tariffs and a weaker dollar.

- Inflation Likely above Target Till 2026: Import-sensitive sectors such as electronics, autos, and consumer durables are witnessing the highest price hikes.

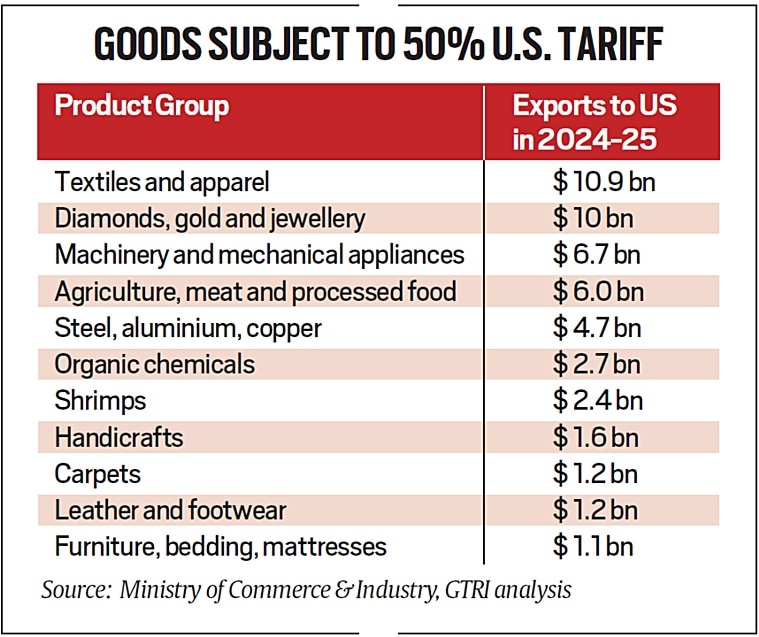

- Affected Trade Volume: An estimated $45 billion worth of Indian goods will be affected by the 50% tariffs.

Impact on the US Economy:

1. GDP Erosion:

o Tariff-induced cost pressures are estimated to shave 40–50 bps off US GDP this fiscal.

o Growth already slowed to 1.2% in Jan–June 2025.

2. Worsening Inflation:

o Tariffs increase the cost of imports, pushing consumer prices higher, especially in sectors like furniture, clothing, and processed goods.

o The Producer Price Index has shown the steepest rise in over three years.

3. Fragile Labor Market and Policy Dilemma:

o The Federal Reserve faces a challenging trade-off between controlling inflation and protecting jobs.

o Fed Chair Jerome Powell acknowledged that the effects of tariffs on prices are “now clearly visible.”

Impact on the Indian Economy:

1. Key Export Sectors Affected:

o Textiles and Apparel: Employs 45 million, contributes 2.3% to GDP, and exports heavily to the US. India’s growing share in the US market now faces a setback.

o Gems & Jewellery: The US accounts for one-third of India’s $28.5 billion annual shipments. A $10 billion trade exposure is at risk.

o Seafood (Shrimp): Over 50% of exports go to the US. Higher tariffs could lead to order cancellations and market share loss to competitors like Ecuador.

2. Trade Surplus at Risk:

o India had a $41 billion trade surplus with the US in FY25.

o With $45 billion in exports now under heavy tariff, this surplus may turn into a deficit unless mitigated by diversification and trade diplomacy.

Conclusion:

The recent tariff hikes represent a classic trade war scenario with no immediate winners. While the US aims to assert geopolitical pressure, it risks domestic inflation, GDP contraction, and policy complications. For India, the tariff escalation threatens key labour-intensive sectors, particularly MSMEs in textiles and jewellery.