Context

Unified Pension Scheme (UPS) for Central Government Employees

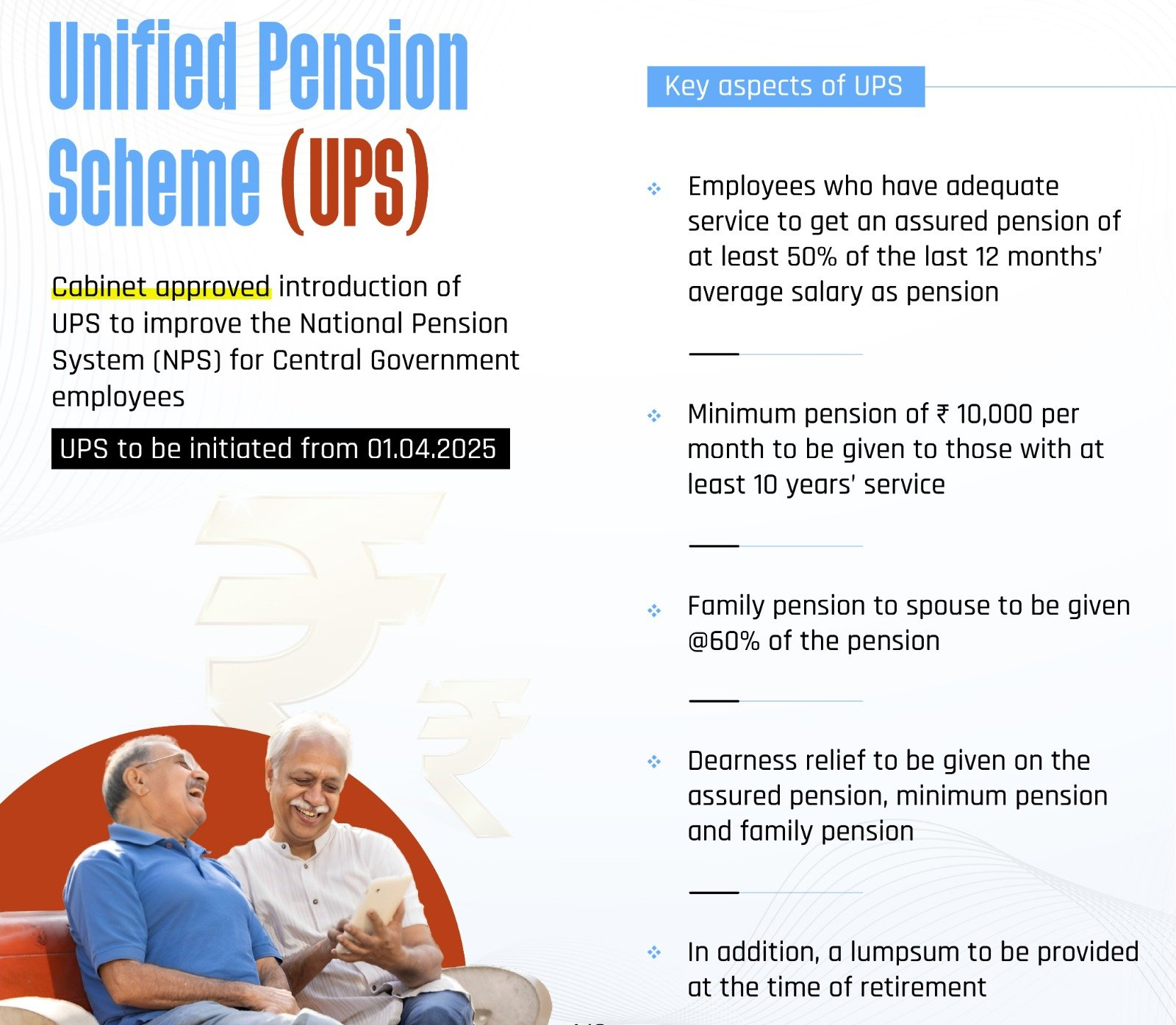

The Unified Pension Scheme (UPS), introduced for Central Government employees under the National Pension System (NPS), came into effect on April 1, 2025. Recently, the deadline to opt for it has been extended to September 30, 2025.

Background:

-

- Old Pension Scheme (OPS): In place before January 1, 2004, it guaranteed a fixed pension of 50% of last drawn salary plus dearness allowance. No employee contribution was required.

- National Pension System (NPS): Introduced in 2004, it made pensions market-linked, requiring contributions from both employee and employer. However, it does not guarantee a fixed payout.

- Unified Pension Scheme (UPS): Announced in 2024 after recommendations of the Somanathan Committee (2023), the UPS aims to strike a balance between OPS’s assured pension and NPS’s fund-based structure. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

- Old Pension Scheme (OPS): In place before January 1, 2004, it guaranteed a fixed pension of 50% of last drawn salary plus dearness allowance. No employee contribution was required.

Key Features of UPS:

1. Eligibility:

o Applicable to all existing Central Government employees covered under NPS as of April 1, 2025.

o New recruits joining after April 1, 2025, will also be eligible.

o Covers employees who retired or voluntarily retired before March 31, 2025, and even their legally wedded spouses (if the employee has passed away before opting).

2. Contributions:

o Employee: 10% of basic pay + DA.

o Employer: 10% of basic pay + DA.

o Additional Government contribution: 8.5% of basic pay + DA into a pool corpus to support assured payouts.

3. Assured Benefits:

o 50% of the average basic pay of the last 12 months before retirement, provided the employee has completed 25 years of service.

o Minimum assured payout: ₹10,000/month after completing at least 10 years of service.

o Proportionate pension: For service between 10 and 25 years.

o Family pension: Upon the pensioner’s death, the spouse receives 60% of the assured payout.

o Dearness Relief (DR): Payable as notified by the government.

4. Other Provisions:

o A one-time option exists to revert from UPS back to NPS, but only before superannuation or voluntary retirement.

o UPS allows a lump-sum withdrawal: 1/10th of last basic pay + DA for every completed six months of service.

o Employees dismissed from service are not eligible for assured payouts.

Reason behind low adoption:

Uptake of UPS has been slow – only about 40,000 of 23.94 lakh employees have opted so far.

· UPS offers more security than NPS, but many unions are not satisfied.

· Unions continue to demand restoration of OPS, which required no employee contribution and gave higher certainty.

· UPS still requires employee contributions, unlike OPS, making it less attractive.

· Complex rules and a short decision window have also reduced adoption.

Conclusion:

The Unified Pension Scheme is an important milestone in India’s pension reforms, designed to ensure post-retirement stability for government employees while containing fiscal risks. It reflects the state’s attempt to reconcile employee welfare with economic prudence. However, whether it becomes widely accepted or remains overshadowed by demands for OPS will be clear only in the coming years.