Context:

On October 10, 2025, U.S. President Donald Trump announced the imposition of 100% tariffs on all Chinese imports, effective November 1, marking a significant escalation in an already volatile trade relationship. This development follows China’s sweeping export restrictions on rare earth elements (REEs) and associated technologies, particularly those involving military and semiconductor applications.

Background:

China announced new export controls covering additional rare earth elements and related technologies.

· The new rules require export licences for items using even trace amounts of Chinese rare earths (≥ 0.1 %) and restrict technologies for mining, magnet production, and recycling.

· China cites national security, non‑proliferation, and dual‑use risk as rationales.

About Rare Earth Elements:

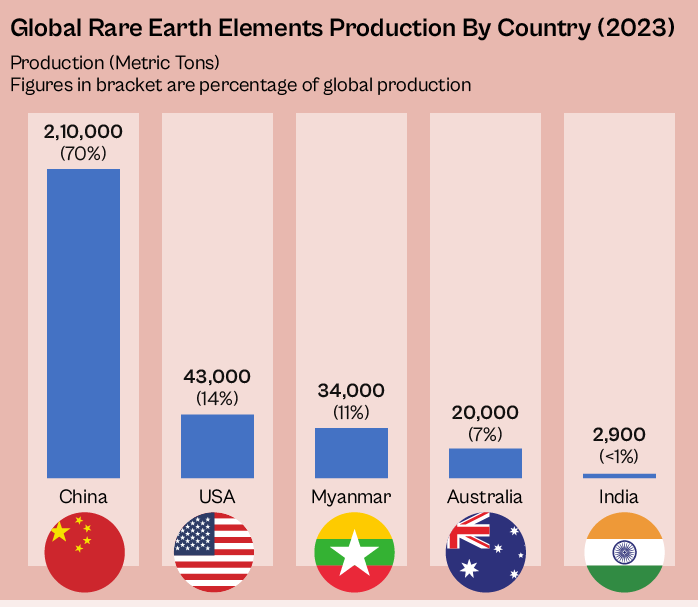

Rare earth elements (REEs) are 17 metallic elements used in high‑tech applications: magnets, motors, electronics, renewable energy, aerospace, and defense. China dominates the global market—mining ~60 % and processing ~90 % of rare earths. Because of this dominance, China’s policies can create supply chokepoints.

Implications:

· Supply Chain Disruption & Cost Spikes: Industries like electronics, electric vehicles, defense, and semiconductors could face material shortages, higher costs, and delays.

· Tariff Fallout & Consumer Impact: U.S. retailers warn the 100 % tariff would push up consumer prices.

· Domestic Backlash in China: China’s own rare earth and magnet producers are hurt, exports have dropped and inventories piled up.

· Geopolitical & Strategic Leverage: Rare earths become a bargaining chip: China may use its grip to extract concessions, while the U.S. and allies accelerate efforts to diversify sources.

· Risk of Escalation: The confluence of tariffs and resource control raises the threat of a full‑scale trade war, with negative spillovers for global growth.

Conclusion:

The U.S.–China standoff over tariffs and rare earth export controls marks a tectonic shift: economic policy, technology, and resource control are now deeply entangled. China’s dominance over rare earth supply gives it strategic leverage, but the retaliation potential and global backlash make this a risky game. If diplomacy fails, the escalation could usher in a more volatile, resource‑centric trade war—one with high stakes for industries, consumers, and geopolitical stability.