Context:

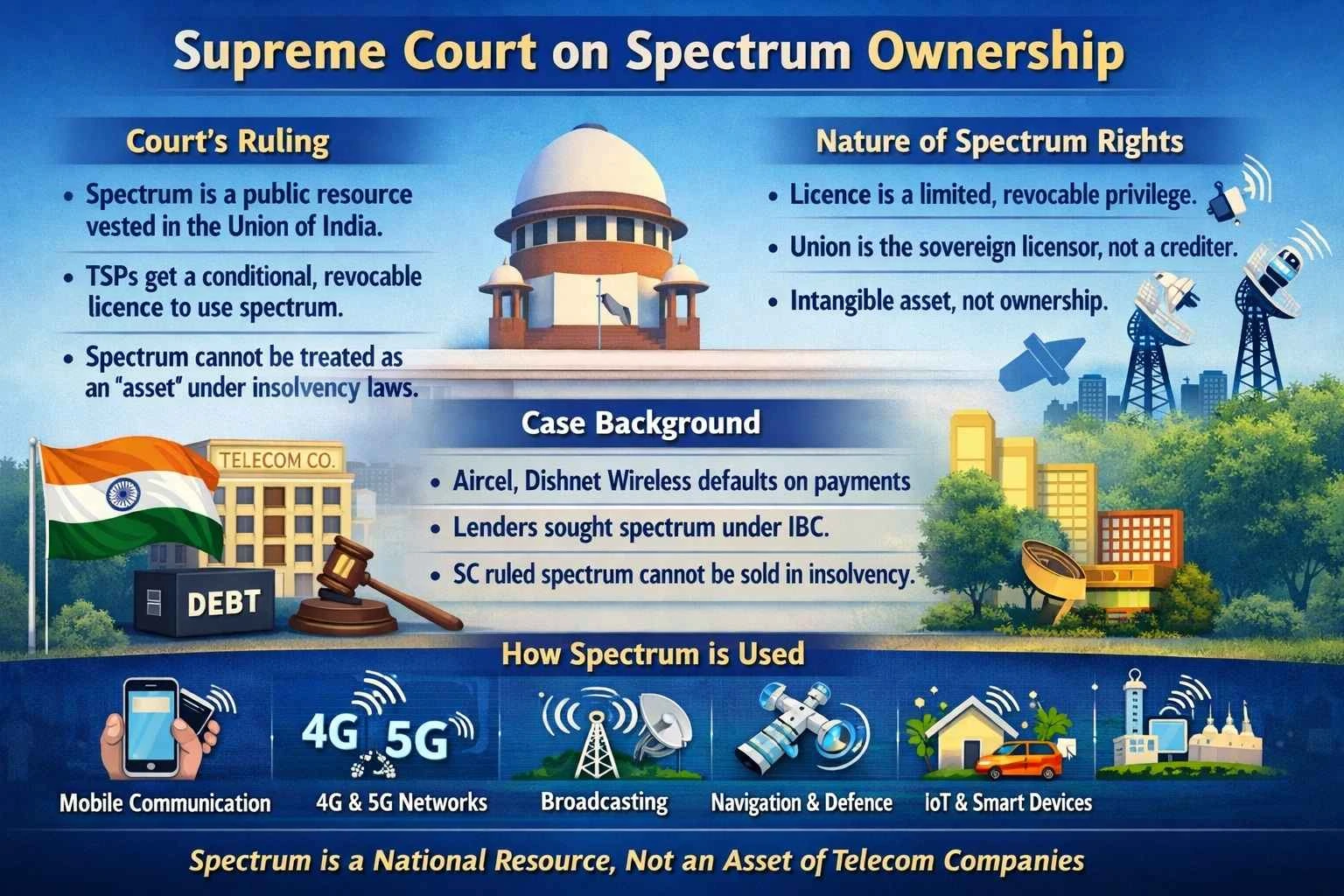

Recently, the Supreme Court of India ruled that the spectrum held by bankrupt telecom operators cannot be sold to repay lenders. This issue arose from insolvency proceedings involving companies such as Aircel Ltd and Reliance Communications (RCom), whose lenders had sought to monetise spectrum usage rights to recover debts. The judgment clarified the legal status of spectrum under the Insolvency and Bankruptcy Code (IBC), 2016, emphasising that such resources cannot be treated as corporate assets.

Legal and Constitutional Reasoning:

The Supreme Court held that telecom spectrum is a scarce public resource owned by the Union of India and held in trust for its citizens. Licences granted to telecom service providers allow usage but do not confer ownership rights. The IBC does not permit liquidation of assets that the debtor does not own. Even conditional transfer under a licence does not equate to ownership, reinforcing the primacy of sectoral laws over insolvency provisions.

Economic and Sectoral Implications:

The ruling impacts lenders and financial institutions by limiting recovery options and potentially increasing NPAs. Future telecom financing may involve stricter risk assessments. For the government, sovereign control over spectrum is reinforced, enabling reallocation through auctions or re-licensing. The judgment also clarifies the treatment of statutory licences in insolvency cases, balancing public interest with creditor rights.

About Insolvency and Bankruptcy Code (IBC), 2016:

The IBC, 2016 is India’s comprehensive, creditor-driven law for the time-bound resolution of distressed companies and individuals. It consolidated archaic laws to expedite recovery, with a 180-day timeline (extendable up to 270 days) for insolvency resolution or liquidation. Its objectives include maximising asset value, improving ease of doing business, and reducing Non-Performing Assets (NPAs).

Key Aspects:

-

-

-

- Objective: A swift and efficient legal framework for corporate, partnership, and individual insolvency.

- Time-Bound Process: CIRP completion mandated within 180 days, extendable up to 270 days.

- Institutions: Insolvency and Bankruptcy Board of India (IBBI), National Company Law Tribunal (NCLT), Debt Recovery Tribunal (DRT), and Information Utilities (IUs).

- Process Initiation: Can be triggered by financial creditors, operational creditors, or the debtor itself.

- Committee of Creditors (CoC): Financial creditors decide the company’s future (revival or liquidation).

- Objective: A swift and efficient legal framework for corporate, partnership, and individual insolvency.

-

-

Impact & Challenges:

Over 1,194 companies had been resolved as of March 2025, with creditors recovering over ₹3.89 lakh crore. The IBC has shifted power from “debtor-in-possession” to “creditor-in-control,” though delays in admission and resolution remain a challenge.

Conclusion:

The Supreme Court’s decision reaffirms spectrum as a public trust resource and aligns insolvency law with sectoral regulation. By distinguishing ownership from licensing rights, it safeguards public resources while providing clarity to lenders and regulators. The ruling strengthens the framework of the IBC and sets a precedent for how statutory licences and natural resources are treated in corporate insolvency, ensuring long-term governance and financial stability.