Context:

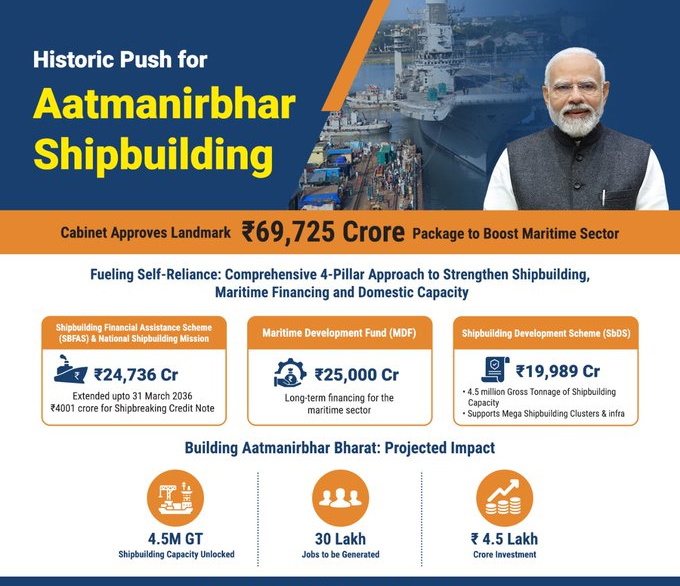

The Union Cabinet, chaired by Prime Minister Narendra Modi, recently approved a comprehensive package worth ₹69,725 crore to revitalise India's shipbuilding and reduce dependence on foreign ships as part of the government's plan to regain the country's maritime power.

Key Components of the Package:

The package is built on four pillars:

|

Pillar |

Aim / Intervention |

Budget / Details |

|

(a) Shipbuilding Financial Assistance Scheme (SBFAS) |

Extend assistance until 31 March 2036; motivate shipyards; promote recycling of old ships via a credit note; oversight via a National Shipbuilding Mission. |

Total corpus ₹24,736 crore; includes ₹4,001 crore for the Shipbreaking Credit Note; includes small amount for the National Shipbuilding Mission (₹181 crore) |

|

(b) Maritime Development Fund (MDF) |

Provide long‑term financing (equity + debt) to make maritime projects bankable; reduce debt cost via interest incentives. |

₹25,000 crore corpus: ₹20,000 crore as Maritime Investment Fund (49% Govt participation), ₹5,000 crore as Interest Incentivisation Fund. |

|

(c) Shipbuilding Development Scheme (SbDS) |

Expand and strengthen domestic shipbuilding capacity; develop clusters; provide risk cover & insurance; enhance infrastructure & technology; boost greenfield & brownfield yards. |

Outlay of ₹19,989 crore: includes ~ ₹9,930 crore for greenfield clusters, ₹8,261 crore for brownfield expansion, ₹305 crore for India Ship Technology Centre, ₹1,443 crore for risk‑related credit cover. Capacity target: ~ 4.5 million Gross Tonnage (GT) annually. |

|

(d) Legal, Taxation & Policy Reforms |

Improve enabling environment: grant infrastructure status to large ships; ship registration & MRO services GST considerations; regulatory simplification; strengthen institutions. |

Infrastructure status will apply to: commercial vessels with 10,000 GT or more that are Indian‑owned and flagged; and vessels built in India with 1,500 GT or more, also Indian‑owned/flagged. |

Rationale behind this package:

· India’s maritime sector handles nearly 95% of trade by volume and 70% by value.

· Historically, Indian shipyards have had low share in global shipbuilding tonnage (~ 0.07%) and heavy dependence on foreign vessels for EXIM trade.

· Strategic, economic, and supply‑chain resilience concerns (energy, food security, defence) prompted the government to take bold action

Expected Outcomes & Targets:

-

- Unlock 4.5 million GT of shipbuilding capacity.

- Generate ~ 30 lakh jobs (3 million) over time.

- Attract investment of ~ ₹4.5 lakh crore into India’s maritime sector.

- Build 2,500+ vessels over the scheme period.

- Unlock 4.5 million GT of shipbuilding capacity.

Strategic Significance:

-

- Strengthens India’s Make in India posture; reduces dependency on foreign shipyards & foreign flag / foreign vessels for critical trade routes.

- Enhances national security & strategic autonomy through self‑reliance in shipbuilding.

- Boosts economic multiplier effects: upstream industries (steel, engines, electronics), downstream services (repair, maintenance), and regional development

- Strengthens India’s Make in India posture; reduces dependency on foreign shipyards & foreign flag / foreign vessels for critical trade routes.

Conclusion:

The ₹69,725 crore package represents a landmark policy step to put India on a path to becoming a major global shipbuilding power. If well implemented, it can offer economic, strategic, and employment dividends. However, success depends heavily on execution, reform coherence, and demand creation.