Context:

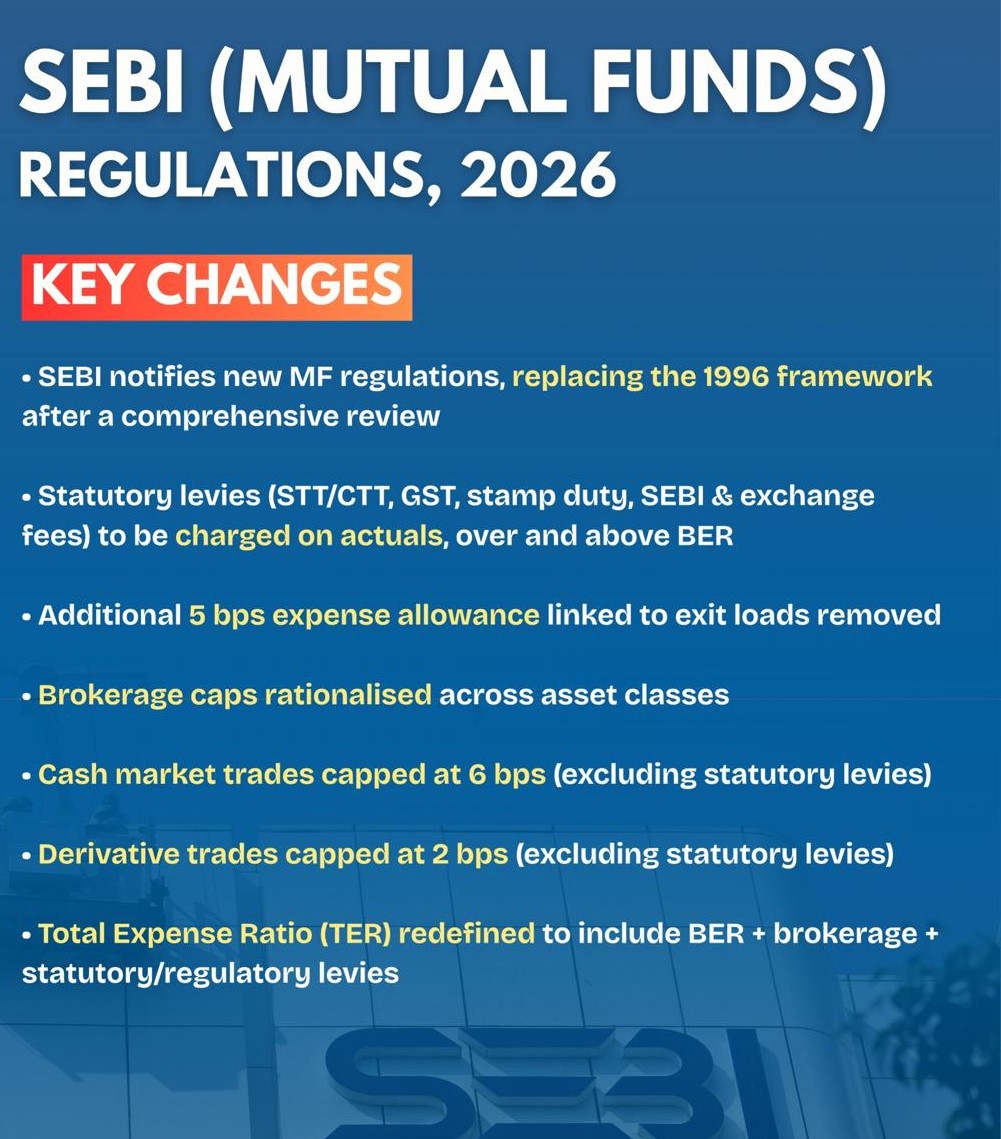

The Securities and Exchange Board of India (SEBI) has approved a comprehensive overhaul of mutual fund regulations aimed at enhancing transparency, reducing costs for investors, and simplifying compliance. The new framework, to be titled the SEBI (Mutual Funds) Regulations, 2026, will replace the nearly three-decade-old 1996 regulations and introduce wide-ranging reforms covering expense structures, fund operations, and governance standards.

Key Changes in Mutual Fund Regulations:

1. Expense Ratio Framework

-

- SEBI has redefined the Total Expense Ratio (TER) by introducing a Base Expense Ratio (BER).

- Statutory and regulatory levies such as GST, STT, stamp duty, and other statutory charges will be excluded from the BER and charged separately on an actuals basis.

- This reform provides investors with a clearer breakdown of fund costs and significantly enhances cost transparency.

- SEBI has redefined the Total Expense Ratio (TER) by introducing a Base Expense Ratio (BER).

2. Reduced Expense Caps

-

- The BER limits have been lowered across multiple categories of mutual fund schemes.

- For index funds and Exchange Traded Funds (ETFs), the expense cap has been reduced from 1.0% to 0.9% (excluding statutory levies).

- Similar reductions across other fund categories are expected to lower management costs and improve investor returns over the long term.

- The BER limits have been lowered across multiple categories of mutual fund schemes.

3. Lower Brokerage Limits

-

- SEBI has significantly reduced the maximum brokerage fees payable by mutual funds:

- Equity cash market transactions: Cap reduced from 12 basis points (bps) to 6 bps.

- Derivative transactions: Cap reduced from 5 bps to 2 bps.

- Equity cash market transactions: Cap reduced from 12 basis points (bps) to 6 bps.

- These measures aim to curb hidden transaction costs and align fund operations more closely with investor interests.

- SEBI has significantly reduced the maximum brokerage fees payable by mutual funds:

4. “Skin in the Game” Rule

-

- Senior employees of Asset Management Companies (AMCs) are now mandated to invest a portion of their compensation in the mutual fund schemes they manage.

- This provision ensures better alignment of interests between fund managers and investors, strengthening accountability and governance.

- Senior employees of Asset Management Companies (AMCs) are now mandated to invest a portion of their compensation in the mutual fund schemes they manage.

5. Mandatory Stress Testing

-

- Mutual fund schemes are required to conduct stress tests under adverse market conditions and publicly disclose the results.

- This enhances transparency regarding portfolio risks and supports informed investor decision-making.

- Mutual fund schemes are required to conduct stress tests under adverse market conditions and publicly disclose the results.

6. NFO Fund Deployment Norms

-

- Funds raised during a New Fund Offer (NFO) must be deployed within 30 business days.

- In cases of delayed deployment, investors must be provided an exit option without any exit load, thereby safeguarding investor interests.

- Funds raised during a New Fund Offer (NFO) must be deployed within 30 business days.

Investor Impact and Benefits:

1. Enhanced Transparency

-

- The clear separation of management expenses and statutory levies enables investors to better assess the true cost of investing in mutual fund schemes.

- The clear separation of management expenses and statutory levies enables investors to better assess the true cost of investing in mutual fund schemes.

2. Potentially Lower Costs

-

- Reduced expense ratios and brokerage caps ensure that a larger portion of investor capital remains invested, potentially improving long-term net returns.

- Reduced expense ratios and brokerage caps ensure that a larger portion of investor capital remains invested, potentially improving long-term net returns.

3. Improved Governance

-

- Measures such as mandatory employee investment and public stress-test disclosures strengthen investor confidence and promote responsible fund management practices.

- Measures such as mandatory employee investment and public stress-test disclosures strengthen investor confidence and promote responsible fund management practices.

4. Simpler Investment Decisions

-

- Clearer scheme naming norms and the reduction of duplicate strategies within AMCs make it easier for investors to choose products aligned with their financial goals.

- Clearer scheme naming norms and the reduction of duplicate strategies within AMCs make it easier for investors to choose products aligned with their financial goals.

Conclusion:

SEBI’s regulatory overhaul represents a significant step towards modernising India’s mutual fund framework by balancing investor protection, transparency, and market efficiency. By lowering costs, clarifying expense structures, and strengthening governance standards, the reforms aim to foster trust in the mutual fund ecosystem, encourage greater retail participation, and ensure that investor interests remain central to fund management practices.