Context:

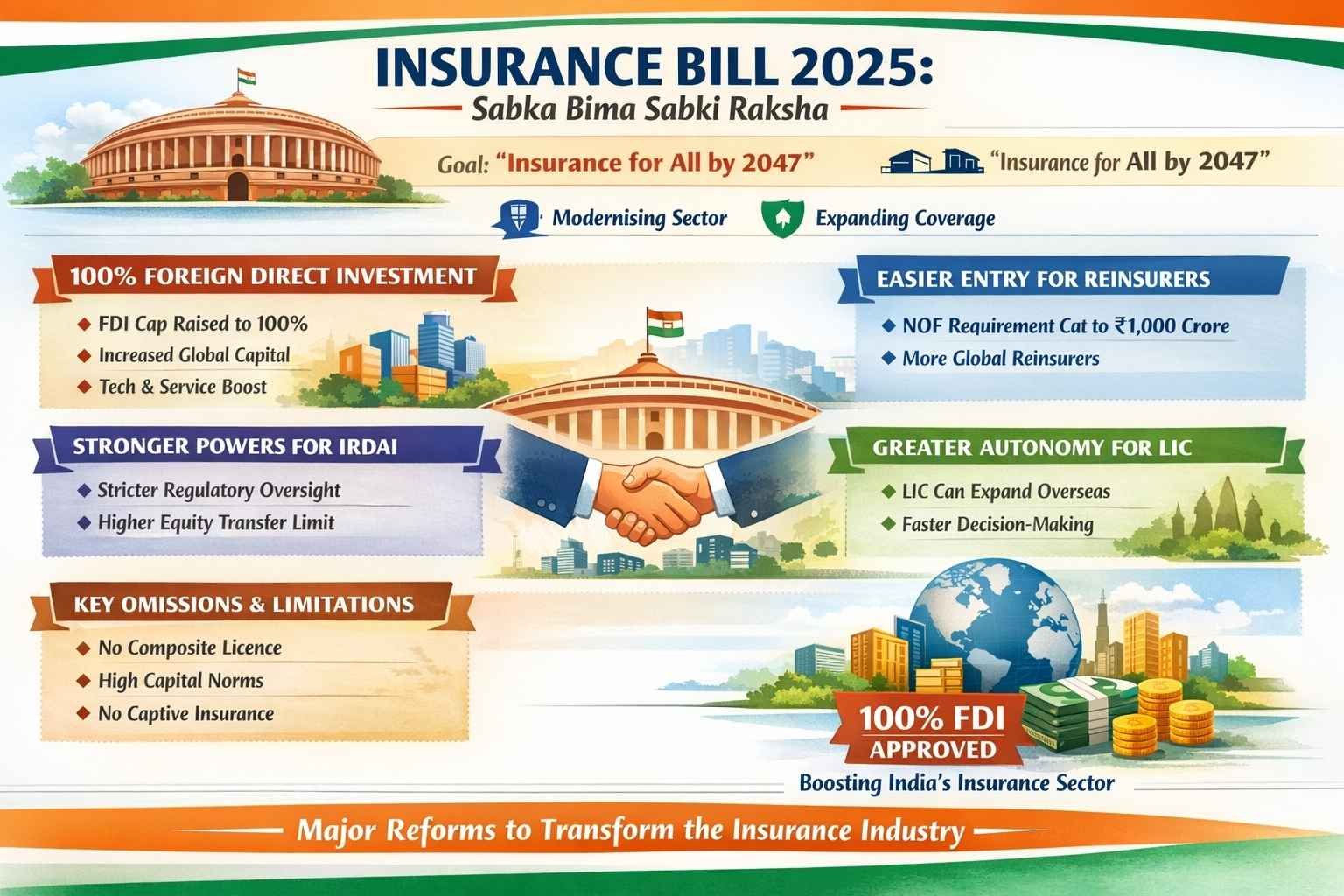

Recently, the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 was passed in the Lok Sabha. This legislative reform aims to modernize India’s insurance regulatory framework and significantly liberalize foreign investment norms in the sector.

Background:

-

-

- India’s insurance sector has historically been governed by three key statutes:

- The Insurance Act, 1938

- The Life Insurance Corporation (LIC) Act, 1956

- The Insurance Regulatory and Development Authority of India (IRDAI) Act, 1999

- The Insurance Act, 1938

- The Bill seeks to amend these Acts to modernize regulations, liberalize investment norms, and enhance oversight in India’s insurance sector.

- India’s insurance sector has historically been governed by three key statutes:

-

Key Provisions of the Bill:

-

-

- 100% FDI in Indian Insurance Companies: Increases the foreign direct investment (FDI) limit from 74% to 100%, allowing full foreign ownership.

- Lower Net-Owned Fund Requirements for Foreign Re-insurers: Reduces the minimum net-owned fund requirement from ₹5,000 crore to ₹1,000 crore, encouraging global participation.

- Registration of Share Transfers: IRDAI approval is required only when the value of shares transferred exceeds 5% of paid-up share capital, up from 1%.

- Insurance Co-operative Societies: Removes the minimum paid-up share capital requirement of ₹100 crore, simplifying entry for co-operative insurers.

- Applicability to SEZs and IFSCs: Extends provisions for regulatory modifications to International Financial Services Centres (IFSCs) and intermediaries operating in SEZs.

- Expansion of Insurance Intermediaries: Broadens the definition to include managing general agents and insurance repositories.

- Enhanced Powers of IRDAI: IRDAI can approve arrangements with non-insurance companies, supersede boards of insurers if policyholder interests are at risk, regulate remuneration and commissions, and inspect intermediaries.

- Policyholders’ Education and Protection Fund: Establishes a Fund administered by IRDAI to protect policyholders and promote awareness, funded through grants, penalties, and other specified sources.

- 100% FDI in Indian Insurance Companies: Increases the foreign direct investment (FDI) limit from 74% to 100%, allowing full foreign ownership.

-

Expected Impact:

-

-

- Capital Inflows and Competition: Full foreign ownership is expected to attract long-term global capital, promote competition, and introduce international best practices in underwriting, risk management, and customer service.

- Market Expansion and Penetration: With insurance penetration in India below global averages, enhanced capital and competition could drive innovation, product diversity, digital adoption, and market expansion into underserved regions.

- Strengthened Policyholder Protection: Provisions like the Policyholders’ Education and Protection Fund, along with improved regulatory oversight, aim to boost consumer trust and safeguard policyholder interests.

- Structural and Regulatory Efficiency: Amending legacy laws and creating unified regulatory norms will reduce compliance friction, simplify licensing, and empower IRDAI to act decisively in a rapidly evolving financial landscape.

- Capital Inflows and Competition: Full foreign ownership is expected to attract long-term global capital, promote competition, and introduce international best practices in underwriting, risk management, and customer service.

-

Conclusion:

The Bill represents a major reform to modernise India’s insurance ecosystem through liberalised investment and stronger regulation. By attracting global capital and enhancing policyholder protection, it advances the vision of inclusive insurance coverage for all by 2047.