Context:

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC), in its 56th meeting held from August 4–6, 2025, has unanimously decided to maintain the repo rate at 5.5%, while continuing with a neutral monetary policy stance. The decision aims to balance price stability with economic growth, especially in a volatile global environment.

Key Highlights of meeting:

- Repo Rate: Held steady at 5.5%

- GDP Growth Forecast: Maintained at 6.5% for FY 2025-26, citing strong domestic demand and robust government spending

- CPI Inflation Projection: Revised down to 3.1% from 3.7% due to a fall in food inflation and better agricultural output

- Monetary Policy Stance: Neutral, offering flexibility to adjust in response to evolving macroeconomic conditions

Rationale behind the Decision

- Benign Inflation Outlook: CPI inflation dropped to a 77-month low of 2.1% in June 2025, supported by a good monsoon and supply-side measures

- Steady Core Inflation: Core inflation remains moderate around 4.4%, not requiring immediate tightening

- Global Uncertainty: Ongoing geopolitical tensions, trade policy shifts, and financial market volatility pose risks to India’s external sector

- Domestic Resilience: Despite external headwinds, India’s economy shows strong consumption, investment, and fiscal momentum

Economic Implications

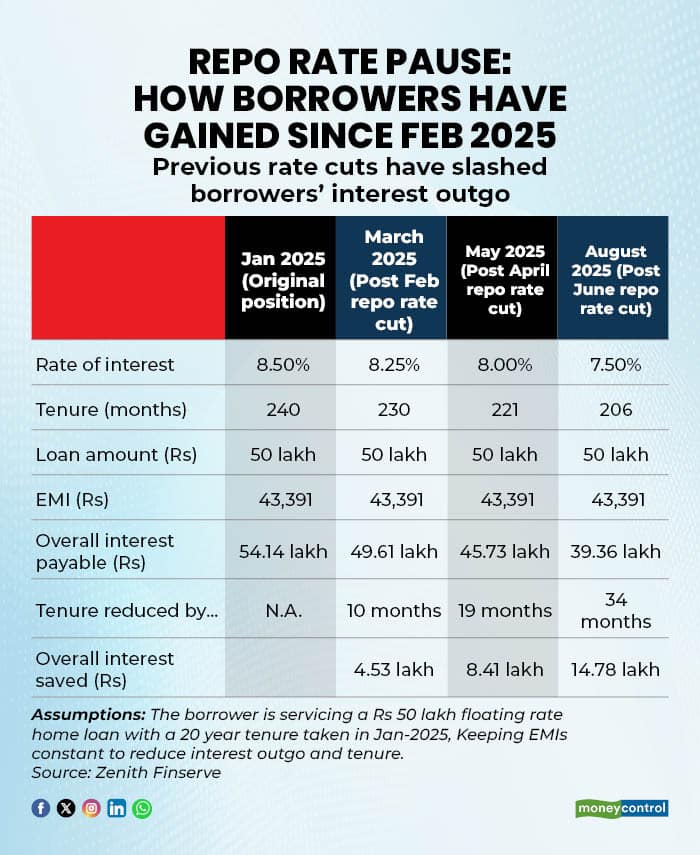

- Credit & Consumption: Stable rates may encourage borrowing, especially during the festive season, boosting consumption and business investment

- Housing Sector: Home loan rates are likely to stay affordable, aiding real estate and construction sectors

- Investor Confidence: A cautious, data-driven policy reassures markets and strengthens macroeconomic stability

About Monetary Policy Committee (MPC):

The Monetary Policy Committee (MPC) is a six-member body responsible for setting India’s benchmark interest rates. It includes three RBI officials and three government-nominated external members. Chaired by the RBI Governor, decisions are made by majority vote, with the Governor holding a casting vote.

· Established in 2016 under the amended RBI Act, the MPC ensures transparency and accountability in monetary policy. Its current mandate is to maintain 4% inflation (±2%) till March 2026.

· Meeting at least quarterly, the MPC is supported by the RBI’s Monetary Policy Department and publishes its policy decisions after each meeting. It replaced the earlier advisory model.

Conclusion:

The RBI’s decision to hold the repo rate at 5.5% reflects a cautious yet balanced approach, aiming to support growth while keeping inflation within target. Amid global uncertainties and domestic resilience, the Monetary Policy Committee prioritizes stability, signalling confidence in India’s economic fundamentals and room for future data-driven adjustments.