Context:

Recently, India’s Financial Intelligence Unit (FIU) mandated live selfies, geo-tagging, and penny-drop bank verification for cryptocurrency users. This step strengthens AML (Anti-Money Laundering) and KYC (Know Your Customer) compliance to prevent fraud, money laundering, and financing of illegal activities via digital assets.

About New KYC Norms:

-

-

- FIU now mandates:

- Live selfie with liveness detection to confirm user presence.

- Geo-tagging and IP tracking during onboarding.

- Penny-drop verification to confirm bank account ownership.

- Additional KYC includes PAN and government ID, verified via OTPs, with updates every six months for high-risk clients and annually for others.

- Live selfie with liveness detection to confirm user presence.

- FIU now mandates:

-

Regulatory Rationale:

-

-

- The updated norms aim to:

- Strengthen identity verification and prevent fake accounts or identity theft.

- Enhance traceability of transactions to curb money laundering and terrorist financing risks via digital assets.

- Ensure that the individual initiating an account is physically present and legitimately connected to the financial instruments used.

- Strengthen identity verification and prevent fake accounts or identity theft.

- The updated norms aim to:

-

Significance for Policy and Governance:

-

-

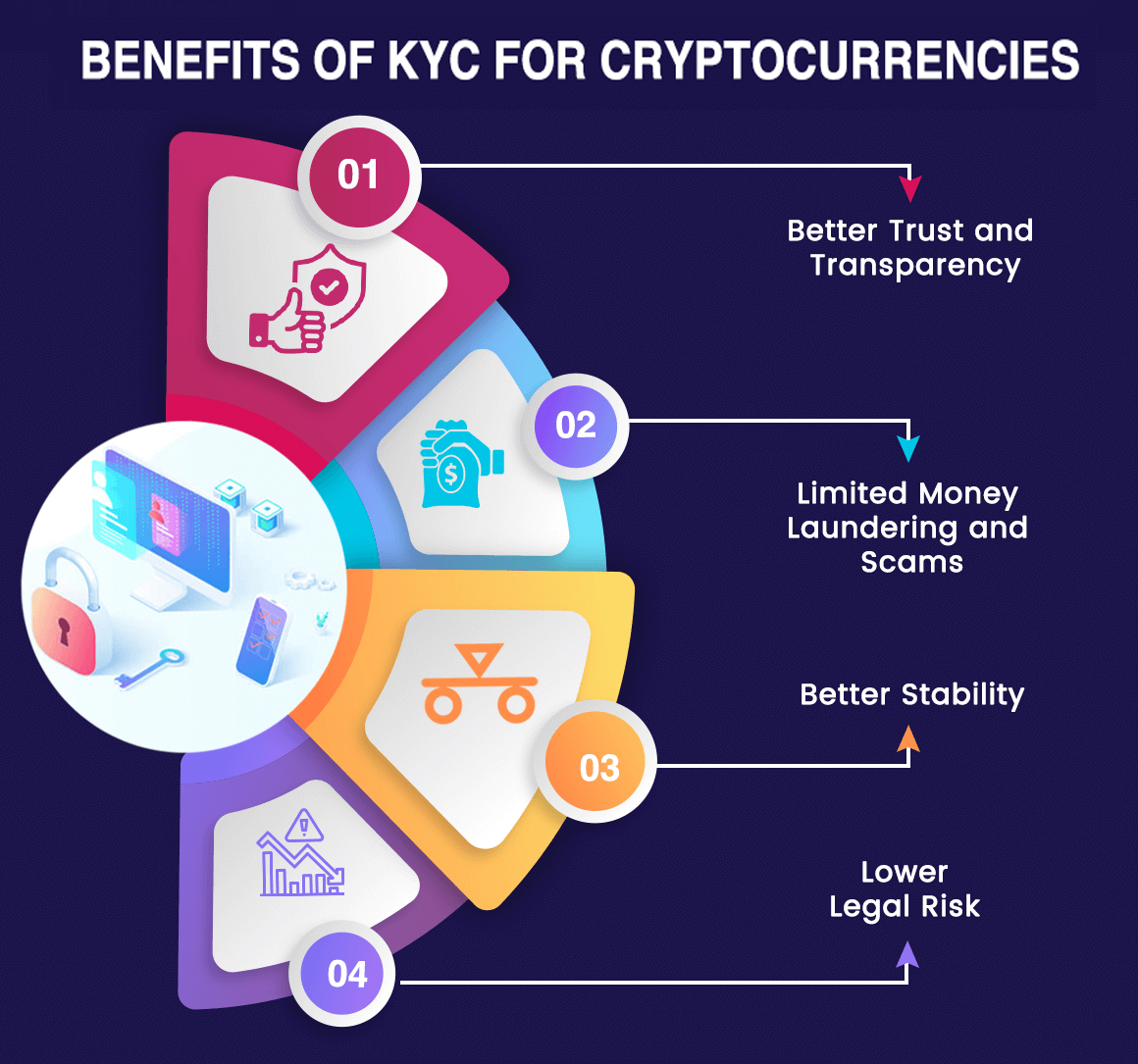

- Combating Illicit Finance: Stricter AML and KYC norms for crypto platforms align with global efforts to bring digital assets within regulated financial systems and reduce their misuse for illegal activities such as tax evasion and funding of prohibited organisations.

- Regulatory Clarity: Although India does not recognise cryptocurrencies as legal tender, the updated guidelines position exchanges under the Prevention of Money Laundering Act (PMLA) as reporting entities, ensuring they regularly submit reports on suspicious activity.

- Protection of Users: Enhanced verification can protect genuine users by reducing fraud and identity theft. However, the increased compliance burden could also deter casual investors or complicate onboarding for new users.

- Combating Illicit Finance: Stricter AML and KYC norms for crypto platforms align with global efforts to bring digital assets within regulated financial systems and reduce their misuse for illegal activities such as tax evasion and funding of prohibited organisations.

-

About Cryptocurrency:

-

-

- Cryptocurrency is a digital/virtual currency secured by cryptography, operating on decentralized networks without central authority control. Its core technology, blockchain, is a distributed and immutable ledger recording transactions in linked “blocks.”

- Decentralization ensures no single entity controls the network. Transactions are verified through mining/validation mechanisms like Proof-of-Work or Proof-of-Stake. Users store their coins in digital wallets, which safeguard private and public keys. Popular types include Bitcoin, Ethereum, stablecoins.

- Cryptocurrency is a digital/virtual currency secured by cryptography, operating on decentralized networks without central authority control. Its core technology, blockchain, is a distributed and immutable ledger recording transactions in linked “blocks.”

-

Advantages and Disadvantages:

|

Advantages |

Disadvantages |

|

Decentralization and no government control |

High volatility and speculation |

|

Enhanced cryptographic security |

Cyber threats and hacking risks |

|

Faster, cheaper cross-border transfers |

Potential misuse for illegal finance |

|

Financial inclusion for unbanked |

High energy consumption for mining |

|

Transparency through blockchain |

Regulatory uncertainty |

About India’s Regulatory Stance:

-

-

- Cryptocurrencies are unregulated but not banned in India; they are not legal tender. The RBI warns of financial risks, while taxation includes 30% on crypto transfers and 1% TDS on transactions.

- Cryptocurrencies are unregulated but not banned in India; they are not legal tender. The RBI warns of financial risks, while taxation includes 30% on crypto transfers and 1% TDS on transactions.

-

Conclusion:

The mandate for selfies with liveness detection and penny‑drop bank verification marks a significant shift in how cryptocurrency users are identified and authenticated in India. These changes reflect the government’s prioritisation of financial integrity, user security, and closer supervision of virtual assets — a rapidly evolving segment with both high growth potential and significant risks.