Context:

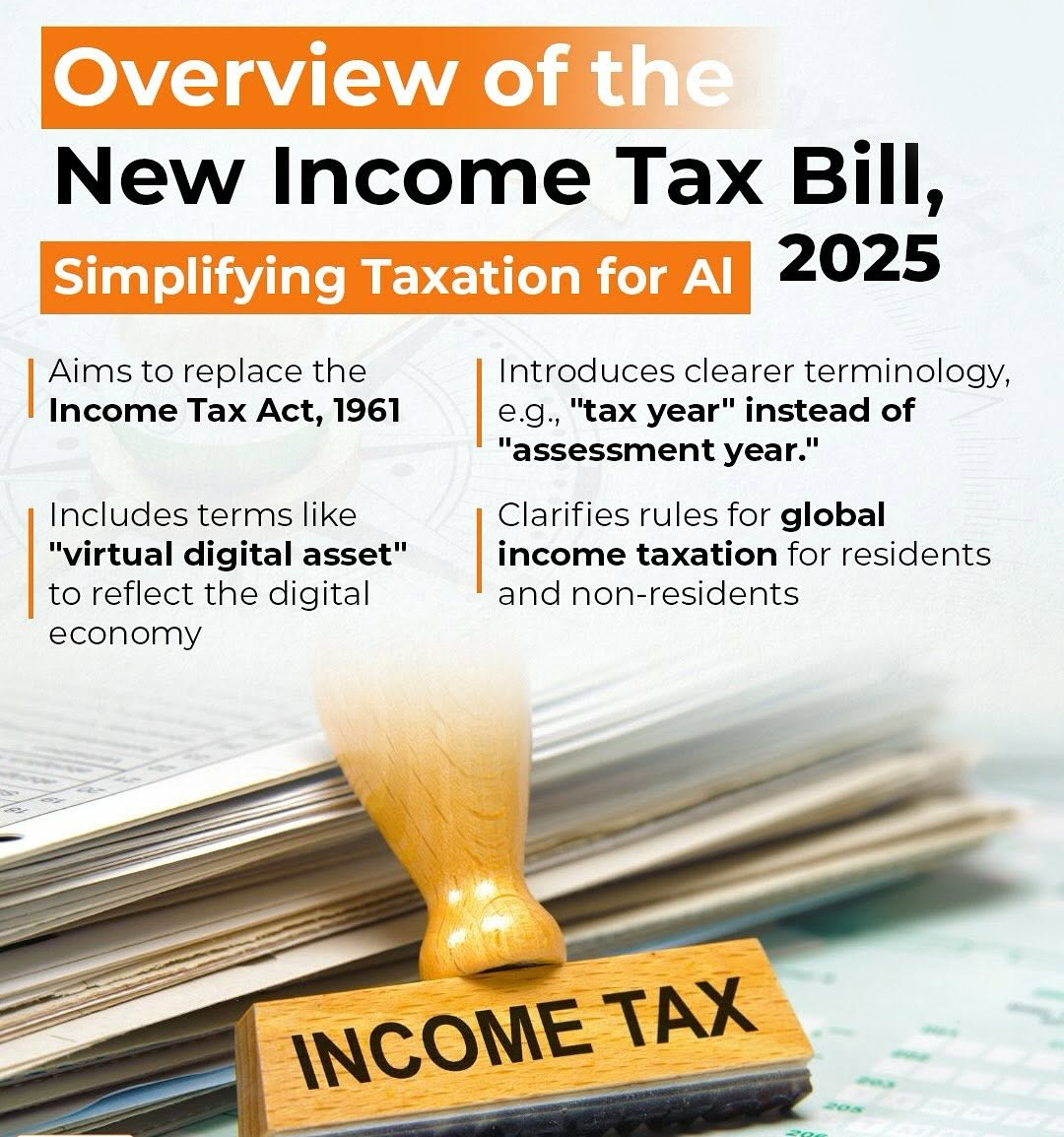

Recently, the Income Tax Bill, 2025 was approved in the Lok Sabha and Rajya Sabha, which is an important step towards simplifying and rationalizing the existing Income Tax Act, 1961. The new law aims to make tax regulations clearer and more accessible for taxpayers.

Key Features of the Bill:

· Simplified Framework: The bill reduces the number of chapters from 47 to 23 and sections from 819 to 536, streamlining the legislation for easier comprehension.

· Expanded Powers to Officials: Income tax authorities are now empowered to forcibly access personal emails, social media accounts, and other electronic records during search operations.

· Access to Electronic Records: The bill mandates individuals to provide authorized officers with access codes for electronic documents, including digital books of account, or face the possibility of officials overriding such codes.

Introduction of ‘Tax Year’

Replacing the traditional concepts of ‘assessment year’ and ‘previous year’, the Bill introduces a single, simpler term — ‘tax year’. This change helps taxpayers better grasp the period for which taxes are calculated and filed, removing confusion around different timelines.

Easier Refund Process for TDS

Under the new provisions, taxpayers can claim refunds on Tax Deducted at Source (TDS) even if they file their returns after the original statutory deadline. This ensures genuine taxpayers are not penalized for delayed filing and can still receive their rightful refunds.

Controversy Surrounding the Bill

Wide powers to access private digital data could be misused, violating the constitutional right to privacy as upheld by the Supreme Court in the Puttaswamy judgment.

Government's Stance

- Justification: The government argues these powers are essential to uncover incriminating evidence hidden in electronic communications like WhatsApp and emails.

- Select Committee's Support: The committee’s report underscores the importance of these measures in enabling effective search and seizure operations.

About The Income-tax Act, 1961:

· The Income-tax Act, 1961, is the principal law governing the levy, administration, and collection of income tax in India. It lays down the framework for taxing individuals and entities based on their income.

Objectives of the Income Tax Law

The Income-tax Act defines the scope of total income based on an individual's residential status, taxing residents on global income and non-residents only on income earned in India.

· Income is classified under five heads: salary, house property, business/profession, capital gains, and other sources.

· The Act’s main objectives are revenue generation, equitable wealth distribution, economic regulation through incentives, and enforcement of compliance.

Conclusion

The New Income Tax Bill 2025 marks a significant step towards simplifying India’s tax regime. With clearer definitions, improved refund processes, and a reduced compliance load, the Bill is designed to make tax filing less complex and more taxpayer-friendly.