Context:

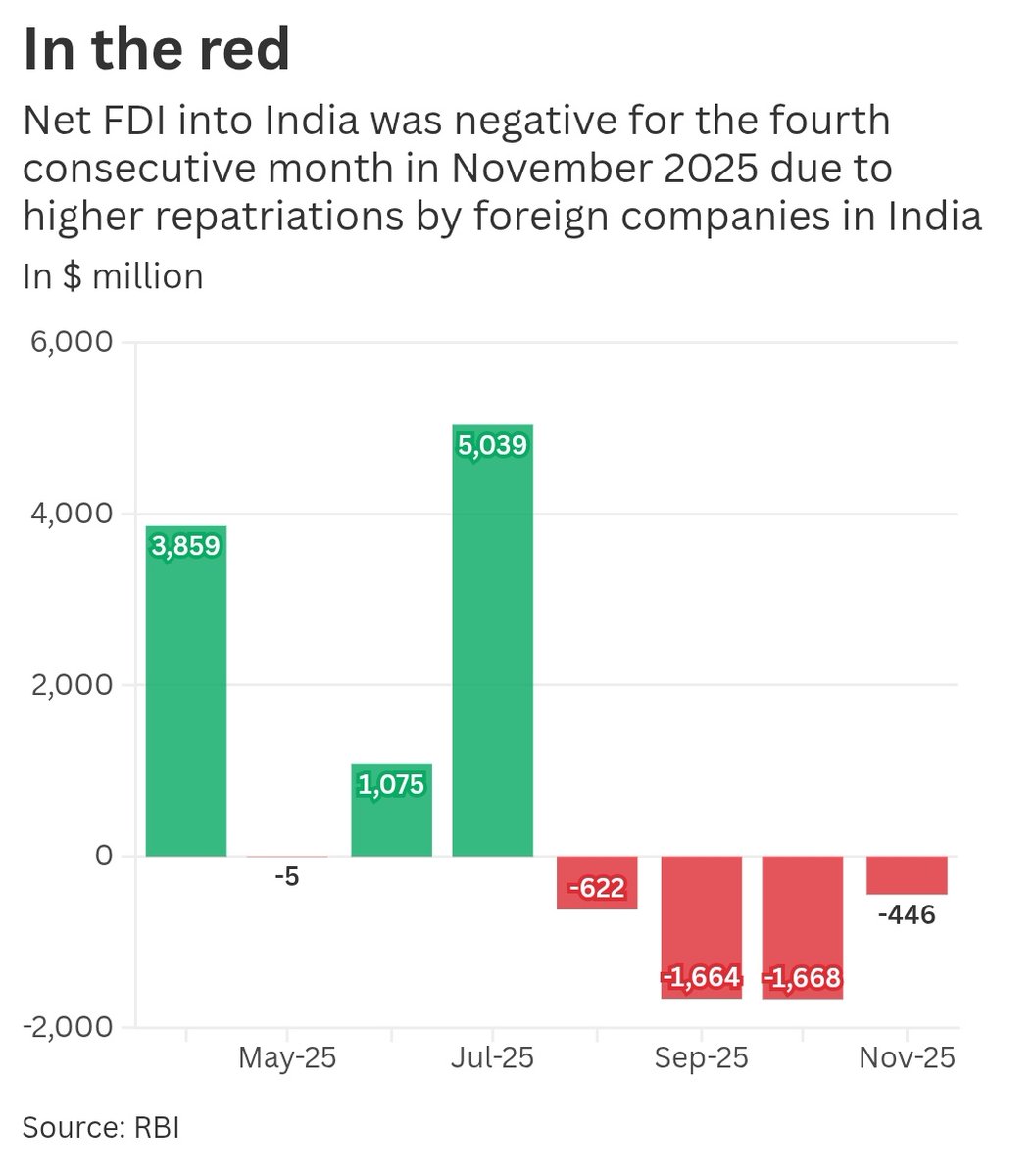

According to the Reserve Bank of India’s latest monthly bulletin, India’s net Foreign Direct Investment (FDI) was negative for the fourth consecutive month in November 2025, with outflows exceeding inflows by approximately US $446 million. Net FDI represents the difference between gross FDI inflows and FDI outflows (including repatriation and outward investments). A sustained negative net FDI trend signals that more capital is leaving the country than entering in the form of long‑term productive investment.

What is FDI?

Foreign Direct Investment (FDI) refers to a long‑term investment by a foreign entity into a business or productive asset in another country, typically involving significant ownership or control. It can occur through greenfield investments, acquisitions, or joint ventures, and reflects a sustained commitment to the host economy. FDI is distinguished from short‑term portfolio flows by its strategic, long‑term orientation and involvement in management decisions.

Significance of FDI:

-

-

- FDI plays a transformative role in economic development, especially for emerging economies like India:

- Capital Formation and Economic Growth: FDI brings long‑term capital into the host country, supplementing domestic savings and supporting investment in infrastructure, manufacturing, and services.

- Employment Generation: Entry of foreign firms stimulates job creation across sectors, reducing unemployment and enhancing income levels.

- Technology and Knowledge Transfer: Foreign investors often introduce advanced technologies, managerial expertise, and global best practices, boosting productivity and innovation.

- Increase in Exports and Market Access: FDI can strengthen export capacities by establishing production for global markets and integrating domestic firms into international value chains.

- Improved Infrastructure: Projects financed through FDI frequently contribute to developing infrastructure such as transport networks, energy facilities, and logistics systems.

- Foreign Exchange and Balance of Payments: By attracting foreign capital, FDI helps improve the balance of payments position and stabilise exchange rates.

- Capital Formation and Economic Growth: FDI brings long‑term capital into the host country, supplementing domestic savings and supporting investment in infrastructure, manufacturing, and services.

- For developing economies, FDI is also instrumental in industrial diversification, competitive market creation and human capital development through training and skill enhancement.

- FDI plays a transformative role in economic development, especially for emerging economies like India:

-

Why Net FDI Turned Negative?

-

-

- Several factors have contributed to India’s recent negative net FDI trend:

- Higher Repatriation and Divestments: Foreign companies repatriating profits or realising investments abroad increases outflows, leading to negative net figures.

- Outward Investments by Indian Firms: Strategic investments overseas by Indian companies add to total outflows.

- Global Economic Uncertainty: External macroeconomic conditions, currency volatility and geopolitical tensions influence investor behaviour, affecting both inflows and outflows.

- Higher Repatriation and Divestments: Foreign companies repatriating profits or realising investments abroad increases outflows, leading to negative net figures.

- Several factors have contributed to India’s recent negative net FDI trend:

-

Conclusion:

While Net FDI remained negative in November 2025 due to higher outflows, broader trends indicate resilient gross investment inflows and cumulative net investment growth. FDI continues to be a cornerstone for economic expansion, technology acquisition and employment generation. A strategic policy focus on facilitating foreign investment, bolstering infrastructure, and maintaining macroeconomic stability can help India leverage FDI for sustained and inclusive growth.