Context:

The Reserve Bank of India (RBI), through its recent Monetary Policy Committee (MPC) meeting, has decided to keep the key policy repo rate unchanged at 5.25% in its monetary policy review. The decision balances price stability with growth support amid benign domestic inflation and global uncertainties. Simultaneously, the RBI revised its FY26 inflation projection to 2.1%, well below its target rate of 4%.

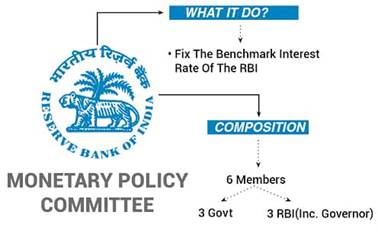

About RBI Monetary Policy Committee (MPC):

The MPC is a six-member statutory body established in 2016, based on the recommendations of the Urjit Patel Committee, to ensure rule-based and collective decision-making for monetary policy.

Key Details:

-

-

- Objective: Maintain inflation at 4% ± 2% while supporting economic growth.

- Composition (6 members):

- Chairperson: RBI Governor (ex officio)

- Members: Three RBI officials (including a Deputy Governor) and three external experts appointed by the Government of India

- Chairperson: RBI Governor (ex officio)

- Meetings: At least four times a year (bi-monthly)

- Voting: Majority vote; the Governor has a casting vote in case of a tie

- Key Tools: Repo rate, reverse repo rate, cash reserve ratio (CRR), statutory liquidity ratio (SLR), and open market operations (OMO)

- Objective: Maintain inflation at 4% ± 2% while supporting economic growth.

-

Monetary Policy Stance:

-

-

-

- Expansionary/Accommodative: Reduce rates to boost growth

- Contractionary/Tight: Increase rates to control high inflation

- Neutral: Balanced approach between growth and inflation

- Expansionary/Accommodative: Reduce rates to boost growth

- The MPC introduces transparency, accountability, and collective decision-making, replacing the earlier single-member system.

-

-

Policy Decision:

-

-

- Repo Rate: Held steady at 5.25%

- Policy Stance: Neutral, signalling stability with flexibility to act if conditions change

- Repo Rate: Held steady at 5.25%

-

Rationale Behind Holding Rates:

-

-

- Low Inflation: Limited price pressures reduce the need for further tightening.

- Economic Growth: Robust domestic demand and resilient sectors support continued growth.

- Global Risks: Geopolitical uncertainties and commodity price volatility warrant a cautious stance.

- Low Inflation: Limited price pressures reduce the need for further tightening.

-

Significance:

-

-

- Price Stability: Inflation remains well within the target, enhancing confidence in the RBI’s framework.

- Policy Predictability: Stable rates aid borrowing, lending, and investment decisions.

- Monetary Space: A neutral stance preserves flexibility for future adjustments based on evolving data.

- Price Stability: Inflation remains well within the target, enhancing confidence in the RBI’s framework.

-

Conclusion:

By holding the policy rate and revising the FY26 inflation forecast to 2.1%, the RBI signals a prudent, data-driven approach that balances growth with price stability. The role of the MPC ensures transparency, accountability, and collective decision-making, reinforcing the credibility of India’s monetary policy framework while providing flexibility to respond to domestic and global economic developments.