Context:

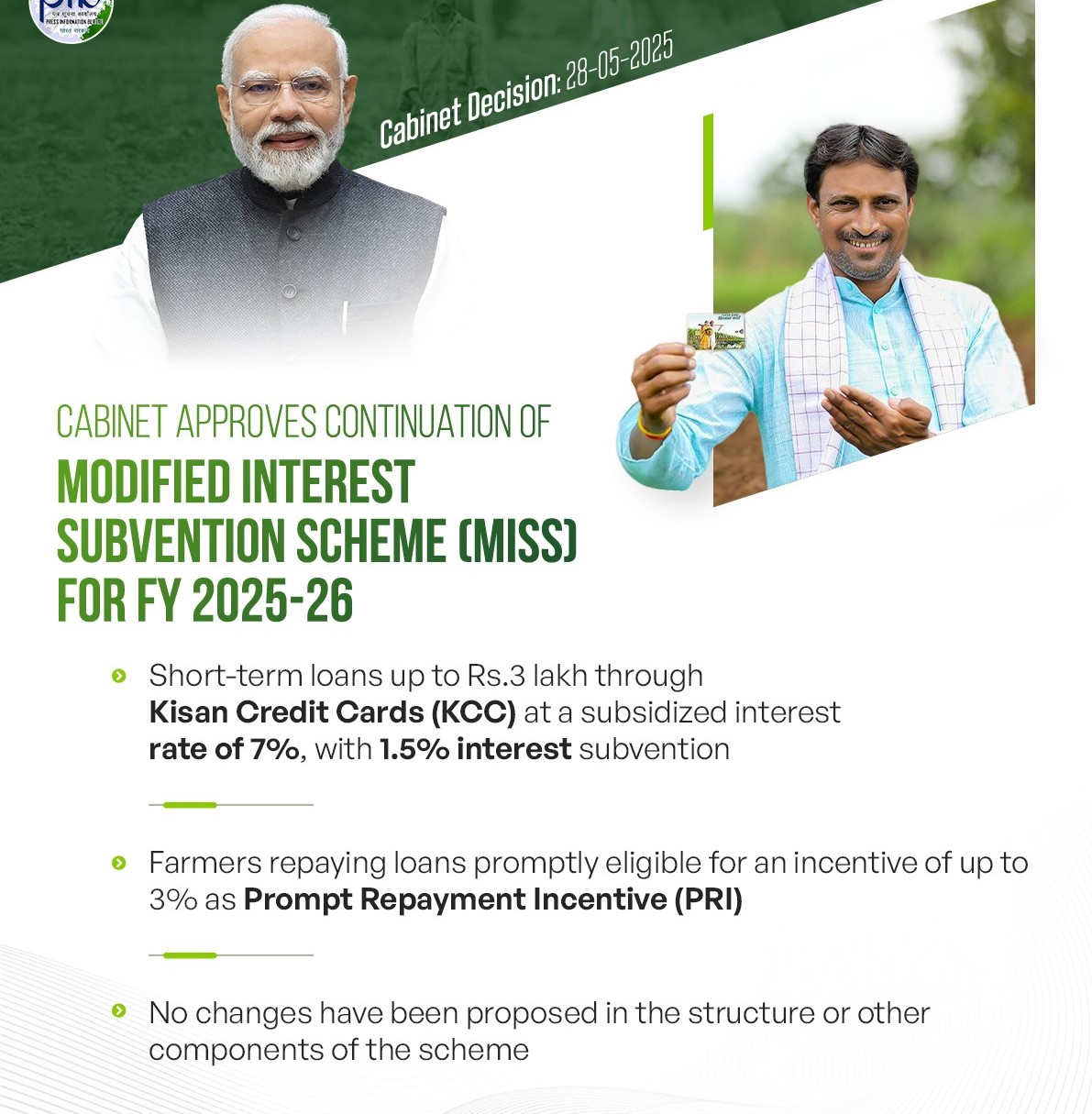

The Union Cabinet, chaired by Prime Minister Narendra Modi, has recently approved the continuation of the Modified Interest Subvention Scheme (MISS) for the financial year 2025-26. The scheme provides short-term credit to farmers at an affordable interest rate through Kisan Credit Cards (KCC).

About Modified Interest Subvention Scheme (MISS):

The Modified Interest Subvention Scheme (MISS) is a Central Sector Scheme designed to provide short-term credit to farmers at affordable interest rates through Kisan Credit Cards (KCC). Here are the key features and benefits:

Key Features:

- Interest Subvention: 1.5% interest subvention is provided to eligible lending institutions, enabling farmers to access loans at a subsidized interest rate of 7%.

- Prompt Repayment Incentive: Farmers repaying loans promptly are eligible for an incentive of up to 3%, effectively reducing their interest rate to 4%.

- Loan Limit: The interest benefit is applicable on loans up to ₹3 lakh for general purposes and up to ₹2 lakh for loans taken exclusively for animal husbandry or fisheries.

Benefits:

· Affordable Credit: Lowers the cost of borrowing for farmers, making it easier to access funds for agricultural needs.

· Increased Credit Flow: Encourages banks to lend more to the agriculture sector.

· Financial Stability: Helps farmers manage their financial requirements without falling into high-interest debt traps.

Implementation:

· Implementing Institutions: Public Sector Banks (PSBs), Private Sector Banks (rural and semi-urban branches), Small Finance Banks (SFBs), and computerized Primary Agriculture Cooperative Societies (PACS) are eligible for interest subvention.

· Fund Allocation: The continuation of the scheme for FY 2025-26 is expected to incur an expenditure of ₹15,640 crore

Impact of the Scheme:

- Credit Disbursement Boost:

Institutional credit disbursement through KCC has seen a major rise from ₹4.26 lakh crore in 2014 to ₹10.05 lakh crore by December 2024. - Surge in Agricultural Credit Flow:

Total agricultural credit flow increased from ₹7.3 lakh crore in FY 2013–14 to ₹25.49 lakh crore in FY 2023–24. - Digital Reforms:

The Kisan Rin Portal (KRP), launched in August 2023, has streamlined claim processing, improving transparency and efficiency in the system.

Conclusion

The Government's commitment to supporting farmers through initiatives like the MISS scheme demonstrates its focus on promoting agricultural growth and ensuring the well-being of farmers. By providing affordable credit and promoting financial inclusion, the scheme contributes to the overall development of the agricultural sector and the economy.