Context:

Recently, The Karnataka Legislative Assembly has passed the Gig Workers’ Welfare Bill, 2025, with aim of comprehensive welfare framework for platform-based gig workers (such as delivery agents, ride-hailing drivers, etc.).

- The Bill responds to the rapid growth of the gig economy, especially in urban areas, and aims to secure basic rights and protections for gig workers.

Key Provisions of the Bill:

1. Welfare Fund Creation

- A Gig Workers’ Social Security and Welfare Fund will be created.

- Fund sources:

- 1% to 5% welfare fee on each transaction between platform and worker.

- Contributions from gig workers (voluntary).

- Grants-in-aid from State and Central governments.

- Administrative expenses capped at 5% of the fund.

2. Gig Workers’ Welfare Board

- A dedicated board will be formed to:

- Register gig workers and aggregator platforms.

- Implement welfare schemes.

- Ensure compliance with the Act.

3. Dispute Resolution

- Mechanisms will be created to resolve disputes between gig workers and platforms.

4. Working Conditions and Income Security

- The Bill emphasizes reasonable working conditions, health protection, and income stability for gig workers, many of whom work long hours (up to 16 hours/day) in hazardous conditions.

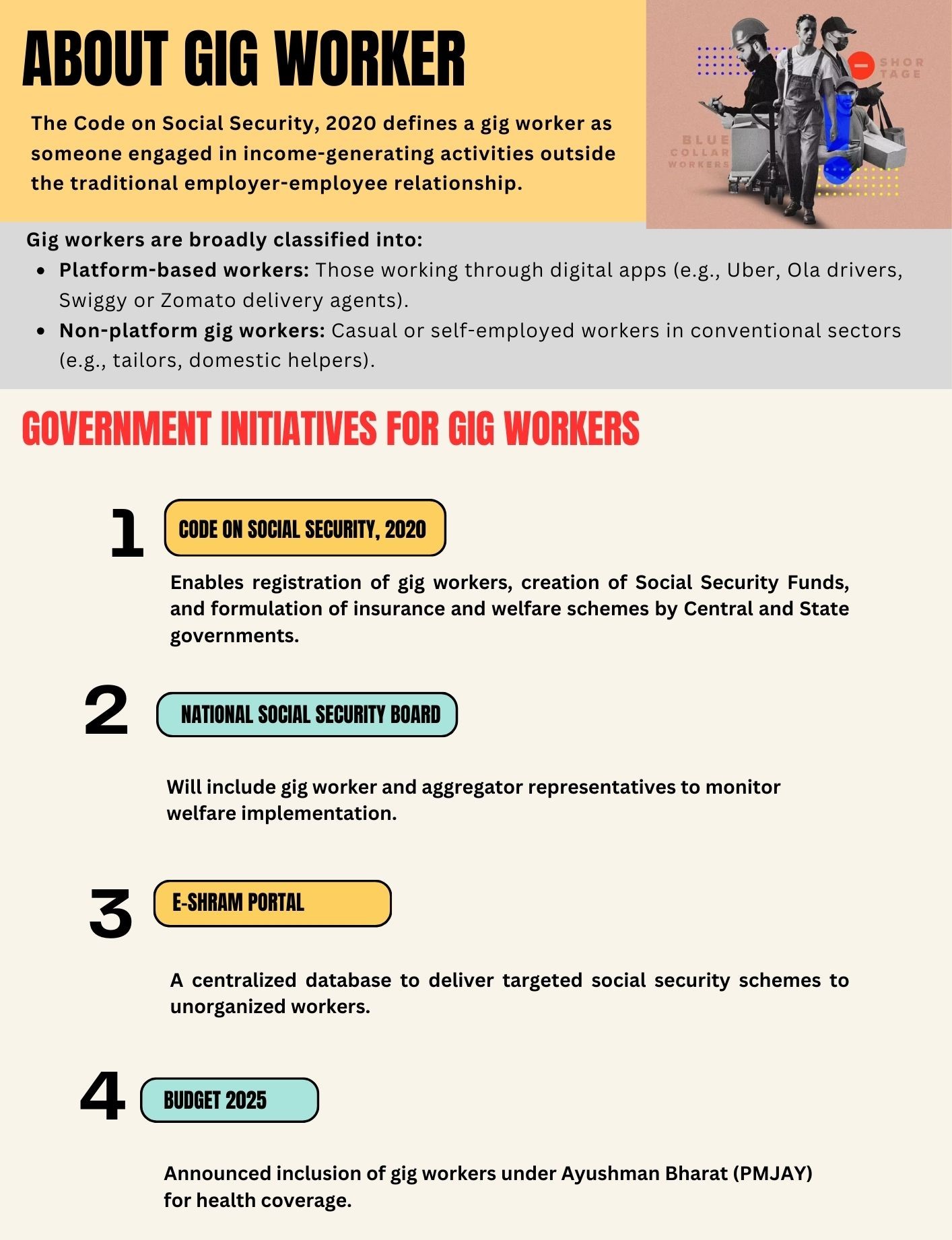

About gig worker:

The Code on Social Security, 2020 defines a gig worker as someone engaged in income-generating activities outside the traditional employer-employee relationship. Gig work is typically flexible, part-time, or task-based, often mediated by digital platforms. Gig workers are broadly classified into:

- Platform-based workers: Those working through digital apps (e.g., Uber, Ola drivers, Swiggy or Zomato delivery agents).

- Non-platform gig workers: Casual or self-employed workers in conventional sectors (e.g., tailors, domestic helpers).

India's gig workforce stands at 7.7 million, expected to grow to 23.5 million by 2029–30, as per NITI Aayog.

Government Initiatives for Gig Workers:

- Code on Social Security, 2020: Enables registration of gig workers, creation of Social Security Funds, and formulation of insurance and welfare schemes by Central and State governments.

- National Social Security Board: Will include gig worker and aggregator representatives to monitor welfare implementation.

- e-Shram Portal: A centralized database to deliver targeted social security schemes to unorganized workers.

- Budget 2025: Announced inclusion of gig workers under Ayushman Bharat (PMJAY) for health coverage.

Key Challenges Faced by Gig Workers:

- Lack of social security: Classified as “independent contractors,” they are excluded from wage, hour, and working condition protections.

- Health and safety risks: Long hours and pressure for fast deliveries increase physical and accident risks.

- Algorithmic control: Platforms use opaque algorithms and ratings, often penalizing workers unfairly.

- Low pay: Many earn modest incomes; e.g., Blinkit pays ₹15 per delivery, barely covering fuel costs.

Conclusion

The passage of the Gig Workers' Welfare Bill, 2025, is a landmark moment for gig workers in Karnataka. The legislation has the potential to improve the lives of thousands of gig workers and sets a precedent for other states to prioritize the welfare of gig workers. As the gig economy continues to grow, it is essential to ensure that gig workers have access to basic rights and protections