Context:

The Ministry of Statistics and Programme Implementation (MoSPI) has released the Provisional Estimates (PEs) for India's Gross Domestic Product (GDP) and Gross Value Added (GVA) for the financial year 2024–25. These estimates serve as a critical indicator of the nation’s economic performance and provide valuable input for fiscal planning, monetary policy, and investment decisions.

Key findings:

Overall GDP Performance

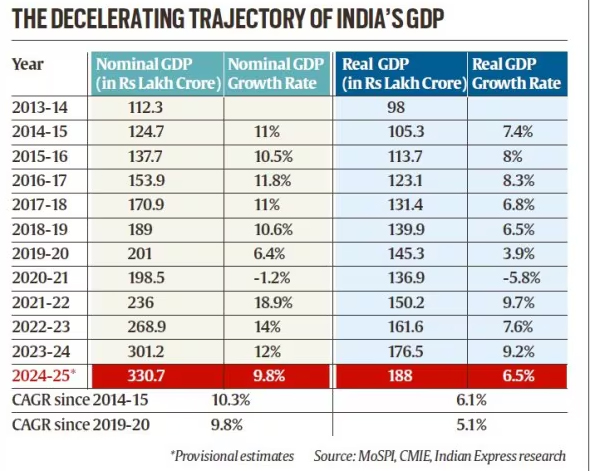

India’s economy posted a robust performance in FY 2024–25. The Real Gross Domestic Product (GDP) grew by 6.5%, reaching ₹187.97 lakh crore at constant prices (2011–12 base year). This reflects the economy’s resilience amid global uncertainties and domestic structural adjustments.

On the other hand, Nominal GDP, which includes inflation, expanded by 9.8%, reaching ₹330.68 lakh crore. The higher nominal growth relative to real growth indicates the influence of moderate inflationary pressures in the economy.

Primary Sector

The primary sector, encompassing agriculture, forestry, and fishing, saw a rebound in growth to 4.4%, compared to just 2.7% in the previous fiscal year. Favorable monsoons, improved agricultural productivity, and stable rural demand were key contributors.

Notably, the Q4 growth of the primary sector was 5%, showing strong seasonal performance and contribution to rural income stability.

Consumption and Investment:

- Private Final Consumption Expenditure (PFCE) grew by 7.2%, indicating a revival in consumer demand. This reflects increased spending by households, particularly in urban areas, possibly fueled by rising disposable incomes and improved job market conditions.

- Gross Fixed Capital Formation (GFCF), a proxy for investment in physical assets like machinery, buildings, and infrastructure, grew by 7.1%. This signals continued investor confidence and expansion in productive capacity.

Manufacturing Sector:

Despite the broad-based recovery, the manufacturing sector continues to underperform. Its Compound Annual Growth Rate (CAGR) stood at just 4.04%, compared to agriculture’s 4.72%.

This sluggish growth in manufacturing raises concerns about employment generation, as the sector is traditionally a major source of jobs, especially for semi-skilled labor. Structural bottlenecks, weak global demand, and domestic competitiveness issues likely contributed to this muted performance.

Positives findings:

· Consistent Economic Expansion: India remains one of the fastest-growing major economies despite global uncertainties.

· Resilience in Agriculture: GVA in agriculture has grown faster than manufacturing since FY20.

Challenges

· Slowing Nominal GDP Growth: FY25 shows the third-slowest nominal GDP growth since 2014 at 9.8%.

· Manufacturing Lag: Manufacturing GVA growth lags behind agriculture, highlighting industrial stagnation.

· Employment Concerns: Sluggish manufacturing explains high urban youth unemployment and increased labor migration to rural areas.

Significance

The provisional GDP data offers critical input for fiscal planning, monetary policy, and investment strategies, reflecting India's macroeconomic stability while exposing vulnerabilities in key growth engines like manufacturing.

Conclusion

India's provisional GDP data indicates moderate economic resilience with real growth at 6.5%, but deeper issues persist, especially in manufacturing. Addressing sectoral imbalances and revitalizing industrial growth are vital for sustainable development.