Context:

The International Monetary Fund's (IMF) report, "Growing Retail Digital Payments: The Value of Interoperability," recently highlighted India's remarkable digital transformation, with a particular focus on the Unified Payments Interface (UPI).

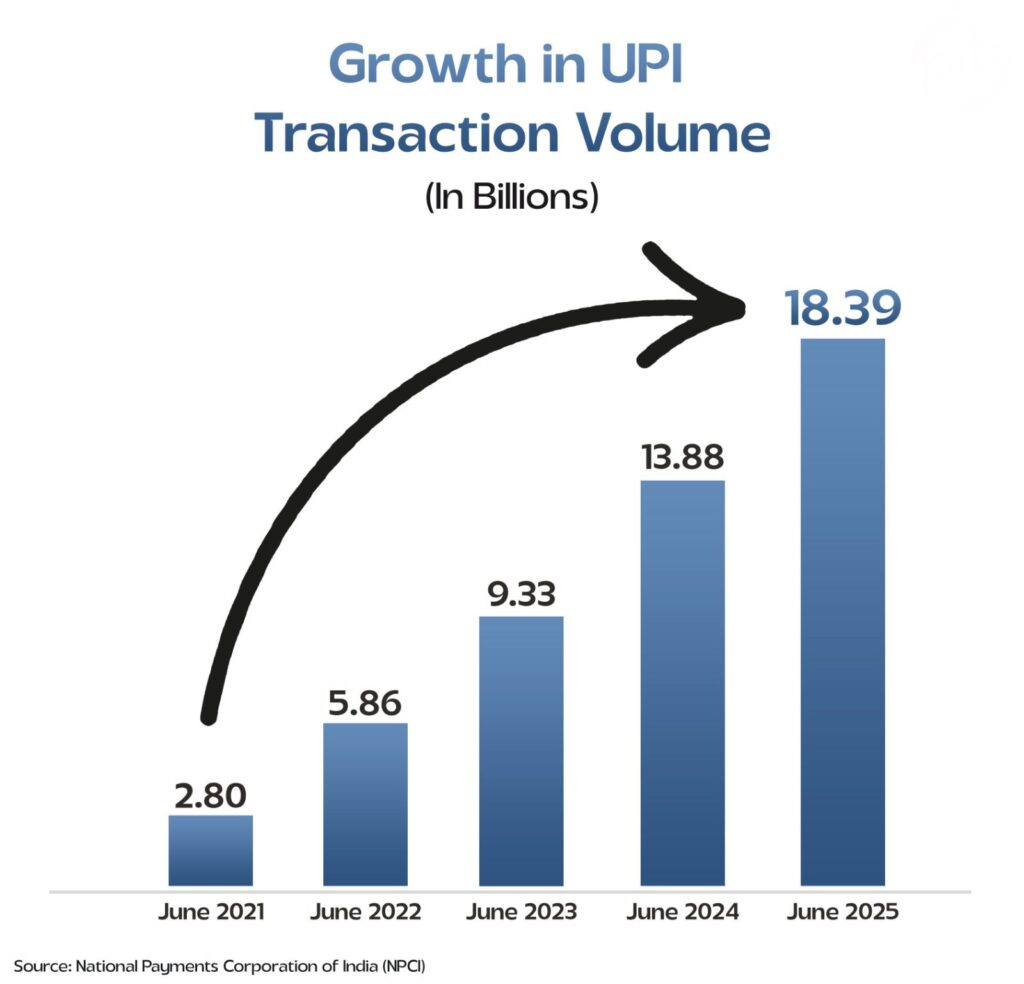

UPI’s Rapid Growth

· India's Digital Transactions: UPI accounts for 85% of all digital transactions in India, making it a dominant force in the country's digital payment landscape.

· Global Real-Time Digital Payments: UPI powers nearly 50% of all real-time digital payments globally, solidifying its position as a leader in fast payments worldwide.

· Transaction Volume: In June 2025, UPI processed 18.39 billion transactions, valued at over ₹24.03 lakh crore, representing a 32% year-on-year growth.

· Daily Transactions: UPI handles over 640 million transactions daily, surpassing global giants like Visa, which processes around 639 million transactions per day.

UPI’s Impact on Financial Inclusion:

UPI now serves 491 million individuals and 65 million merchants, seamlessly connecting 675 banks through a unified digital infrastructure.

By providing a fast, accessible, and affordable mode of payment, UPI has significantly advanced financial inclusion, especially in rural and small-town areas, bringing digital financial services to the doorstep of millions.

Global Expansion:

UPI is currently live in seven countries, including the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, helping expand India's digital payment ecosystem globally.

· The launch of UPI in France signifies its formal entry into Europe, enabling Indians traveling or living abroad to make convenient, seamless transactions.

· India is also pushing for UPI to be adopted as a standard payment system within the BRICS group, which would help enable faster, cheaper, and more secure cross-border payments, further enhancing India’s position as a global leader in digital finance.

About UPI:

UPI (Unified Payments Interface) is a real-time digital payment system developed by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI).

· Launched on April 11, 2016, UPI allows users to instantly transfer money between bank accounts using a mobile device through a simple, two-click authentication process.

· UPI simplifies transactions by using virtual payment addresses (VPAs) such as a UPI ID, mobile number, or QR code instead of traditional account numbers.

· It eliminates the need to enter sensitive bank details for every transaction. Users can perform peer-to-peer (P2P) and peer-to-merchant (P2M) payments, schedule future transfers, and make recurring payments like utility bills or school fees — all with a single UPI PIN and 24/7 availability.

Conclusion:

UPI's success is a testament to India's digital innovation and vision for inclusive growth. As a global benchmark in public digital infrastructure, UPI is poised to continue its rapid growth and expansion, both domestically and internationally. With its convenience, speed, and accessibility, UPI has revolutionized digital payments in India and is set to make a significant impact globally