Context:

In a significant development, India has made tremendous progress in social security coverage, with nearly two out of three people now covered under at least one social security benefit. According to the International Labour Organization (ILO), India's social security coverage stood at 64.3% in 2025, This marks a remarkable rise from just 19% in 2015 to 64.3% in 2025.

ILO Recognition and Methodology:

The ILO's assessment included data from 32 social protection schemes — 24 focused on pension, two on maternity benefits, and two on child benefits. These include prominent initiatives such as:

- Atal Pension Yojana

- PM-Kisan Samman Nidhi

- MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act)

- Janani Suraksha Yojana

- PM POSHAN (Midday Meal Scheme)

To qualify under the ILO’s criteria, a scheme must be legislatively backed, cash-based, actively functioning, and supported by verified time-series data from the past three years.

Implications for India's Global Engagements:

The increase in social protection coverage will also enhance India's position in trade and labor mobility negotiations by showcasing a credible and robust social protection regime. The government has initiated a data pooling exercise to consolidate beneficiary data from various social security and welfare schemes, which is expected to further increase India's total social protection coverage.

About Social Security/Protection:

Social security is the protection that a society provides to individuals and households to ensure access to health care and to guarantee income security, particularly in cases of old age, unemployment, sickness, invalidity, work injury, maternity or loss of a breadwinner.

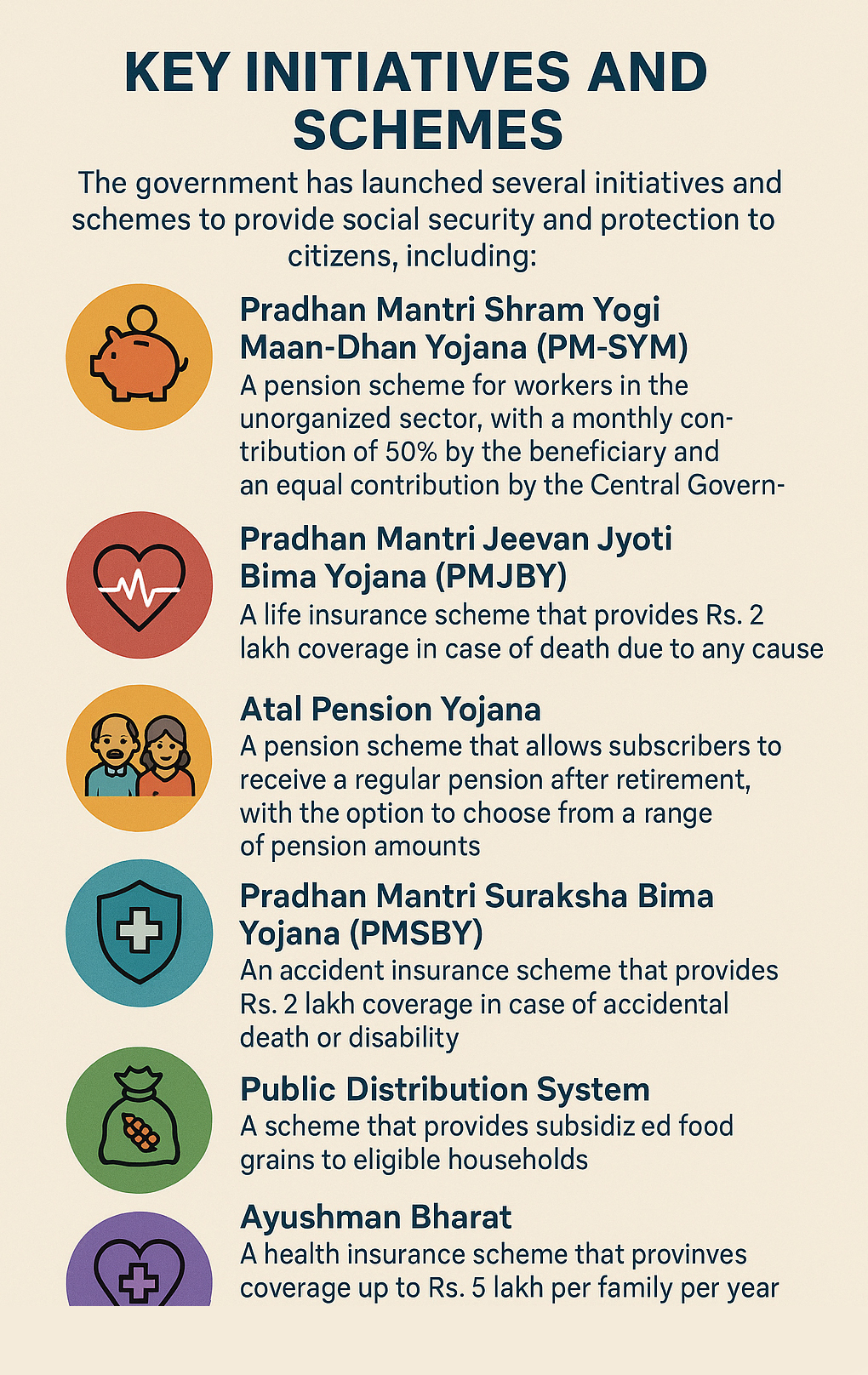

Key Initiatives and Schemes:

The government has launched several initiatives and schemes to provide social security and protection to citizens, including:

· Pradhan Mantri Shram Yogi Maan-Dhan Yojana (PM-SYM): A pension scheme for workers in the unorganized sector, with a monthly contribution of 50% by the beneficiary and an equal contribution by the Central Government.

· Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): A life insurance scheme that provides Rs. 2 lakh coverage in case of death due to any cause.

· Atal Pension Yojana: A pension scheme that allows subscribers to receive a regular pension after retirement, with the option to choose from a range of pension amounts.

· Pradhan Mantri Suraksha Bima Yojana (PMSBY): An accident insurance scheme that provides Rs. 2 lakh coverage in case of accidental death or disability.

· Public Distribution System: A scheme that provides subsidized food grains to eligible households.

· Ayushman Bharat: A health insurance scheme that provides coverage up to Rs. 5 lakh per family per year for secondary and tertiary care hospitalization.

Conclusion:

India’s leap in social protection coverage from 19% to 64.3% in just ten years is a story of sustained policy focus, inter-agency collaboration, and digital innovation. As India enters the next phase of welfare consolidation, it stands as a global example of how developing nations can strengthen social resilience and promote inclusive development.