Context:

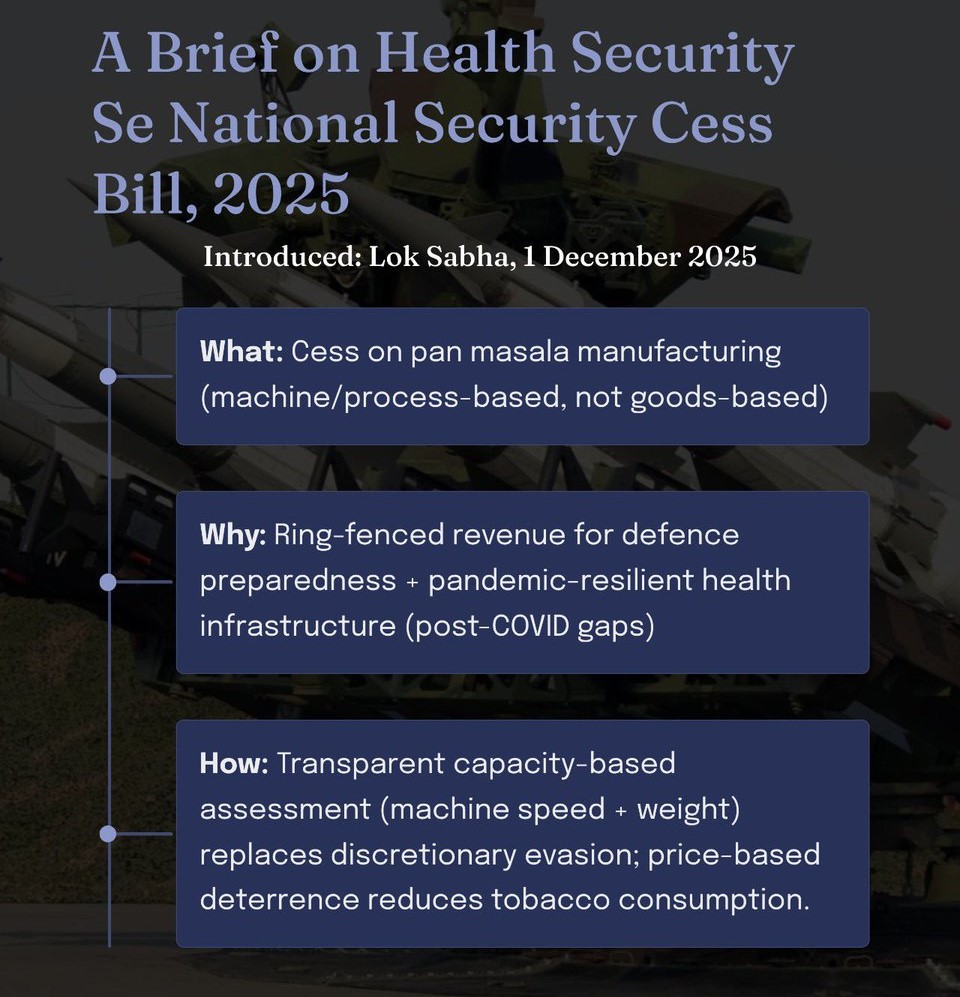

The Central Government recently introduced the Health Security se National Security Cess Bill, 2025 and it was passed on December 4, 2025. The bill aims to augment funding for health and national security with the imposition of cess on production of pan masala.

Key Features of the bill:

1. A Combined Health & National Security Cess

-

-

- Proposed as a unified cess to fund health infrastructure and national defence needs.

- Intended to ensure stable financing for long-term priority sectors.

- Proposed as a unified cess to fund health infrastructure and national defence needs.

-

2. Applicable Only on Demerit Goods

-

-

- The cess will not be levied on essential commodities or everyday consumption goods.

- It targets demerit goods such as pan masala, known to cause health risks.

- The cess will not be levied on essential commodities or everyday consumption goods.

-

3. Levy Based on Production Capacity

-

-

- The cess will be imposed on the manufacturing capacity or machines installed, rather than actual production or consumption.

- This bypasses the consumption-based GST/excise model.

- The cess will be imposed on the manufacturing capacity or machines installed, rather than actual production or consumption.

-

4. No Burden on Essential Commodities

-

-

- The government clarified that essential goods are fully exempt to protect common households from inflationary impact.

- The government clarified that essential goods are fully exempt to protect common households from inflationary impact.

-

Objectives & Rationale:

Public Health Objective

-

-

- To discourage consumption of harmful goods by making them costlier.

- Intended to reduce long-term public health burden associated with tobacco and pan masala products.

- To discourage consumption of harmful goods by making them costlier.

-

National Security and Fiscal Resources

-

-

- Rising expenditure on defence and security requires steady, predictable revenue.

- With the earlier GST compensation cess winding down, new sources of revenue are needed.

- Rising expenditure on defence and security requires steady, predictable revenue.

-

Predictable, Dedicated Funding

-

-

- Establishes a statutory, ring-fenced stream of funds rather than relying on ad-hoc budget allocations.

- Establishes a statutory, ring-fenced stream of funds rather than relying on ad-hoc budget allocations.

-

Revenue Sharing & Federal Structure:

Sharing with States

-

-

- Unlike many past cesses retained solely by the Centre, the HS-NS Cess revenue will be shared with States.

- Funds will be earmarked for state-level health programmes.

- Unlike many past cesses retained solely by the Centre, the HS-NS Cess revenue will be shared with States.

-

Strengthening Cooperative Federalism

-

-

- Enhances state participation in health sector financing.

- Represents a shift toward more inclusive fiscal federalism.

- Enhances state participation in health sector financing.

-

Significance and Concerns:

|

Category |

Sub-Category |

Key Points |

|

Policy & Constitutional Significance – Positive Aspects |

1. Targeted Sin-Goods Taxation |

• Taxes harmful/de-merit goods while protecting essential consumption. |

|

2. Resource Mobilisation for Priority Sectors |

• Supports chronically under-funded public health systems. |

|

|

3. Greater Fiscal Accountability |

• Earmarking and sharing of revenue increases transparency in utilisation. |

|

|

4. Behavioural Impact |

• Capacity-based taxation may deter expansion of demerit-good manufacturing units. |

|

|

Concerns & Challenges |

1. Burden on Small Producers / MSMEs |

• Capacity-based levy may disproportionately affect small-scale producers. |

|

2. “Cessification” of Governance |

• Excessive use of cesses may: |

|

|

3. Complex Tax Structure |

• Adds another layer over GST + excise, increasing compliance and administrative burden. |

|

Conclusion:

The Health Security se National Security Cess Bill, 2025 represents a significant step towards establishing a stable and transparent revenue channel dedicated to strengthening India’s Public Health Systems and National Security capabilities. By adopting a capacity-based levy structure supported by a robust compliance and enforcement framework, the Bill ensures predictability in revenue mobilisation while maintaining accountability through oversight.