Context:

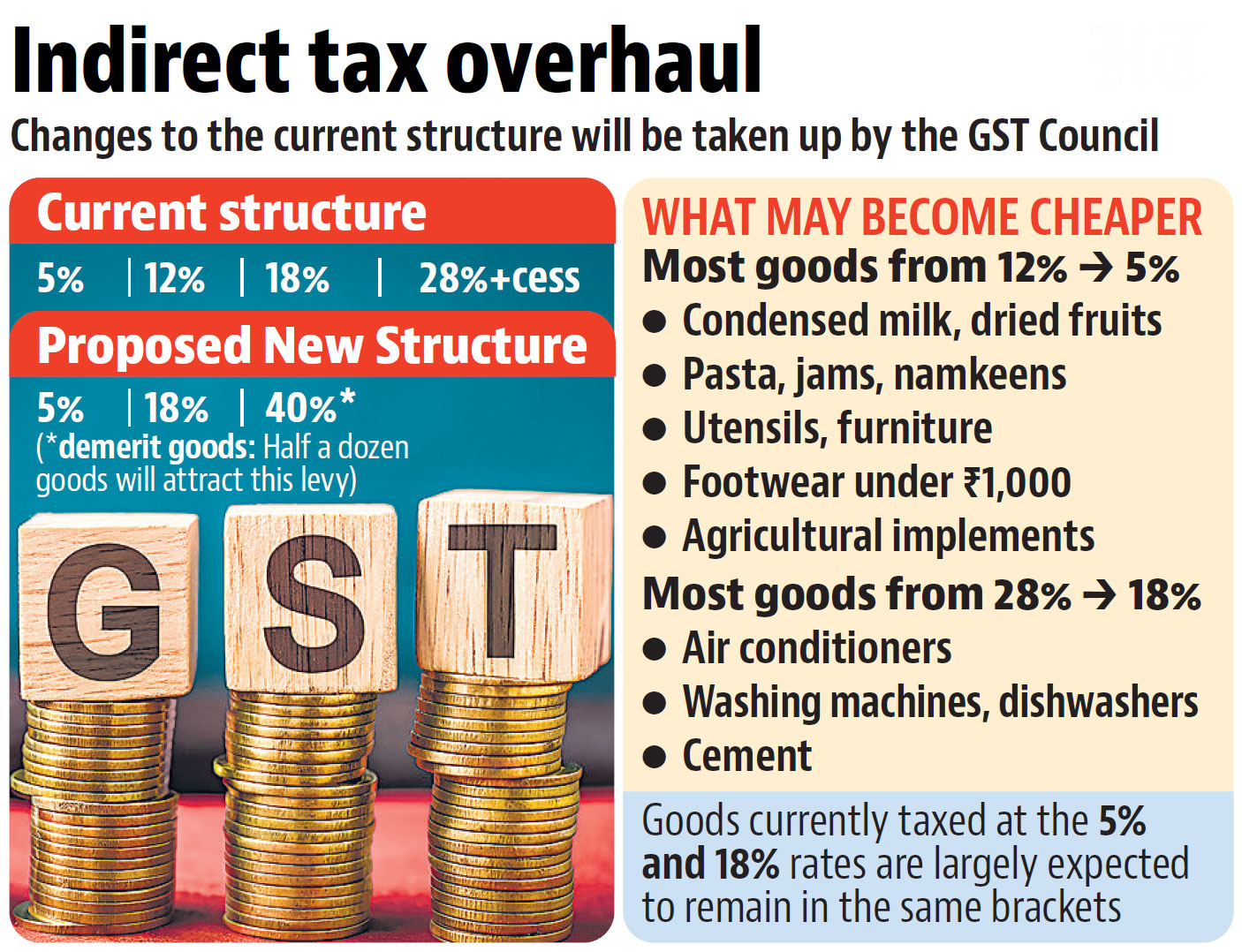

The Group of Ministers (GoM) constituted by the GST Council has accepted the Centre’s proposal to overhaul India’s GST rate structure, recommending the elimination of the 12% and 28% slabs. The proposal now heads to the GST Council for final approval.

Key Recommendations:

- Two-Slab Structure: Retain only 5% and 18% rates—merit and standard categories respectively.

- Special 40% Slab: For luxury or demerit items like tobacco and online gaming.

- Slab Rationalisation: Shift 99% of items in the 12% bracket to 5%, and 90% from 28% to 18%.

Strategic Implications:

- Consumer Relief: Lowers tax burden on daily essentials like packaged foods and household goods.

- Economic Stimulus: Expected to boost demand ahead of Diwali and help offset global headwinds.

- Simplified Taxation: Reduces compliance costs, classification disputes, and improves administrative efficiency.

GoM's Role & Functioning

· The Group of Ministers (GoM) is a specially constituted panel drawn from the GST Council, tasked with analyzing complex issues, consulting stakeholders, and recommending policy actions.

· The GoM on Rate Rationalisation, chaired by Bihar Deputy CM Samrat Choudhary, includes finance ministers from states like West Bengal, Karnataka, Kerala, UP, Rajasthan, and Goa.

· Recently, Finance Minister Nirmala Sitharaman briefed the panel on the Centre’s proposal for sweeping GST reforms.

About GST:

- GST is a comprehensive, multi-stage, destination-based indirect tax that is levied on the supply of goods and services across India.

- Launched on 1st July 2017, the Goods and Services Tax (GST) replaced multiple indirect taxes, aiming to simplify India’s tax structure. It is a destination-based, value-added tax governed by a dual model (CGST + SGST/IGST), with rates decided by the GST Council. GST consolidated excise duty, VAT, and service tax into a unified system, promoting the concept of ‘One Nation, One Tax’.

Constitutional Backing

· Introduced through the 101st Constitutional Amendment Act, 2016

· Came into effect on 1st July 2017

· Empowered both the Centre and States to levy GST

Key Achievements

· In FY 2024–25, GST recorded it's highest-ever collection at ₹22.08 lakh crore. Over 1.51 crore active taxpayers reflect increased formalisation.

· Digital tools like e-way bills, e-invoicing, and ICEGATE integration have improved compliance and refunds.

· For businesses, GST eliminated cascading taxes, reduced logistics costs, and streamlined supply chains.

Challenges

· Despite gains, GST faces hurdles like complex tax slabs, inverted duty structures, and exclusion of petroleum and alcohol.

· The GST Appellate Tribunal (GSTAT) remains inactive in many states, delaying dispute resolution.

· Procedural ambiguities and frequent rule changes further affect compliance.

Conclusion:

The GoM’s report marks a pivotal shift toward “GST 2.0”, featuring a simplified, growth-oriented tax regime. If approved by the GST Council, these reforms could significantly enhance affordability, ease of doing business, and contribute to a consumption-led economic revival under the banner of Atmanirbhar Bharat.