Context:

The Union government recently notified changes to the regulations for the setting up of special economic zones (SEZs) for the manufacturing of semiconductors or electronic parts.

Key changes proposed:

· Reduced Land Requirement: The minimum contiguous land area required for semiconductor/electronics SEZs has been reduced from 50 hectares to 10 hectares (Rule 5 amendment of SEZ act, 2006).

· Domestic Supply Allowed: SEZ units can now supply to the domestic market (Rest of India) after paying applicable duties, in addition to exporting (Rule 18 amendment of SEZ act, 2006).

· Relaxation in Land Encumbrance Rules: The Board of Approval may now relax the requirement for SEZ land to be encumbrance-free if it is mortgaged or leased to the government or authorized agencies (Rule 7 amendment of SEZ act, 2006).

· Inclusion of Free-of-Cost Goods in NFE: The value of free-of-cost goods can now be included in Net Foreign Exchange (NFE) calculations, improving the export-import balance.

Impact of relaxation:

· Boost high-tech manufacturing: The amendments will promote pioneering investments and boost manufacturing in high-tech sectors.

· Create high-skilled jobs: The growth of semiconductor manufacturing ecosystem will create high-skilled jobs in the country.

· Attract investments: The changes will attract investments in the semiconductor and electronics manufacturing sectors.

New Projects:

Following the notification, two SEZ facilities have been approved in Gujarat and Karnataka with a total investment of ₹13,100 crore. Micron Semiconductor Technology India will establish an SEZ facility in Sanand, Gujarat, with an estimated investment of ₹13,000 crore, while Aequs will establish an SEZ in Dharwad, Karnataka, with an estimated investment of ₹100 crore.

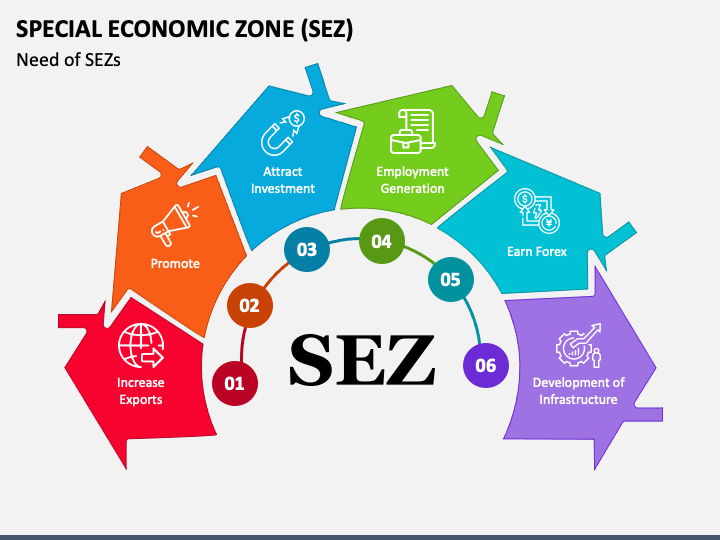

About Special Economic Zones (SEZs):

SEZs are specially designated areas treated as foreign territory for trade and customs, aimed at boosting exports, employment, and investment through tax and regulatory incentives. They are governed by the SEZ Act, 2005 and SEZ Rules, 2006.

Currently, 276 SEZs are operational in India. Total exports from SEZs in 2023-2024 stood at USD 163.69 billion.

Key benefits of SEZs in India:

· Duty-free import of goods for development

· Tax exemptions (e.g., GST zero-rating)

· Single-window clearances

· Foreign direct investment incentives

· Up to USD 500 million ECB allowed per year

About Special Economic Zones (SEZ) Act of 2005:

The Special Economic Zones (SEZ) Act of 2005, which came into effect in February 2006, aims to promote exports, attract foreign investment, and create employment by establishing SEZs. It replaced the earlier Export Processing Zones (EPZs).

The Act facilitates SEZ development through a single-window approval process and offers fiscal incentives like duty-free imports and tax exemptions.

Conclusion:

The government's decision to ease SEZ norms is a significant step towards promoting high-tech manufacturing and creating a favorable business environment in the country.