Context:

On 24th September 2025, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, formally launched the Goods and Services Tax Appellate Tribunal (GSTAT) in New Delhi.

About GST Appellate Tribunal:

-

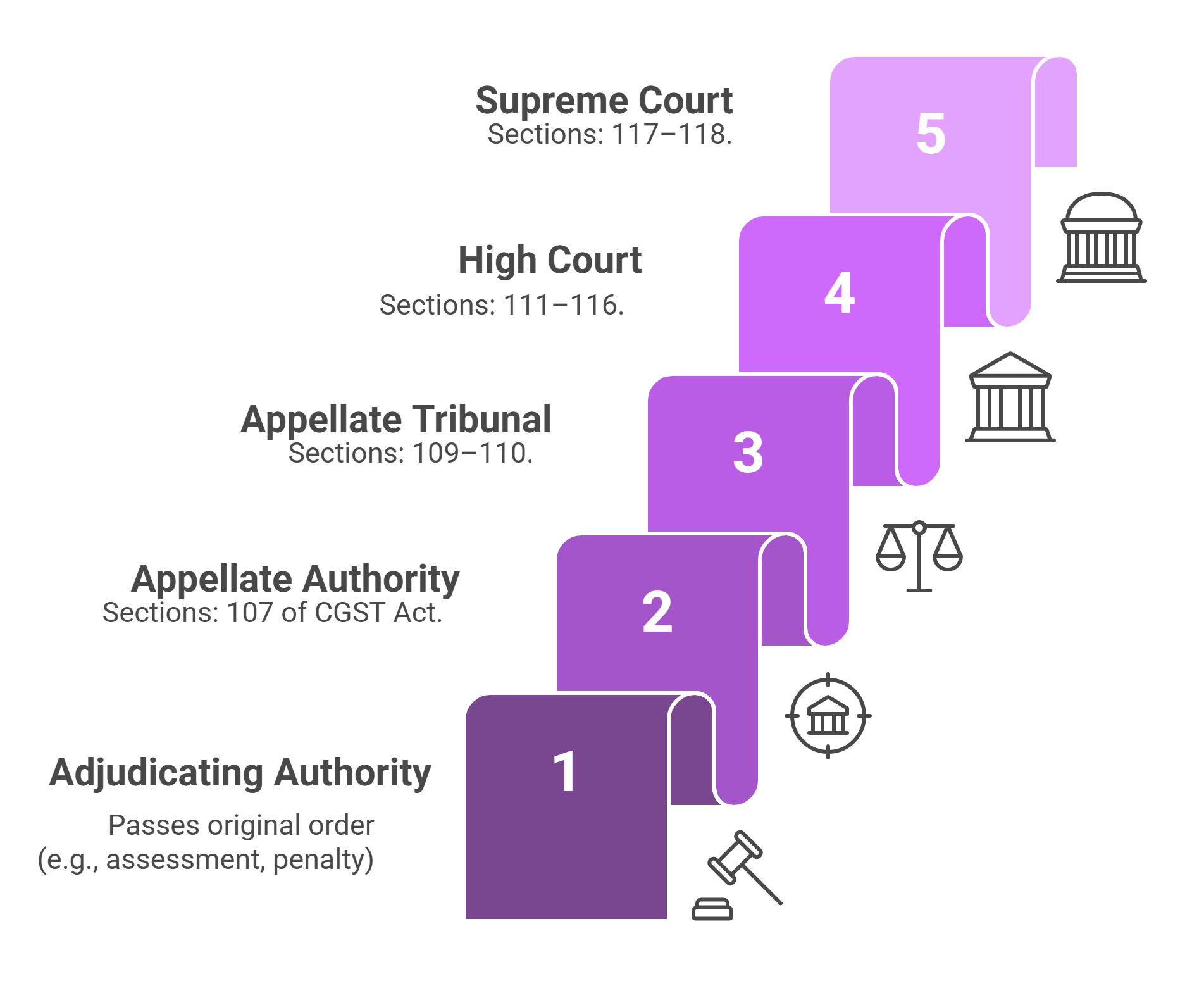

- GSTAT is a statutory tribunal established under Section 109 and Section 110 of the Central Goods and Services Tax Act, 2017 (CGST Act). It serves as a common forum for appeals under the Central GST Act and the respective State/UT GST Acts.

- Its structure reflects cooperative federalism with a Principal Bench in New Delhi and 31 State Benches across 45 locations.

- The GSTAT consists of a President (Head), a Judicial Member, and two Technical Members (one representing the Centre and one from the State). Each State Bench includes two Judicial Members and one Technical Member each from the Centre and the State.

- The President must be a former Supreme Court judge or High Court Chief Justice. Judicial Members must have served as High Court or District Judges for at least 10 years. Technical Members from the Centre and States must be senior officers with at least 25 years of service and experience in GST or tax administration.

- GSTAT is a statutory tribunal established under Section 109 and Section 110 of the Central Goods and Services Tax Act, 2017 (CGST Act). It serves as a common forum for appeals under the Central GST Act and the respective State/UT GST Acts.

Powers & Functions:

-

- GSTAT acts as the second appellate body in the GST structure – hearing appeals against orders passed by Appellate or Revisional Authorities under both central and state GST laws.

- From April 2026, the Principal Bench will also act as the National Appellate Authority for Advanced Ruling (AAR), adding to its jurisdiction.

- It can:

- Pass orders, impose penalties, revoke or cancel registrations, rectify errors, summon documents, examine witnesses etc. (powers akin to civil courts in aspects linked to GST disputes)

- Ensure uniformity in the interpretation of GST across states and Centre, reducing conflicting rulings

- Pass orders, impose penalties, revoke or cancel registrations, rectify errors, summon documents, examine witnesses etc. (powers akin to civil courts in aspects linked to GST disputes)

- GSTAT acts as the second appellate body in the GST structure – hearing appeals against orders passed by Appellate or Revisional Authorities under both central and state GST laws.

Significance of tribunal:

-

- Jargon-free decisions presented in plain language, along with simplified formats and checklists.

- Digital-by-default filings and virtual hearings, along with time standards for listing, hearing, and pronouncement.

- Staggered filing of legacy appeals until 30 June 2026 to manage case volume.

- Reduced legal frictions and simplified dispute resolution, thereby enabling faster cash flows and greater confidence for MSMEs and exporters.

- Building a transparent, predictable, and credible appellate process to strengthen taxpayer trust.

- Jargon-free decisions presented in plain language, along with simplified formats and checklists.

Challenges:

-

- The backlog of appeals (estimated at ~ 4.8 lakh) will strain the new tribunal from the beginning.

- Coordinated Centre–State cooperation will be crucial to staff benches, agree on procedures, and ensure smooth operations.

- Ensuring the independence, competence and consistency of judicial and technical members across various benches is essential to avoid regional disparities.

- To benefit smaller taxpayers, bridging the digital divide (making online filing and virtual hearings accessible) will be important.

- The backlog of appeals (estimated at ~ 4.8 lakh) will strain the new tribunal from the beginning.

Conclusion:

The launch of GSTAT signals a deeper maturity in India’s GST structure. If implemented faithfully, with transparency, speed, fairness, it can be transformative for taxpayers, trade, and the institutional credibility of indirect taxation in India.