Context:

Recently, the Mercer‑CFA Institute’s Global Pension Index was released which placed India among the bottom tier of pension systems worldwide, awarding it a D grade, with an overall score of 43.8 out of 100.

About the Global Pension Index:

The Mercer CFA Institute Global Pension Index 2025 is the seventeenth edition of an annual benchmarking of retirement income (pension) systems around the world.

· It currently covers 52 retirement systems, representing about 65 % of the world’s population.

Methodology & Framework:

The Index evaluates each country’s pension or retirement income system using three core pillars:

|

Pillar |

Weight in overall score |

What it captures |

|

Adequacy |

40 % |

The extent to which pensions provide adequate income in retirement (replacement rates, coverage, social assistance) |

|

Sustainability |

35 % |

Whether the system is financially viable long-term—considering demographic change, fiscal pressures, investment returns |

|

Integrity |

25 % |

Governance, regulation, transparency, costs, trust in the system |

Key Findings:

Top Performers / A‑Grade Systems: The countries that achieved A grades (scores above 80) in 2025 include:

o Netherlands (85.4)

o Iceland (84.0)

o Denmark (82.3)

o Singapore (80.8) — for the first time, Singapore has broken into the A‑grade tier, becoming the only Asian country to do so in 2025.

o Israel (80.3)

India's Performance – Key Findings

-

- Overall Score & Grade: 43.8, Grade D. Slightly down from 44.0 in 2024.

- Adequacy: Worst among its dimensions. India received an E grade in adequacy (score ~34.7) reflecting very low income replacement levels and very limited social assistance for elderly poor.

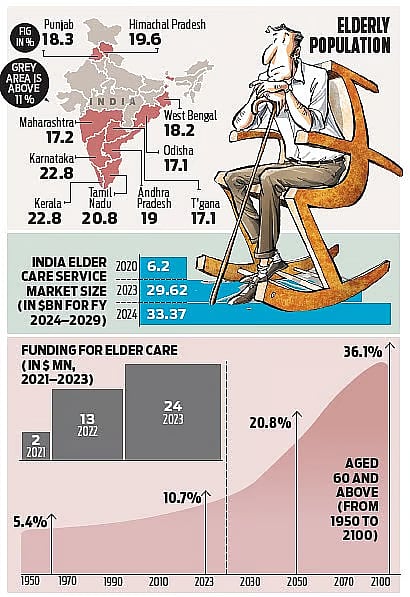

- Sustainability: Also weak. Demographic ageing, limited pension participation especially in informal sector, low savings, and exposure to risks (including climate) are flagging concerns.

- Integrity: Relatively better, but still needing improvement. Regulatory oversight, transparency, and governance are not at the level seen in top‑pension systems.

- Overall Score & Grade: 43.8, Grade D. Slightly down from 44.0 in 2024.

Challenges Behind the Poor Rating

1. Low coverage of informal sector

A large proportion of India’s workforce is in the informal economy, which is not covered adequately by formal pensions. Many workers have no pension, or what they have is token.

2. Inadequate pension amounts / low replacement ratio

The income retirees get (from EPFO, NPS, etc.) often falls short of what is needed to maintain a decent standard of living. The replacement rate (income during working age vs income after retirement) is too low.

3. Fragmentation in pension architecture

Multiple pension schemes (Old Pension Scheme, EPFO, NPS), overlapping responsibilities, different rules and benefits – lead to inefficiencies and confusion.

Conclusion

India’s D grade in Global Pension Index 2025 is a clarion call: while economic growth continues, the retirement security of millions remains vulnerable. With its elderly population growing, there is limited time to address these gaps. Policymakers must push for reforms — universal assistance, better coverage, stronger regulation — to build a pension system that is not just financially sustainable, but also socially just.