Context:

Recently, the Reserve Bank of India (RBI) and the European Central Bank (ECB) announced the launch of the initial phase of linking India’s Unified Payments Interface (UPI) with the Eurosystem’s TARGET Instant Payment Settlement (TIPS) platform.

Key Features of UPI–TIPS Linkage:

|

Section |

Details |

|

1. What Is Being Linked? |

• The initiative aims to interlink UPI and TIPS to enable seamless payments across the India–Eurozone corridor. |

|

2. Strategic Rationale |

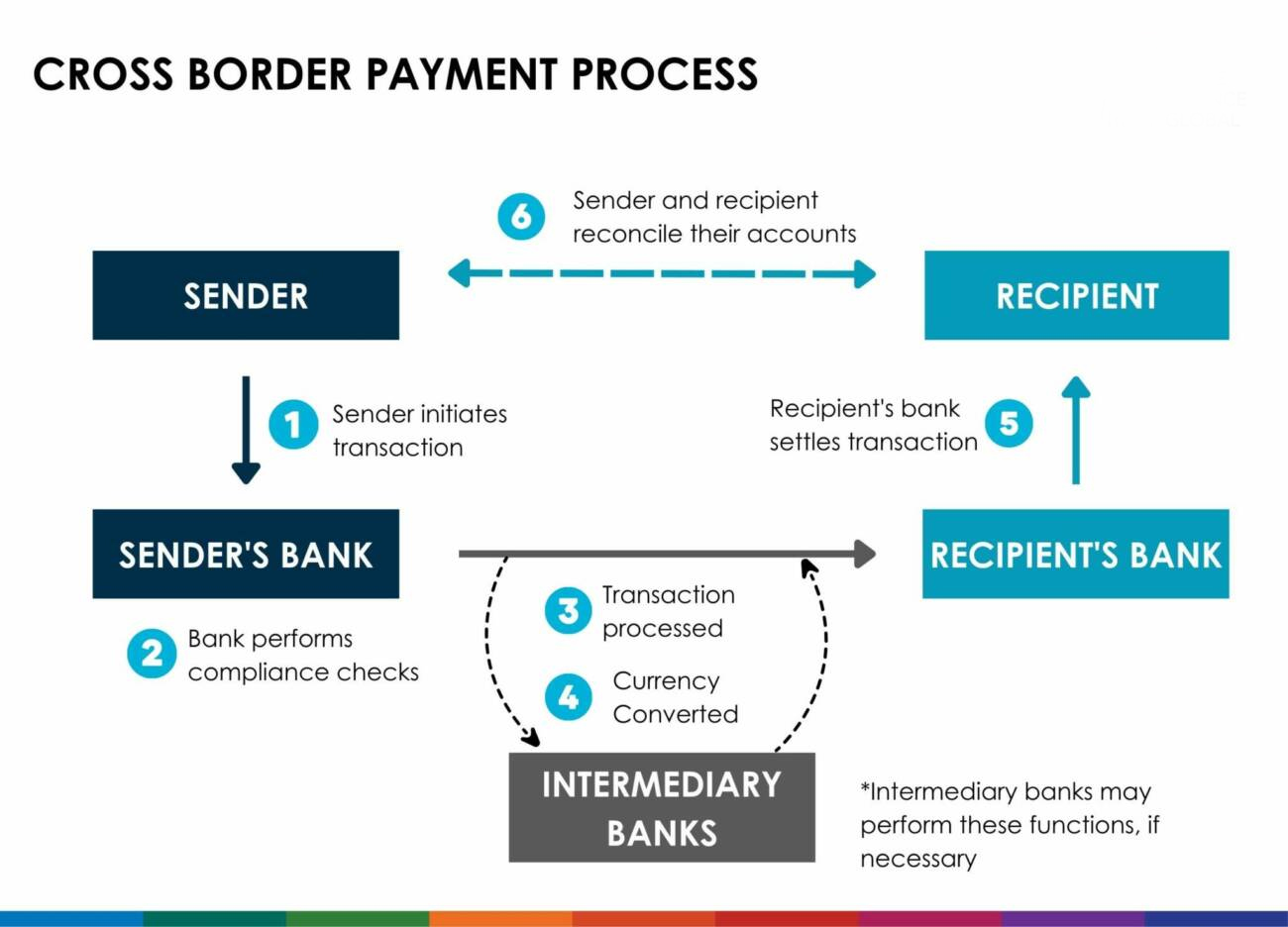

• Aligns with the G20 Roadmap for Enhancing Cross-Border Payments—faster, cheaper, more transparent, inclusive payments. |

|

4. Benefits |

• Reduced Remittance Costs through interoperability and streamlined payment flows. |

|

5. Challenges / Risks |

• Regulatory & legal hurdles relating to cross-jurisdiction rules, data norms, compliance. |

About UPI International Expansion:

|

About UPI |

What it is: Real-time payment system developed by NPCI enabling instant bank-to-bank transfers. |

|

|

Countries Where UPI Is Accepted |

• Bhutan |

|

|

International Expansion |

• Expansion led by NPCI International Payments Limited (NIPL). |

|

Conclusion:

The realisation phase of the UPI–TIPS linkage between RBI and ECB is a landmark step in global payments architecture. It represents not just a technical integration, but a strategic leap in cross-border financial connectivity. Once operational, it could significantly lower the friction and cost of remittances between India and Europe — benefiting millions of users, especially in the diaspora and SMEs.