Context:

Under a new regulation of the European Union (EU), an additional charge is being imposed from 1 January 2026 on steel and aluminium exported from India to Europe, based on the amount of carbon emissions generated during their production. As a result, Indian companies are likely to face adverse impacts on their competitiveness, profit margins, and existing trade contracts.

Impact on Indian Exports:

-

- The EU accounts for about 22% of India’s steel and aluminium exports, valued at USD 5.8 billion in FY 2024–25.

- CBAM could erode 16–22% of realised sales prices, forcing contract renegotiations and weakening India’s market presence.

- The EU accounts for about 22% of India’s steel and aluminium exports, valued at USD 5.8 billion in FY 2024–25.

Mechanism and Coverage of CBAM:

-

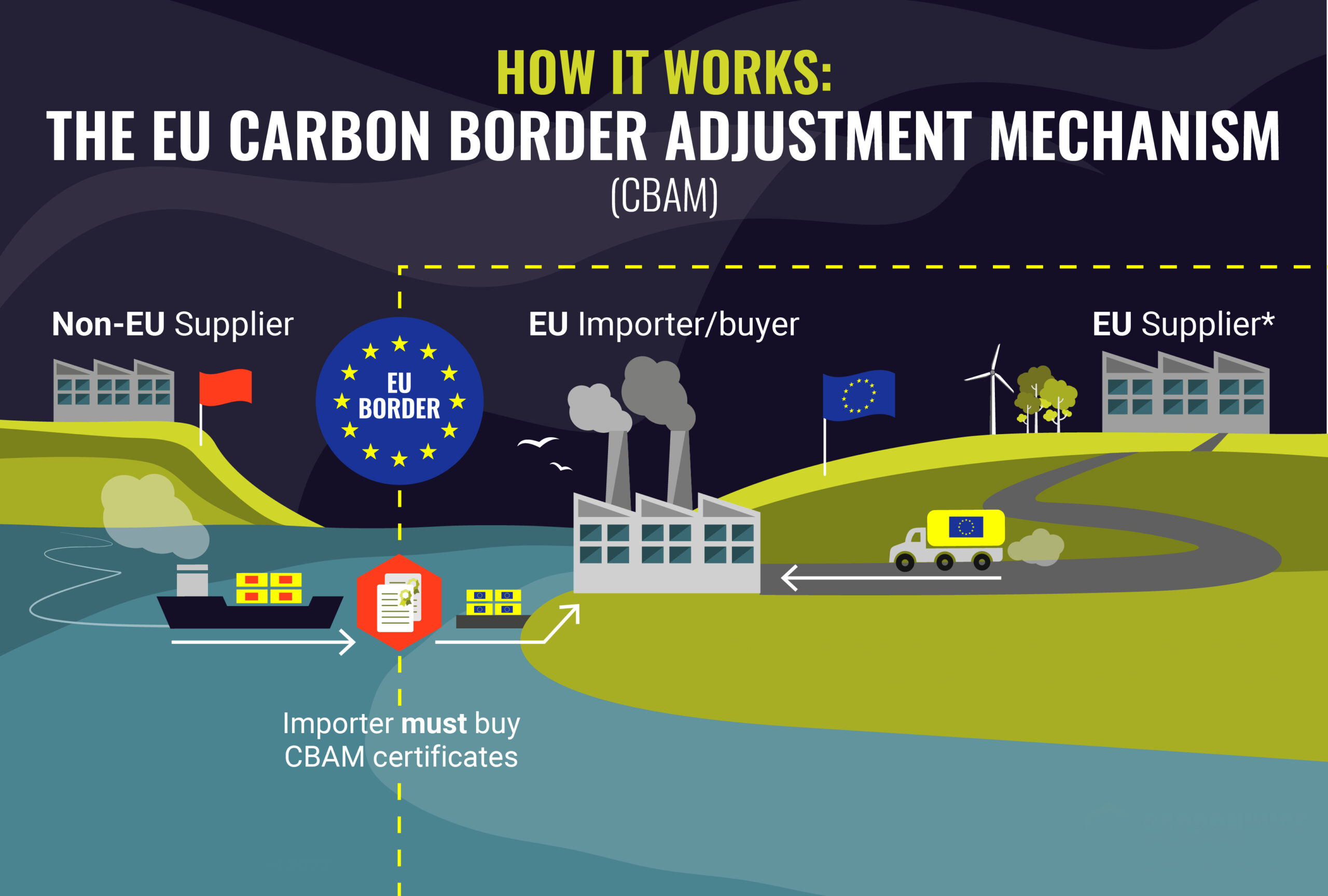

- CBAM extends the EU’s carbon pricing system to imports. While domestic EU companies pay under the EU Emissions Trading System (ETS), CBAM imposes equivalent costs on foreign producers.

- Covered sectors include steel, aluminium, cement, fertilisers, electricity, and hydrogen, with plans for further expansion.

- CBAM costs are calculated based on Scope 1 and Scope 2 emissions at the plant level. Failure to submit verified data leads to default emission values, significantly increasing costs.

- CBAM extends the EU’s carbon pricing system to imports. While domestic EU companies pay under the EU Emissions Trading System (ETS), CBAM imposes equivalent costs on foreign producers.

Financial Implications:

-

- For coal-based BF–BOF steel, production emits around 2.4 tonnes of CO₂ per tonne of steel. At an EU carbon price of €80 per tonne, CBAM costs could reach €192 per tonne.

- Buyers typically pass 50–70% of the cost to Indian exporters, reducing margins by 16–22%.

- CBAM burden varies by production route:

- BF–BOF (coal-based): Highest cost

- Gas-based DRI: Moderate cost

- EAF (scrap/electric): Lowest cost

- BF–BOF (coal-based): Highest cost

- For coal-based BF–BOF steel, production emits around 2.4 tonnes of CO₂ per tonne of steel. At an EU carbon price of €80 per tonne, CBAM costs could reach €192 per tonne.

Strategic Implications:

-

- CBAM represents a structural shift in global trade, not a temporary barrier.

- Developed economies increasingly use carbon pricing for climate goals as well as trade protection and revenue generation.

- Countries like India face disadvantages due to limited domestic carbon pricing and higher emissions intensity.

- CBAM represents a structural shift in global trade, not a temporary barrier.

Policy Recommendations for India:

-

- Diplomatic Resolution: Address CBAM concerns within the India–EU FTA framework to seek exemptions or transition arrangements.

- Domestic Reforms: Strengthen carbon accounting, promote cleaner production, and ensure verified emissions data.

- Industry Adaptation: Exporters must adjust production methods, track carbon footprints, and revise contracts to include CBAM costs.

- Diplomatic Resolution: Address CBAM concerns within the India–EU FTA framework to seek exemptions or transition arrangements.

Conclusion:

CBAM transforms carbon into a trade currency where competitiveness depends on both cost efficiency and emission intensity. India’s ability to protect exports, maintain EU market share, and negotiate favourable trade terms will shape its response to this emerging carbon-conscious trade order.