Context:

Recently, The World Inequality Report 2026, the third in its series after the 2018 and 2022 editions, was released by the World Inequality Lab, based on research by over 200 scholars worldwide. It provides detailed estimates and analysis of income and wealth inequalities both globally and within countries, including India. The report highlights that economic growth in many countries, including India, has been accompanied by widening disparities in income and wealth distribution.

Key Findings related to India:

1. Income Concentration in India:

-

-

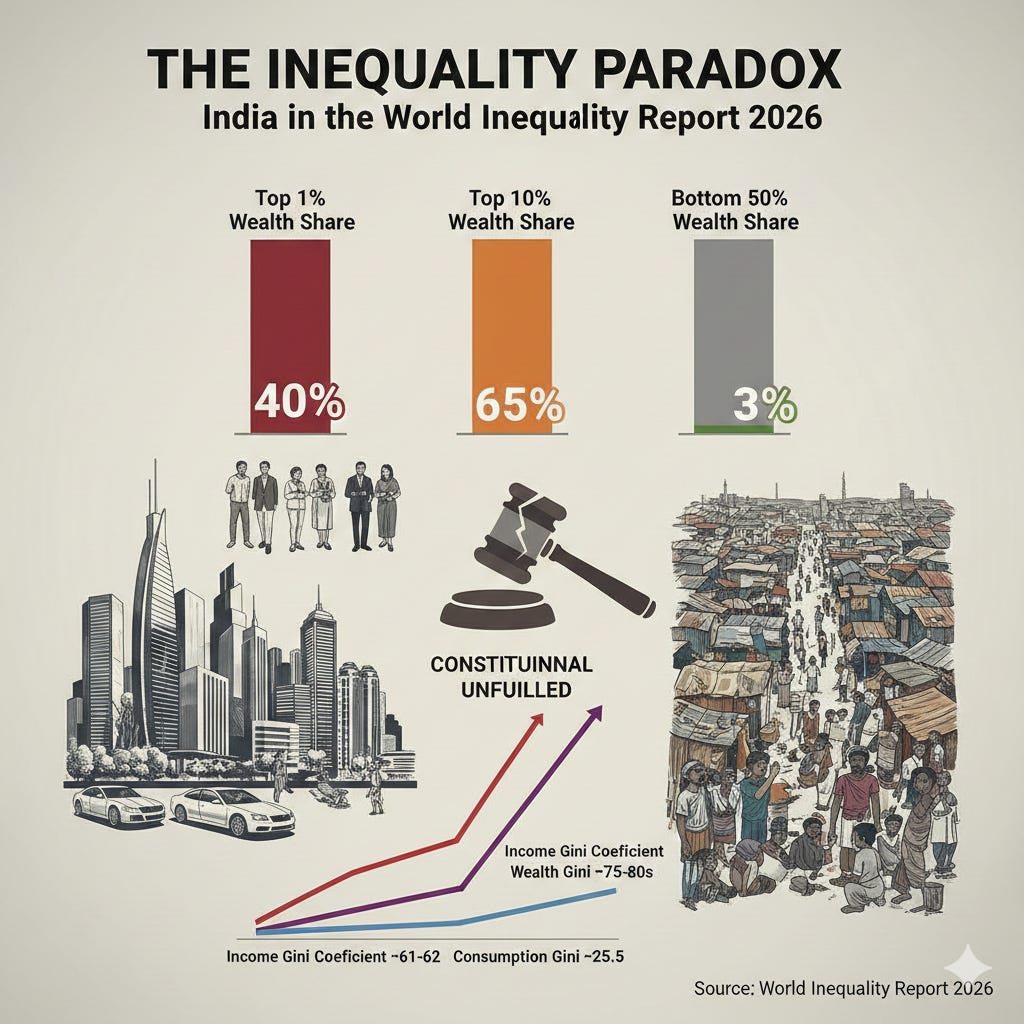

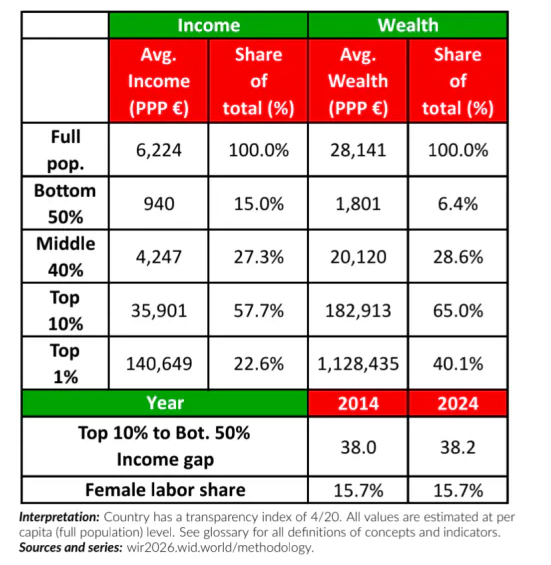

- In India, the top 10% of income earners capture about 58% of the national income, while the bottom 50% receive only 15%. This indicates that more than half of the total national income accrues to just one‑tenth of the population, leaving the majority with a disproportionately small share.

- In India, the top 10% of income earners capture about 58% of the national income, while the bottom 50% receive only 15%. This indicates that more than half of the total national income accrues to just one‑tenth of the population, leaving the majority with a disproportionately small share.

-

2. Wealth Inequality:

-

-

- Wealth disparities are even more pronounced. The top 10% of Indians own around 65% of total wealth, whereas the top 1% alone holds about 40% of the country’s wealth. In contrast, the bottom 50% of the population holds a negligible share of wealth.

- Wealth disparities are even more pronounced. The top 10% of Indians own around 65% of total wealth, whereas the top 1% alone holds about 40% of the country’s wealth. In contrast, the bottom 50% of the population holds a negligible share of wealth.

-

3. Comparison with Past Trends:

-

-

- Compared to the World Inequality Report 2022, the concentration of income and wealth has increased further. In 2021, the top 10% held about 57% of national income and the bottom 50% only 13%, indicating a widening gap over the past few years.

- Compared to the World Inequality Report 2022, the concentration of income and wealth has increased further. In 2021, the top 10% held about 57% of national income and the bottom 50% only 13%, indicating a widening gap over the past few years.

-

4. Labour Market and Gender Inequality:

-

-

- India’s average per capita annual income is around €6,200 (on a purchasing power parity basis).

- Female labour force participation remains very low at about 15.7%, and inequality persists across gender in income and employment.

- India’s average per capita annual income is around €6,200 (on a purchasing power parity basis).

-

Global Context of Inequality:

The report situates India’s inequality within a broader global picture:

-

- Globally, the top 10% own around 75% of total wealth, while the bottom 50% hold just 2%.

- The top 1% controls about 37% of global wealth, more than 18 times that of the bottom half of the world’s population.

- The top 0.001% (fewer than 60,000 ultra‑wealthy individuals) now own about three times more wealth than the entire bottom half of humanity.

- Globally, the top 10% own around 75% of total wealth, while the bottom 50% hold just 2%.

Structural Drivers across the world:

The report emphasises that such extreme levels of inequality are not inevitable but result from policy choices, institutional structures, and governance frameworks. Key structural factors include:

-

- Taxation and redistribution failures, especially at the very top of the distribution where ultra‑wealthy individuals often pay proportionally less tax than middle and lower‑income groups.

- Weak social protection systems, which fail to redistribute wealth and income effectively.

- Labour market design and access to quality employment opportunities, which remain limited for large segments of the population.

- Taxation and redistribution failures, especially at the very top of the distribution where ultra‑wealthy individuals often pay proportionally less tax than middle and lower‑income groups.

The report also identifies climate inequality, where the top 10% are responsible for about 77% of carbon emissions associated with private capital ownership, while the bottom half contributes only 3% highlighting disparities in both economic and environmental impact.

Drivers of Rising Inequality in India:

The report and subsequent analyses highlight multiple structural and policy-driven factors:

1. Uneven Growth & Sectoral Bias: Service sector and urban areas benefited more from liberalisation than agriculture and rural India.

2. Capital vs. Labour: Growth in capital income (dividends, rents) outpaced wages, concentrating wealth in assets rather than salaries.

3. Regressive Tax Policies: Tax cuts for corporations and high indirect taxes (GST, excise) disproportionately burden lower-income groups, while wealth taxes remain minimal.

4. Weak Public Services: Underinvestment in quality education, healthcare, and infrastructure limits social mobility.

5. Caste & Gender: Historical disadvantages are exacerbated by economic structures, limiting access for marginalized communities.

6. Political Economy: Close ties between big business and policymaking influence policies in favour of elites.

7. COVID-19 Impact: Pandemic disproportionately affected the poor, while billionaires’ wealth surged.

Constitutional Framework against Inequality in India:

Fundamental Rights Ensuring Equality:

The Constitution of India provides a strong framework to address historical and structural inequalities.

Under Articles 14 to 18, the Constitution guarantees:

· Equality before the law,

· Prohibition of discrimination on the grounds of religion, caste, sex, or place of birth,

· Equality of opportunity in public employment (including reservations under Article 16(4)),

· Abolition of untouchability (Article 17)

· Abolition of titles (Article 18).

These provisions strengthen the constitutional foundation of social justice and equal participation.

Directive Principles: Pathways to Social and Economic Justice:

The Directive Principles of State Policy (DPSPs), especially Articles 39(a), 39(d), 39A, 42, and 46 assign the state the responsibility to:

• Ensure the right to livelihood,

• Provide equal pay for equal work,

• Ensure humane working conditions,

• Provide free legal aid,

• Ensure maternity relief, and

• Promote the educational and economic interests of weaker sections.

Provisions for Positive Discrimination:

Articles 15(3), 15(4), 16(4) and the 103rd Constitutional Amendment (2019), which introduced 10% reservation for Economically Weaker Sections (EWS), collectively empower the state to actively promote social justice and enable marginalized groups to access opportunities.

Income and Employment Generation Programs:

• MGNREGA – Wage-based employment in rural areas

• PM-KISAN – Income support for farmers

• PMEGP – Promotion of micro-entrepreneurship

• DAY-NULM – Urban livelihood enhancement

• Skill India Mission (PMKVY) – Skill development and employment opportunities

Financial Inclusion Programs

• Pradhan Mantri Jan-Dhan Yojana (PMJDY) – Universal access to banking services

• MUDRA Yojana – Loans for small enterprises

• Stand-Up India – Encouraging entrepreneurship among women and SC/ST communities

Health and Food Security Measures:

• Ayushman Bharat (PM-JAY) – Free health insurance coverage

• Pradhan Mantri Garib Kalyan Anna Yojana (under NFSA) – Free food grains to vulnerable households

Social Security and Empowerment Programs

• National Social Assistance Programme (NSAP) – Old-age, widow, and disability pensions

• Atal Pension Yojana – Pension security for unorganized-sector workers

• Beti Bachao Beti Padhao – Empowerment of the girl child

• Self-Help Groups (SHGs) – Women’s economic empowerment and micro-entrepreneurship

Policy Recommendations:

To address growing inequality, the World Inequality Report 2026 suggests several policy avenues:

-

-

- Progressive taxation and tax justice measures, including a global minimum tax on billionaires and coordinated action to reduce tax evasion.

- Redistributive public investment in universal healthcare, education, childcare, and social protection to enhance equality of opportunity.

- Expansion of cash transfers, pensions, unemployment benefits, and targeted support to vulnerable groups.

- Progressive taxation and tax justice measures, including a global minimum tax on billionaires and coordinated action to reduce tax evasion.

- Strengthening labour rights, minimum wages, and inclusive economic policies that broaden access to productive employment.

-

Conclusion:

The World Inequality Report 2026 reveals that income and wealth inequalities in India remain among the highest globally, with the richest segments capturing a disproportionately large share of resources while the bottom half of the population manages a limited share of income and wealth. The report’s analysis highlights the need for robust policy interventions, especially in taxation, social protection and labour markets to build a more equitable economic structure that supports sustainable and inclusive growth.

| UPSC/PCS Mains Exam: |