India’s deep tech ecosystem, although growing rapidly, faces significant challenges in securing the support it needs to thrive. A recent study commissioned by the Office of the Principal Scientific Advisor and executed by the Confederation of Indian Industry (CII) and the Centre for Technology, Innovation, and Economic Research highlights critical gaps, particularly within research and development (R&D). Despite innovation within deep science and technology sectors, public-funded research organizations in India are falling short in supporting start-ups, especially those focused on deep tech.

The study assessed over 60 parameters across a wide range of research labs and found that only 25% of public-funded R&D institutions provide incubation support to start-ups, with a mere 16% extending this support to deep tech ventures. Key scientific agencies like the Council of Scientific and Industrial Research (CSIR), the Ministry of Electronics and Information Technology (MeitY), and the Department of Science and Technology (DST) often struggle to collaborate with industry players, both domestically and internationally. Furthermore, only half of these labs open their facilities to external researchers and students, limiting their potential to foster an inclusive and dynamic innovation ecosystem.

Key Findings

1. Limited Incubation and Startup Support: Only 25% of public R&D institutions offer incubation support to start-ups, and just 16% extend this to deep tech ventures. This indicates a significant gap in supporting the commercialization of cutting-edge research in India.

2. Low External Collaboration and Access: Only 15% of institutions engage with foreign industries, and just 50% provide access to their facilities for outside researchers and students, limiting opportunities for interdisciplinary innovation and global exposure.

3. Exclusion of Strategic Sector Labs: Labs in strategic sectors—such as defence, atomic energy, and space—were excluded from the study due to the sensitive nature of their work. The analysis focused on institutions under departments like CSIR, DST, MeitY, ICMR, ICAR, and AYUSH.

4. R&D Spending Trends: The government allocated ₹55,685 crore to R&D in 2020–21, with ₹24,587 crore spent on civilian sectors. A quarter of organizations allocated between 75% and 100% of their budgets to R&D, underscoring the substantial investment in scientific research.

Human Resource Trends

1. Decline in Permanent Staff: A reduction in permanent staff was observed across multiple labs, with a shift towards contractual employees, increasing from 17,234 to 19,625 between 2022–23.

2. Share of Young Researchers: The proportion of young researchers increased slightly from 54% to 58% between 2021–23 but remains lower than the 63–65% share recorded in previous years (2017–2020).

Deep Tech Start-Up Landscape: Opportunities and Challenges

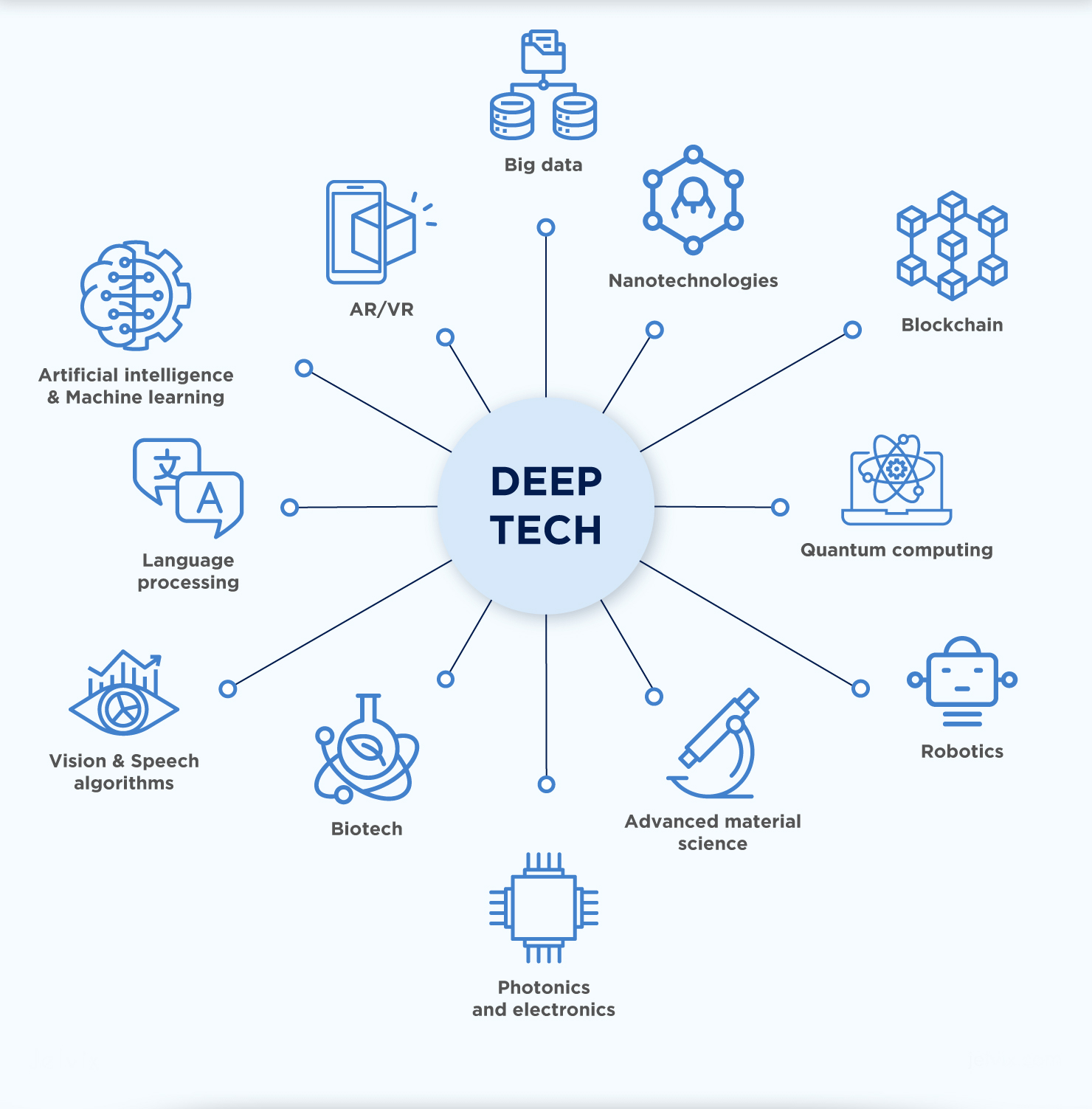

Deep tech ventures, encompassing fields like artificial intelligence (AI), biotechnology, semiconductors, drones, and clean energy, have emerged as key pillars of India’s innovation agenda. However, these ventures face a unique set of challenges, particularly around funding.

Growth and Investment Trends

India has seen rapid growth in deep tech ventures, with funding more than doubling every three years over the past decade. By 2023, the sector attracted over $1 billion in investments, and projections estimate $10 billion in funding by 2029. However, the funding landscape has slowed, particularly at the growth stage, with deep tech ventures facing substantial hurdles securing the capital needed for scaling.

Funding Gaps and the Growth-stage Crisis

While seed-stage funding is accessible, deep tech start-ups face significant challenges during the growth phase when larger investments are required. This funding gap, referred to as the "valley of death," has stalled the progress of many start-ups from prototypes to market-ready products. There is a noticeable shortage of investors willing to commit to late-stage funding, especially for rounds exceeding $20 million. As a result, many start-ups turn to international investors or unconventional financing models, which can hinder their long-term commercial success.

The Investor Dilemma: Knowledge and Risk Aversion

The shortage of funding is compounded by investor knowledge and risk aversion. Deep tech ventures require specialized expertise to assess their true potential, but many investors lack the domain-specific knowledge needed to evaluate these complex technologies. Investing in deep tech requires more than financial acumen; it requires an understanding of the technology and its commercial viability. Additionally, the quality of start-ups plays a significant role. While the number of deep tech start-ups has increased, many still lack the necessary innovation and scalability to attract investors. As per specialists, many ventures are driven by hype rather than genuine scientific breakthroughs, further contributing to investor reluctance.

Growing Sectors in Deep Tech

Despite these challenges, several sectors within deep tech continue to show significant promise. The semiconductor and chip design sectors have attracted increased funding, with start-ups raising substantial amounts in recent rounds. Space technology is another promising sector, with companies like AgniKul Cosmos making strides in 3D-printed rockets and satellite technology. Furthermore, sectors such as electric vehicles, clean energy, and energy storage are gaining momentum, driven by India’s focus on sustainability and energy transition. These areas are critical to India’s growth, and investor interest is beginning to rise.

Path Forward: Strengthening the Deep Tech Ecosystem

1. Bridging the Funding Gap: To address the growth-stage funding gap, there must be a greater focus on attracting specialized venture capitalists and fostering deeper collaborations between investors and deep tech start-ups.

2. Improving Start-up Quality: A more selective approach to funding is necessary, focusing on start-ups with scalable, innovative technologies. Mentorship and resources should be provided to help start-ups refine their business models and go-to-market strategies, increasing their chances of securing funding.

3. Public-Private Collaboration: Strengthening collaborations between public research institutions and private companies is essential. Public-funded labs must open their facilities and collaborate more with industry to bridge the innovation gap and support commercialization.

4. Increasing Investor Education: Educating investors about deep tech is critical. Providing specialized training programs and creating opportunities for investors to engage with the technology and founders directly will enable better investment decisions.

Conclusion

India’s deep tech ecosystem holds immense potential, but it is hindered by funding gaps, lack of institutional support, and investor hesitation. To unlock this potential, a coordinated approach involving government, industry, and investors is required. Public-funded R&D institutions must strengthen their support for start-ups, enhance collaboration with the private sector, and ensure that their research is more accessible and commercially viable. By bridging the funding gap, improving start-up quality, and fostering public-private partnerships, India can position itself as a global leader in deep tech innovation. This will be crucial for driving India’s next wave of scientific and technological breakthroughs.

| Main question: India’s deep tech ecosystem faces significant challenges despite the rapid growth of innovation in sectors like artificial intelligence, biotechnology, and clean energy. Discuss the key obstacles faced by deep tech start-ups in India and suggest measures to overcome these challenges. |