Context:

India’s rapidly expanding gig and platform workforce has emerged as a crucial driver of the country’s digital and urban economic ecosystem. Powered by a young demographic, widespread digital adoption, and rapid urbanisation, gig work—encompassing delivery, ride-hailing, and other app-based services—has created flexible employment opportunities for millions. However, while these workers have contributed significantly to the growth of the digital economy, they have long operated in conditions of uncertainty, low pay, and minimal social security. The recent strikes by delivery workers on Christmas Day and New Year’s Eve 2025–26, demanding a ban on unsafe 10-minute delivery models, fair wages, and legal recognition, highlight the pressing need to reconcile the interests of platform companies with the rights and welfare of their workforce.

-

-

- In a letter to Union Labour Minister Mansukh Mandaviya, the main union behind the strike, the Indian Federation of App-Based Transport Workers (IFAT), has raised several demands including a ban on the unsafe 10-minute delivery model, fair and transparent wages, regulation of companies under the recently notified labour code and recognition of their right to organise and bargain collectively.

- In a letter to Union Labour Minister Mansukh Mandaviya, the main union behind the strike, the Indian Federation of App-Based Transport Workers (IFAT), has raised several demands including a ban on the unsafe 10-minute delivery model, fair and transparent wages, regulation of companies under the recently notified labour code and recognition of their right to organise and bargain collectively.

-

The Rise of the Gig Economy and Emerging Challenges:

-

-

- India’s gig economy, consisting of platforms like Swiggy, Zomato, Blinkit, Zepto, Ola, and Uber, has grown exponentially in recent years. These platforms offer flexible work options, contributing to economic inclusion and providing livelihood opportunities, particularly for the youth. The workforce, predominantly urban and digitally connected, has enabled these platforms to cater to the rising demand for convenience services in the country’s fast-paced cities.

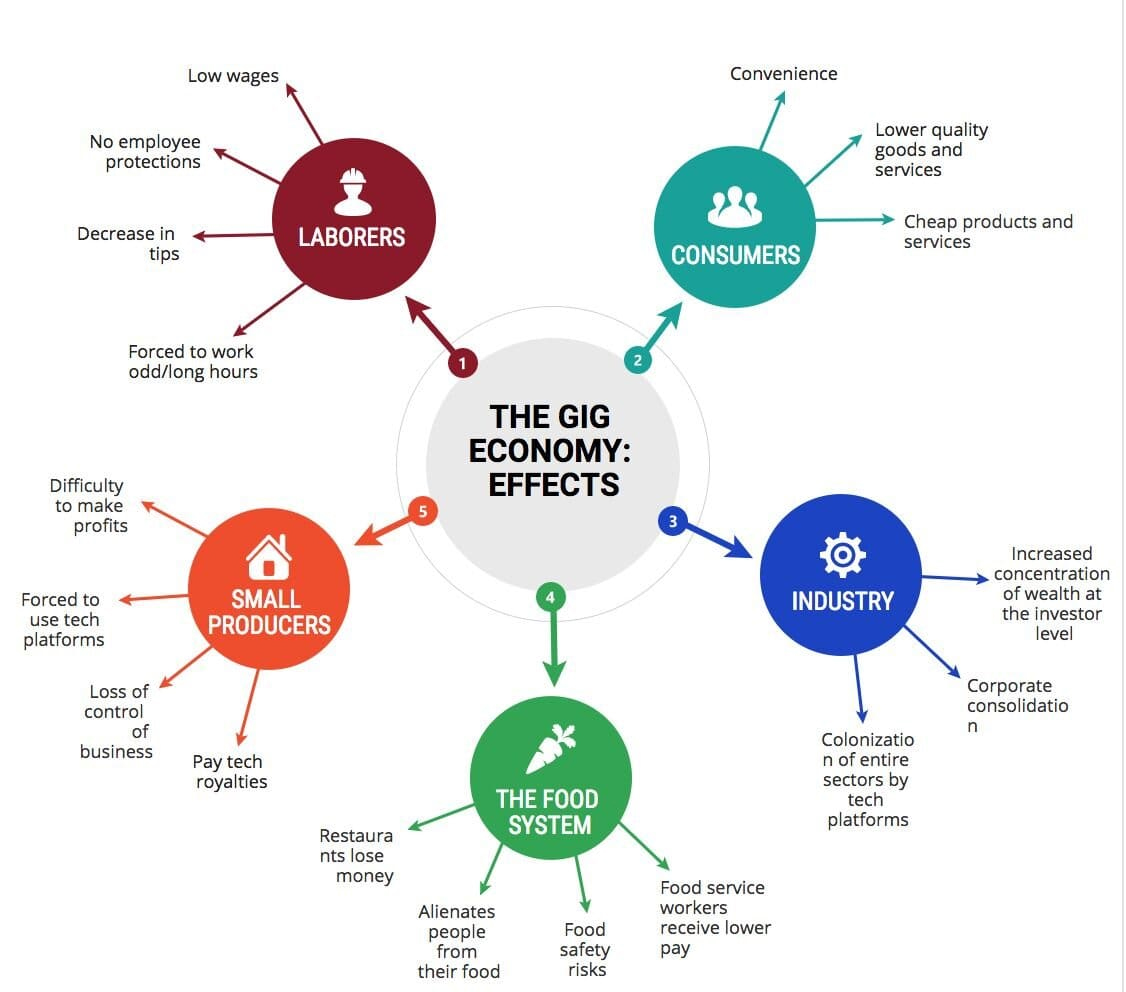

- However, alongside this growth, a set of structural challenges has emerged. Workers face uncertain incomes, often relying on variable incentives, with a low base pay insufficient to cover rising living costs. The work is largely controlled by opaque algorithms, which dictate assignments, delivery timings, and incentives. This results in workers covering hundreds of kilometres daily with minimal remuneration. The 10-minute delivery model, implemented by platforms such as Blinkit, Swiggy, and Zepto, intensifies the pressure, pushing workers to complete deliveries within extremely short timeframes, often compromising their health and safety.

- Moreover, these workers are typically excluded from statutory labour protections. They lack access to health insurance, accident cover, pension schemes, or maternity benefits, reflecting their position in the informal or unorganised sector. Strikes on high-demand dates such as December 25 and December 31 amplify the visibility of these challenges. On Christmas Day 2025, around 40,000 delivery workers participated in the strike, delaying or disputing 50–60% of orders in major cities like Delhi, Karnataka, Hyderabad, and Mumbai. Companies attempted to maintain operations by deploying third-party services, offering additional incentives, and reactivating inactive IDs. These events underscore the growing tensions between platform companies and workers, highlighting the limits of a gig economy built on precarious employment.

- India’s gig economy, consisting of platforms like Swiggy, Zomato, Blinkit, Zepto, Ola, and Uber, has grown exponentially in recent years. These platforms offer flexible work options, contributing to economic inclusion and providing livelihood opportunities, particularly for the youth. The workforce, predominantly urban and digitally connected, has enabled these platforms to cater to the rising demand for convenience services in the country’s fast-paced cities.

-

Legal Recognition through the Code on Social Security, 2020:

-

-

- Recognising the critical role of gig and platform workers, the Code on Social Security (SS), 2020, one of four major labour codes implemented in India’s recent labour reforms, formally brings these workers under the ambit of legal protection and social security for the first time.

- Prior to this reform, gig workers were considered part of the informal or unorganised sector, falling outside the scope of traditional labour laws such as the Payment of Wages Act (1936), Minimum Wages Act (1948), Employees’ Provident Fund Act, and Employees’ State Insurance Act.

- The SS Code provides formal legal recognition, defining key terms:

- Aggregator: A digital intermediary connecting buyers and service providers.

- Gig worker: A person engaged in work outside a traditional employer-employee relationship for remuneration.

- Platform worker: Someone undertaking work through online platforms under a non-traditional employment arrangement.

- Platform work: A work arrangement facilitated through an online platform to solve specific problems or provide services in exchange for payment.

- Aggregator: A digital intermediary connecting buyers and service providers.

- This recognition addresses a long-standing gap, allowing gig workers to claim statutory rights and entitlements while institutionalising protections that were previously absent. Legal recognition also ensures that these workers are acknowledged in national labour statistics, facilitating better policy formulation and welfare delivery.

- Recognising the critical role of gig and platform workers, the Code on Social Security (SS), 2020, one of four major labour codes implemented in India’s recent labour reforms, formally brings these workers under the ambit of legal protection and social security for the first time.

-

Social Security, Welfare, and Portability of Benefits:

-

-

- The Code institutionalises social security benefits for gig and platform workers through multiple mechanisms. A dedicated Social Security Fund has been established, requiring aggregators such as Amazon, Flipkart, Swiggy, and Zomato to contribute 1–2% of their annual turnover, capped at 5% of payments due to workers. This fund finances welfare schemes covering health, accident, maternity benefits, and pensions, shifting the responsibility from individual workers to a structured, statutory framework.

- One of the most significant reforms is the portability of benefits. Workers registered on the e-Shram portal receive a unique Aadhaar-linked ID, allowing them to maintain continuity of benefits while moving across platforms or jobs. Previously, workers lost their entitlements when switching jobs, leading to a lack of security and continuity. Now, whether a worker juggles multiple platforms or changes employment, their benefits remain intact, fostering stability in an otherwise precarious employment sector.

- The national database created through e-Shram enables targeted welfare delivery, supports skill development, and aids in policy-making. Additionally, the SS Code provides for grievance redressal mechanisms, such as toll-free helplines or facilitation centres, addressing complaints of wage exploitation, unsafe working conditions, or denial of benefits. These measures mark a shift from an unregulated gig economy to one that is increasingly structured and worker-centric.

- The Code institutionalises social security benefits for gig and platform workers through multiple mechanisms. A dedicated Social Security Fund has been established, requiring aggregators such as Amazon, Flipkart, Swiggy, and Zomato to contribute 1–2% of their annual turnover, capped at 5% of payments due to workers. This fund finances welfare schemes covering health, accident, maternity benefits, and pensions, shifting the responsibility from individual workers to a structured, statutory framework.

-

Transforming the Gig Economy: From Informal to Protected:

-

-

- The reformative measures under the SS Code signify a paradigm shift in India’s gig economy. Gig and platform workers, once largely invisible and vulnerable, now have access to legal recognition, social security benefits, and welfare schemes, marking a critical step towards formalisation. By providing portable benefits, a dedicated welfare fund, and a national registration framework, the Code ensures that these workers are no longer left at the mercy of platform algorithms or corporate discretion.

- However, legal recognition alone is insufficient. The strikes on New Year’s Eve 2025–26 illustrate the urgent need for enforcement of labour provisions, regulation of unsafe delivery models, and oversight of algorithmic management. Platform companies must engage in fair and transparent wage-setting, respect workers’ rights to organise, and internalise safety and welfare considerations into operational frameworks. Simultaneously, policymakers must ensure effective implementation of social security measures, monitor aggregator compliance, and expand coverage to include new forms of platform work.

- The gig economy represents the future of work in India’s urbanised and digitalised landscape. Ensuring that this sector grows in a fair, safe, and inclusive manner is critical not only for worker welfare but also for sustaining economic growth, urban services, and consumer trust. The Code on Social Security, 2020, provides the legal scaffolding; now, effective enforcement, corporate responsibility, and worker empowerment will determine the extent to which India can achieve a resilient, formalised, and equitable gig ecosystem.

- The reformative measures under the SS Code signify a paradigm shift in India’s gig economy. Gig and platform workers, once largely invisible and vulnerable, now have access to legal recognition, social security benefits, and welfare schemes, marking a critical step towards formalisation. By providing portable benefits, a dedicated welfare fund, and a national registration framework, the Code ensures that these workers are no longer left at the mercy of platform algorithms or corporate discretion.

-

Conclusion:

India’s gig and platform workforce is an integral component of the country’s digital economy, providing flexible employment and driving economic activity. Yet, long-standing vulnerabilities—low pay, unsafe working conditions, and absence of social security—have left millions exposed. The Code on Social Security, 2020, with its provisions for legal recognition, social security benefits, welfare funds, portable entitlements, and grievance redressal, represents a landmark reform aimed at transforming the sector. The recent strikes underline the urgency of translating legal provisions into practice, regulating unsafe work models, and ensuring fair remuneration. For India, the challenge lies in balancing the flexibility and innovation of platform-based work with the rights, protection, and dignity of its workers. By formalising the gig economy and protecting its workforce, India can not only secure the livelihoods of millions but also build a future-ready, inclusive, and resilient economic ecosystem.

| UPSC/PCS Main Question: India's gig and platform economy has created new employment opportunities, but it has also posed serious challenges for workers. In the light of this statement, critically analyse the role of the Code on Social Security, 2020 in addressing the problems of gig and platform workers. |