Context:

- In a major development, the Union Cabinet, chaired by Prime Minister Narendra Modi, has recently approved the establishment of a sixth semiconductor unit under the India Semiconductor Mission (ISM). This upcoming facility will be a joint venture between Hindustan Computers Limited (HCL) and Foxconn, two industry leaders in electronics manufacturing and hardware development.

- The plant will be located near Jewar airport in the Yamuna Expressway Industrial Development Authority (YEIDA) region of Uttar Pradesh. It is designed to manufacture 20,000 semiconductor wafers per month, with a projected chip output of 36 million units monthly. These display driver chips will be used in a wide range of products, including mobile phones, laptops, personal computers, automobiles, and other electronic displays.

- The project, expected to attract an investment of ₹3,700 crore (US$ 433.40 million), supports the broader vision of Atmanirbhar Bharat (Self-Reliant India) by strengthening India’s domestic chip-making capabilities and reducing reliance on imports.

Overview of the Indian Semiconductor Industry:

- India’s semiconductor market was valued at $38 billion in 2023 and is projected to reach $109 billion by 2030, driven by the explosive growth of electronics, IoT, automotive, and telecom sectors. To capture this opportunity and reduce external dependence, the government launched the India Semiconductor Mission (ISM) in 2021, with a substantial outlay of ₹76,000 crore under the Semicon India Program.

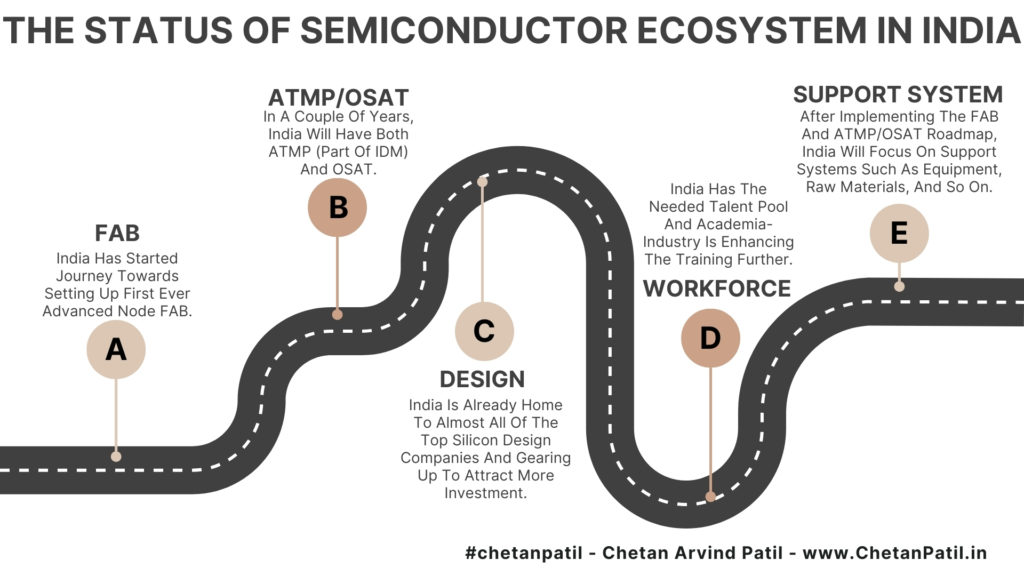

- This mission aims to create a sustainable semiconductor and display ecosystem, making India a global hub for electronics manufacturing and chip design. The ISM works in coordination with government ministries, industry stakeholders, and academic institutions, with guidance from global semiconductor experts, to ensure efficient resource deployment and project execution.

- The Semicon India Program supports not only wafer fabrication units (fabs) but also Outsourced Semiconductor Assembly and Testing (OSAT) units, compound semiconductor facilities, packaging technology, display fabs, and sensor ecosystems—effectively building a complete value chain for semiconductor manufacturing.

Major Semiconductor Projects Approved Under Semicon India:

|

No. |

Company / Project |

Type |

Location |

Investment (₹ Crore) |

Technology / Partner(s) |

Capacity |

|

1 |

Tata Electronics Private Limited (TEPL) |

Semiconductor Fab |

— |

₹91,526 |

Technology partner: PSMC (Taiwan) |

50,000 wafer starts per month |

|

2 |

TEPL – OSAT Facility |

OSAT |

— |

₹27,120 |

Indigenous semiconductor packaging technologies |

48 million units per day |

|

3 |

CG Power and Industrial Solutions Ltd |

OSAT |

— |

₹7,584 |

JV with Renesas (USA) and STARS Microelectronic (Thailand) |

15.07 million units per day |

|

4 |

Kaynes Technology India Ltd (KTIL) |

OSAT |

Sanand, Gujarat |

₹3,307 |

Technology from ISO Technology Sdn. Bhd. and Aptos Technology Inc. |

Over 6.33 million chips per day |

|

5 |

Tata Semiconductor Assembly & Test Pvt Ltd (TSAT) |

ATMP |

Morigaon, Assam |

₹27,000 |

Flip-chip and ISIP (Integrated System in Package) technologies |

48 million units per day |

Why Diversifying Semiconductor Supply Chains Is Crucial:

The global semiconductor supply chain is heavily concentrated, making it vulnerable to disruption. Key concerns include:

- Geopolitical Tensions: The Russia-Ukraine war disrupted the supply of neon gas. Since Ukraine is one of the key suppliers of neon gas and it is a critical input for chip production.

- Trade Restrictions: The US and EU have limited the export of advanced semiconductor equipment to China. In retaliation, China has imposed export controls on materials like gallium and germanium, further stressing global supply lines. Additionally, Washington has banned its companies and allies from supporting China in developing chips smaller than 16nm, which may further trigger supply shortages.

- Geographic Over-concentration: Over 60% of the world’s semiconductors are manufactured in Taiwan, with Taiwan and South Korea producing 100% of advanced chips below 10 nanometers.

The Strategic Need for an Indigenous Semiconductor Industry in India:

1. To Meet Soaring Demand: With 500 million new internet users expected over the next decade, demand for smartphones, laptops, cloud infrastructure and connectivity will rise sharply.

o India’s domestic chip demand could exceed $60 billion by 2026.

2. To Create Employment: Indigenous chip manufacturing will strengthen the domestic electronics supply chain and generate significant employment opportunities.

3. To Increase Revenue and Reduce Import Dependence: Local manufacturing will reduce import bills and increase export capacity, leading to better trade balances and higher local tax revenues.

o Currently, India imports almost all its semiconductors to meet demand expected to touch $100 billion by 2025.

4. To Enhance National Security: Locally manufactured chips can be designated as “trusted sources”, ensuring greater security in sensitive equipment like CCTV systems and 5G networks.

5. To Gain Geopolitical Leverage: Semiconductor independence enhances India's strategic autonomy and reduces reliance on Chinese imports, a key concern in light of events such as the Galwan Valley border clash.

Conclusion:

India’s push toward semiconductor self-sufficiency is a well-timed and strategic response to global supply chain vulnerabilities, rising domestic demand, and the digital transformation sweeping across all sectors.

The India Semiconductor Mission, supported by massive government funding and international partnerships, lays the foundation for India to become a global leader not just in chip manufacturing but also in design, testing, and packaging. This initiative aligns seamlessly with the vision of Atmanirbhar Bharat, empowering India to compete globally, create jobs, enhance national security, and assert its geopolitical influence in the high-tech arena of the future.

With a projected market of $109 billion by 2030, India’s proactive approach today will determine its standing in tomorrow’s digital world.

| Main question: "India’s ambition to become self-reliant in semiconductor manufacturing is as much about economic progress as it is about national security and geopolitical strategy." Critically examine this statement in the context of recent government initiatives and global supply chain dynamics. |