Context:

Semiconductors today are as vital to the modern economy as oil was in the industrial age. Often referred to as the “new oil”, these microelectronic chips power the digital world — enabling devices and systems that shape communication, transport, healthcare, defence, energy, and everyday life. From smartphones and laptops to electric vehicles, satellites, and medical scanners, semiconductors form the invisible but indispensable core of modern technology.

- Their strategic importance has elevated them from being just an industrial commodity to a critical national security and economic asset. Nations worldwide are now investing heavily to secure their place in the semiconductor manufacturing and supply chain ecosystem. The COVID-19 pandemic and rising geopolitical tensions — especially in the Taiwan Strait and the South China Sea — exposed the vulnerability of global supply chains, forcing governments to rethink their dependency on a small group of countries for chip production.

- Recently, the Government of India approved four additional semiconductor manufacturing projects in Odisha, Punjab, and Andhra Pradesh under the India Semiconductor Mission (ISM). These projects, involving a cumulative investment of approximately ₹4,600 crore, are expected to generate employment for 2,034 skilled professionals. With these approvals, the total number of projects sanctioned under ISM has reached ten, spread across six states and attracting total investments of around ₹1.60 lakh crore.

What are Semiconductors and Why They Matter:

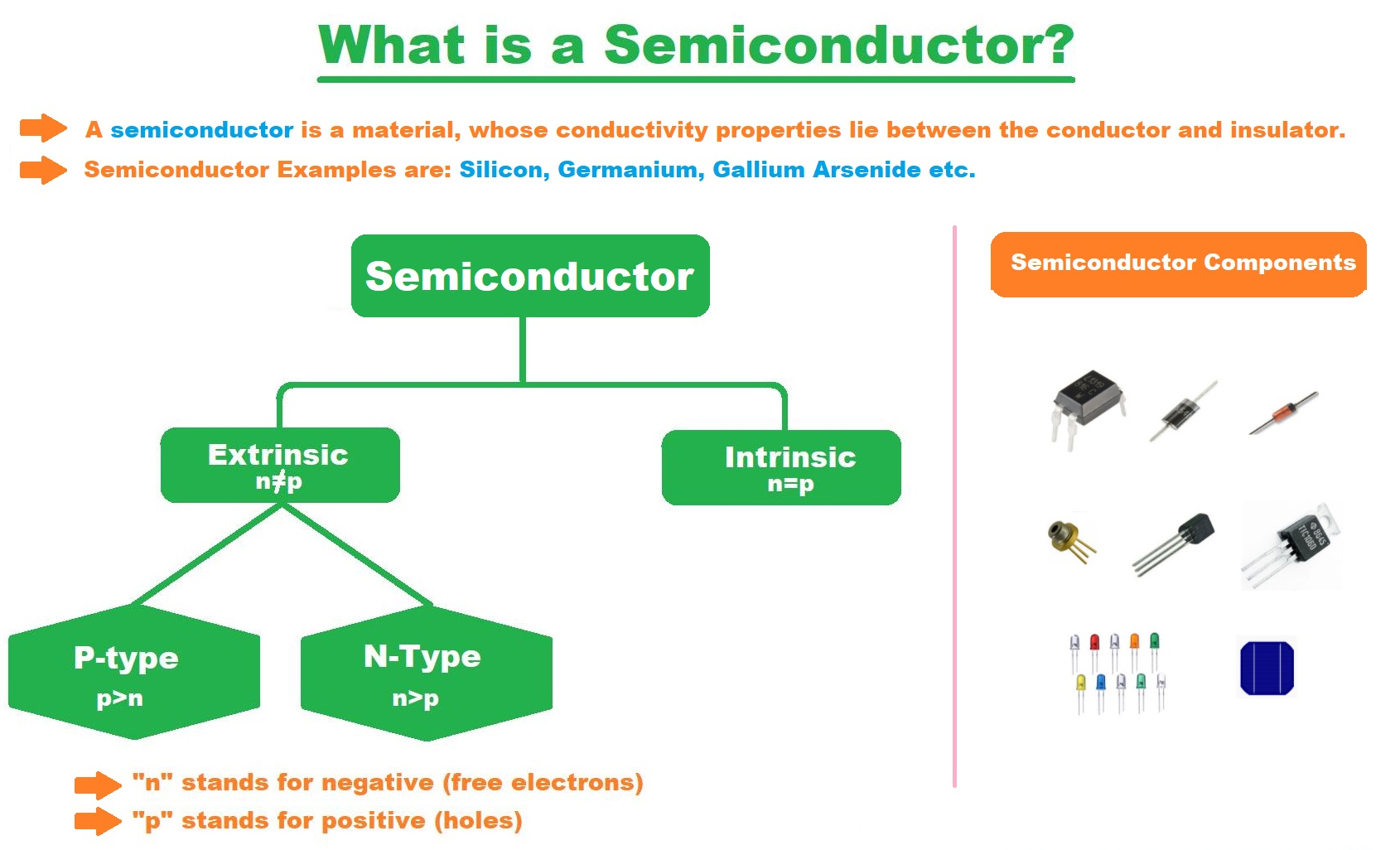

Semiconductors are materials with electrical conductivity between conductors (like copper) and insulators (like glass). Their conductivity can be precisely controlled, making them ideal for electronic circuits.

In modern applications, most semiconductors are manufactured as integrated circuits (ICs) — commonly called “chips”. These chips contain:

· Transistors (acting like miniature electrical switches that turn on/off to process data),

· Diodes, resistors, capacitors,

· And the interconnections that allow them to function as complex circuits.

Key facts:

· Primary material: Silicon, though advanced chips often use Silicon Carbide (SiC) or Gallium Nitride (GaN) for high-performance needs.

· Applications:

o Communications (telecom networks, 5G)

o Computing (servers, AI processors)

o Healthcare (MRI machines, diagnostics)

o Military systems (missiles, radar systems)

o Transportation (EVs, autonomous navigation)

o Clean energy (solar power control systems, smart grids).

Fabs — or fabrication plants — are highly specialised facilities that convert chip designs into physical circuits printed on silicon wafers through processes that require extreme precision, controlled environments, and advanced equipment.

|

About the newly approved projects: 1. SiCSem Private Limited o In collaboration with UK-based Clas-SiC Wafer Fab Ltd. o Establishing India’s first commercial compound semiconductor fabrication facility focusing on Silicon Carbide (SiC) devices. o Location: Info Valley, Bhubaneswar. o Capacity: 60,000 wafers/year and 96 million packaging units/year. o Silicon Carbide devices are particularly important for high-power and high-temperature applications such as electric vehicles, renewable energy systems, and aerospace. 2. 3D Glass Solutions Inc. (3DGS) o US-based company. o Setting up a vertically integrated advanced packaging and embedded glass substrate unit in Info Valley, Bhubaneswar. o Advanced packaging technology is critical for improving chip performance, reducing size, and increasing energy efficiency. 3. Continental Device India Private Limited (CDIL) o Expanding its existing discrete semiconductor manufacturing facility in Mohali, Punjab. o This is a brownfield expansion — meaning the project builds upon existing infrastructure to scale production faster. o Focus: High-power discrete devices such as MOSFETs, IGBTs, Schottky diodes, and transistors, using both Silicon and Silicon Carbide. o Capacity: 158.38 million units/year. 4. Advanced System in Package (ASIP) Technologies o Partnering with South Korea’s APACT Co. Ltd. o Setting up a semiconductor manufacturing facility in Andhra Pradesh. o Capacity: 96 million units/year. o Products: Targeted at mobile phones, set-top boxes, automobiles, and other electronic applications. |

Challenges Facing Semiconductor Manufacturing in India:

1. Capital-Intensive Industry

o One of the world’s most investment-heavy sectors, with R&D costs averaging 22% of annual sales and capital expenditure at 26%.

o High financial risk and long gestation periods make entry difficult.

2. Limited Access to Cutting-Edge Technology

o Global chip manufacturing is concentrated: Taiwan and South Korea account for ~80% of the foundry market.

o Advanced chips require EUV lithography machines, made only by Netherlands-based ASML, creating a dependency bottleneck.

3. Manufacturing Complexity

o The fabrication process can involve 500–1,500 steps, requiring ultra-pure water, uninterrupted electricity, high-grade chemicals, and precise environmental control.

4. Talent Shortages

o While India is a global hub for chip design engineers, it lacks a sufficient number of technicians skilled in fab operations.

5. Low Indigenous R&D in Chip Design

o Original, cutting-edge chip architecture research is limited, reducing long-term competitiveness.

6. Policy and Infrastructure Concerns

o Unpredictable trade policies, sudden tariff changes, and a fragmented administrative structure deter investment.

o Skilling initiatives are not directly under the nodal ministry (MeitY), creating coordination issues.

India’s Domestic Policy Framework:

India Semiconductor Mission (ISM)

· Launch Year: 2021

· Budget Outlay: ₹76,000 crore

· Ministry: Electronics and IT (MeitY)

· Core Goals:

o Establish chip manufacturing fabs.

o Create advanced packaging and testing units.

o Support startups in semiconductor design.

o Train engineers for fab operations.

o Bring in global investors.

Key Schemes:

· Semiconductor Fabs Scheme: Up to 50% fiscal support for wafer fabs.

· Display Fabs Scheme: Up to 50% cost support for display fabs.

· Design Linked Incentive (DLI) Scheme: Financial aid for startups/MSMEs from product conception to deployment.

Flagship Platform: SEMICON India Programme — A convergence point for industry leaders, policymakers, academia, and startups to collaborate and innovate.

Significance of India’s Semiconductor Push:

· India’s semiconductor market is projected to touch $100–110 billion by 2030.

· Reduces dependency on key hubs like Taiwan, China, and the USA.

· Creates a high-value manufacturing ecosystem within India.

· Aligns with Atmanirbhar Bharat and supply chain diversification strategies.

International Collaborations: Strengthening the Ecosystem

1. India–US Partnership

o Announced September 2024: A joint initiative for supply chain opportunities, ecosystem assessment, and workforce development.

o Builds on the 2023 MoU on semiconductor innovation.

2. India–Singapore Partnership

o MoU signed during PM Modi’s 2024 visit.

o Singapore has a complete semiconductor value chain and is home to 9 of the world’s top 15 chipmakers.

o Collaboration areas: Talent development, wafer fab park management, equipment and materials supply.

3. India–EU Semiconductor Pact

o MoU to promote joint ventures, investment flows, technology exchange, and manufacturing cooperation.

4. India–Japan Chip Supply Chain Partnership

o Focuses on R&D, manufacturing, chip design, and skilled workforce development.

5. India–Taiwan Collaboration

o Tata Group and Taiwan’s PSMC are building India’s first commercial fab in Gujarat at a cost exceeding ₹91,000 crore.

Way Forward:

To translate policy into sustained industry leadership, India must:

· Invest heavily in infrastructure: Reliable electricity, ultra-pure water supply, and high-quality logistics.

· Develop a skilled fab workforce through targeted training.

· Promote indigenous R&D for chip design and architecture.

· Ensure policy stability and investor-friendly regulations.

· Deepen global technology partnerships to access critical equipment and know-how.

Conclusion

India’s semiconductor mission is not just an industrial policy; it is a national strategy with far-reaching economic and geopolitical implications. The country stands at the threshold of a historic opportunity to become a reliable, innovation-driven player in the global semiconductor ecosystem. The momentum is visible — but real success will depend on India’s ability to bridge its technology, talent, and infrastructure gaps while maintaining strong, long-term global partnerships.

| Main question: With reference to the India Semiconductor Mission, discuss the role of international collaborations in building India’s semiconductor manufacturing ecosystem. |