India’s agricultural trade has seen mixed developments in recent years. While the country remains a top exporter of several farm products like rice, spices, marine items, and coffee, it is also increasingly dependent on imports—especially edible oils, pulses, cotton, and fruits. Although exports are growing, imports are rising much faster, reducing India’s trade surplus in agriculture.

This changing pattern is being driven by a mix of factors, including domestic production challenges, global market shifts, and India’s evolving trade policies. Ongoing free trade agreement (FTA) talks with the United States, European Union, and United Kingdom could further influence the future of India’s farm trade.

Recent Trends in Export and Import Performance:

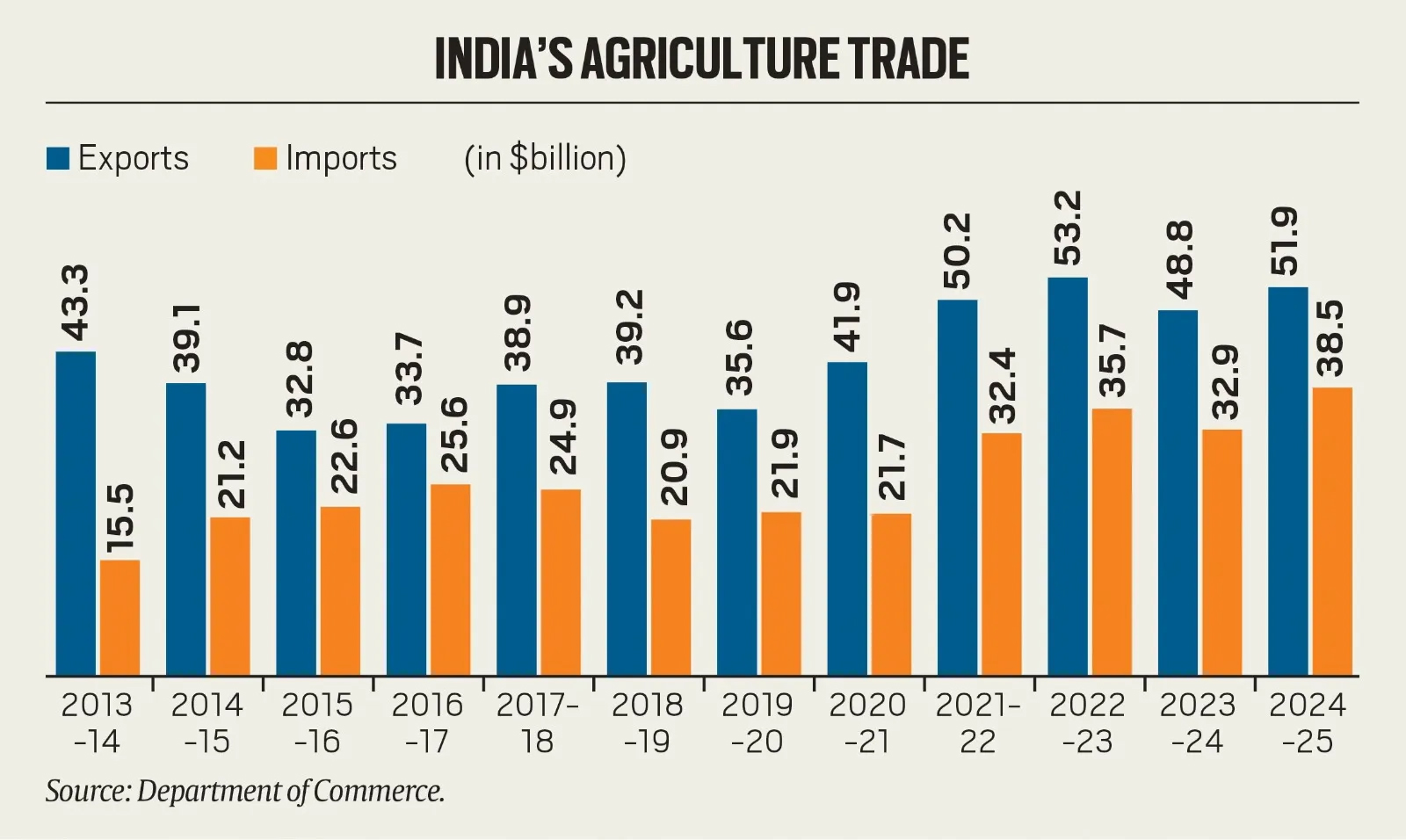

- In 2024–25, India’s agricultural exports grew by 6.4%, reaching $51.9 billion, up from $48.8 billion in 2023–24.

- Meanwhile, total merchandise exports rose by just 0.1% in the same period.

- On the other hand, agricultural imports jumped by 17.2%, touching $38.5 billion, compared to $32.9 billion the previous year.

- As a result, India’s agricultural trade surplus dropped to $13.4 billion—less than half the $27.7 billion recorded in 2013–14.

Long-Term Trends (2013–14 to 2024–25)

- Over the last decade, agri-exports have increased modestly—from $43.3 billion to $51.9 billion (about a 20% growth).

- In contrast, agricultural imports more than doubled—from $15.5 billion to $38.5 billion, marking a 148% rise.

- This growing gap points to deeper structural issues in Indian agriculture, such as productivity stagnation and rising reliance on imports for key items.

Key Export Items and Trends:

- Marine Products: These remain India’s top agri-export but dropped from $8.1 billion in 2022–23 to $7.4 billion.

- Rice: Basmati and non-basmati rice exports hit a record $12.5 billion in 2024–25.

- Basmati is mainly exported to West Asia.

- Non-basmati goes mostly to African countries.

- Basmati is mainly exported to West Asia.

- Spices, Tobacco, Coffee, Fruits & Vegetables: All reached record export levels last year.

- Coffee exports rose due to poor harvests in Brazil and Vietnam.

- Tobacco exports benefited from weak crops in Brazil and Zimbabwe.

- Coffee exports rose due to poor harvests in Brazil and Vietnam.

However, some export items faced challenges:

- Wheat and Sugar: Once major exports, now face bans or restrictions due to domestic supply concerns.

- Cotton: India has become a net importer as exports fell sharply.

- Buffalo Meat: While exports have recovered to over $4 billion, they are still below earlier highs.

Key Import Items and Drivers:

- Vegetable Oils: India continues to rely heavily on imports due to low oilseed yields.

- Pulses: Imports hit a record $5.5 billion in 2024–25, mainly due to low domestic output.

- Cotton and Rubber: Imports are rising due to declining domestic production.

- Cotton output fell from 398 lakh bales in 2013–14 to 291 lakh bales in 2024–25.

- Rubber production is also down, while demand keeps growing.

- Cotton output fell from 398 lakh bales in 2013–14 to 291 lakh bales in 2024–25.

Other Major Imports:

- Fruits and Dry Fruits: Almonds, apples, dates, and walnuts are consistently imported.

- Spices: India still imports pepper and cardamom, despite being a top spice exporter.

- Alcoholic Beverages: Wine and spirits imports are on the rise.

Enhancing India’s Agri-Exports:

As of March 2025, data shows that agricultural exports rose by 6.5% to $37.5 billion (April–December 2024), while imports rose by 18.7% to $29.3 billion. This widened the trade gap in agriculture.

Key Shifts:

- Cotton: Once the world’s second-largest exporter, India’s cotton exports fell from $4.3 billion (2011–12) to $1.1 billion (2023–24).

- Shrinking Surplus: The agri trade surplus, once $27.7 billion in 2013–14, fell to $16 billion in 2023–24.

- Global Price Trends: Between 2013–14 and 2019–20, falling global prices hurt India’s export earnings. Prices rebounded after COVID-19 and the Russia-Ukraine war, pushing exports up to $53.2 billion in 2022–23.

Export and Import Destinations

Exports:

In 2023, India exported $48 billion worth of agri-products.

-

- Asia: 58% share, including $3 billion each to China and UAE, and $2.6 billion to Vietnam.

- Africa: Accounted for 15% of total exports.

- US: 13.4% share, with key exports including rice, sesame seeds, and fresh fruits.

- Europe: 12.6% share, importing mostly tobacco, fruits, and ornamental plants.

- Asia: 58% share, including $3 billion each to China and UAE, and $2.6 billion to Vietnam.

Imports:

-

- Global South: 48% of agri-imports came from Brazil, China, Mexico, Argentina, and Indonesia.

- Developed Countries: Top suppliers were the US, the Netherlands, and Germany.

- Global South: 48% of agri-imports came from Brazil, China, Mexico, Argentina, and Indonesia.

Challenges in India’s Agricultural Exports:

Uneven Playing Field

Western countries offer heavy subsidies to their farmers and place high tariffs on Indian goods.

-

- The US gives about $61,286 per farmer annually.

- India, in contrast, offers only $282—making Indian farm products less competitive.

- The US gives about $61,286 per farmer annually.

MSP Policy Disputes at WTO

Countries like the US and Canada have challenged India’s MSP (Minimum Support Price), saying it breaches WTO rules.

Although India can use the WTO’s "Development Box" to provide uncapped input subsidies, developed countries want tighter rules—posing a threat to small farmers.

Export Restrictions

India often imposes export bans or duties to control inflation (e.g., onions).

Such measures hurt India's image as a reliable exporter and discourage investments in food processing and supply chains.

Non-Tariff Barriers (NTBs)

Developed countries often impose strict sanitary and phytosanitary (SPS) rules and technical barriers (TBT).

For instance:

-

- Europe banned some basmati rice and tea over pesticide concerns.

- Japan banned Indian cut flowers over pest concerns—even though those pests already exist there.

- Europe banned some basmati rice and tea over pesticide concerns.

The FTA Factor: Opportunity or Risk?

India is negotiating trade agreements with the US, EU, and UK. These countries want more access to India’s market, including lower tariffs and fewer non-tariff restrictions. They are pushing for duty cuts on products like wine, cheese, fruits, and genetically modified (GM) crops such as maize and soybeans.

Possible Benefits:

Indian exports of rice, tea, coffee, and spices could gain new markets.

Possible Risks:

Indian farmers may struggle to compete with subsidized foreign products.

-

- Example: Lower tariffs on US dry fruits and wine could increase imports and hurt Indian growers and beverage producers.

- Example: Lower tariffs on US dry fruits and wine could increase imports and hurt Indian growers and beverage producers.

The US is also pressing India to relax its restrictions on GM crops—raising concerns about food safety and public trust.

Conclusion:

India’s agricultural trade is at a turning point. While export growth continues in several sectors, rising imports and policy hurdles are shrinking the trade surplus. With FTAs on the horizon, balancing opportunities and risks will be key to protecting farmers while tapping global markets. A stable and predictable export policy, investment in productivity, and stronger regulatory systems will shape India’s future as a competitive farm exporter.

| Main question: Critically evaluate the potential impact of ongoing Free Trade Agreements (FTAs) with the US, EU, and UK on India’s agriculture. What safeguards should be considered to protect domestic farmers and food sovereignty? |