Introduction:

In October 2025, India's total gross GST collections exceeded ₹1.95 lakh crore, a 4.6% increase over the previous year, despite the new rates. This figure indicates improved consumption and compliance, even after the rate cuts implemented on September 22, 2025.

-

- One of the primary reasons behind the GST reform was to put more money in the hands of the public and stimulate demand. Sectors with high youth participation, such as education, automobiles, technology, handicrafts, footwear, healthcare, food processing, and textiles, were prioritised to lower costs, boost competitiveness, and encourage innovation.

- Following its implementation, there was a sharp rise in consumption demand, from electronics to consumer goods, and a notable increase in bank credit. In October 2025, India’s GST collections rose to ₹1.95 lakh crore, a 4.6% increase over the previous year, driven partly by Diwali-related spending.

- One of the primary reasons behind the GST reform was to put more money in the hands of the public and stimulate demand. Sectors with high youth participation, such as education, automobiles, technology, handicrafts, footwear, healthcare, food processing, and textiles, were prioritised to lower costs, boost competitiveness, and encourage innovation.

What is GST?

The Goods and Services Tax (GST) is an indirect tax. It was implemented on 1 July 2017 through the Constitution (101st Amendment) Act, 2016 and replaced several central and state taxes levied on manufactured goods and services.

However, some taxes remain outside the GST framework, such as cess and surcharge, which are additional taxes levied for a specific fiscal or policy purpose.

The need for a unified tax system:

-

- Although direct tax collections have grown in recent years, indirect taxes still constitute a significant portion of the government’s income. In the FY2023 budget estimates, direct tax collection was projected at 16.42 lakh crore, while indirect tax collection was estimated at 29.08 lakh crore .

- Before GST, the tax system was fragmented and had a ‘cascading effect’ ( a tax on tax) that was in contradiction to the idea of sound indirect taxation and equitable distribution. Consequently, this system had disproportionately burdened lower-income groups and made many of the existing indirect taxes regressive in nature. To address these issues, GST 1.0 was implemented in 2017 under the then Finance Minister Arun Jaitley.

- GST 1.0 sought to address the ‘cascading effect’ of the earlier indirect tax system, and its impact on lower-income groups. It comprised four tax slabs – 5%, 12%, 18% and 28%.

- Products like petroleum and liquor for human consumption continued to be under the old excise tax system. Products like tobacco, cigarettes, pan masala, and chewing tobacco were brought under GST and were subjected to a 28% GST rate along with an additional compensation cess.

- Although GST 1.0 was a landmark reform, it had challenges like, High compliance costs, an Inverted duty structure, Delays in releasing funds, Supply chain disruptions, a Lack of information and other technical issues.

- Although direct tax collections have grown in recent years, indirect taxes still constitute a significant portion of the government’s income. In the FY2023 budget estimates, direct tax collection was projected at 16.42 lakh crore, while indirect tax collection was estimated at 29.08 lakh crore .

The need for GST 2.0:

-

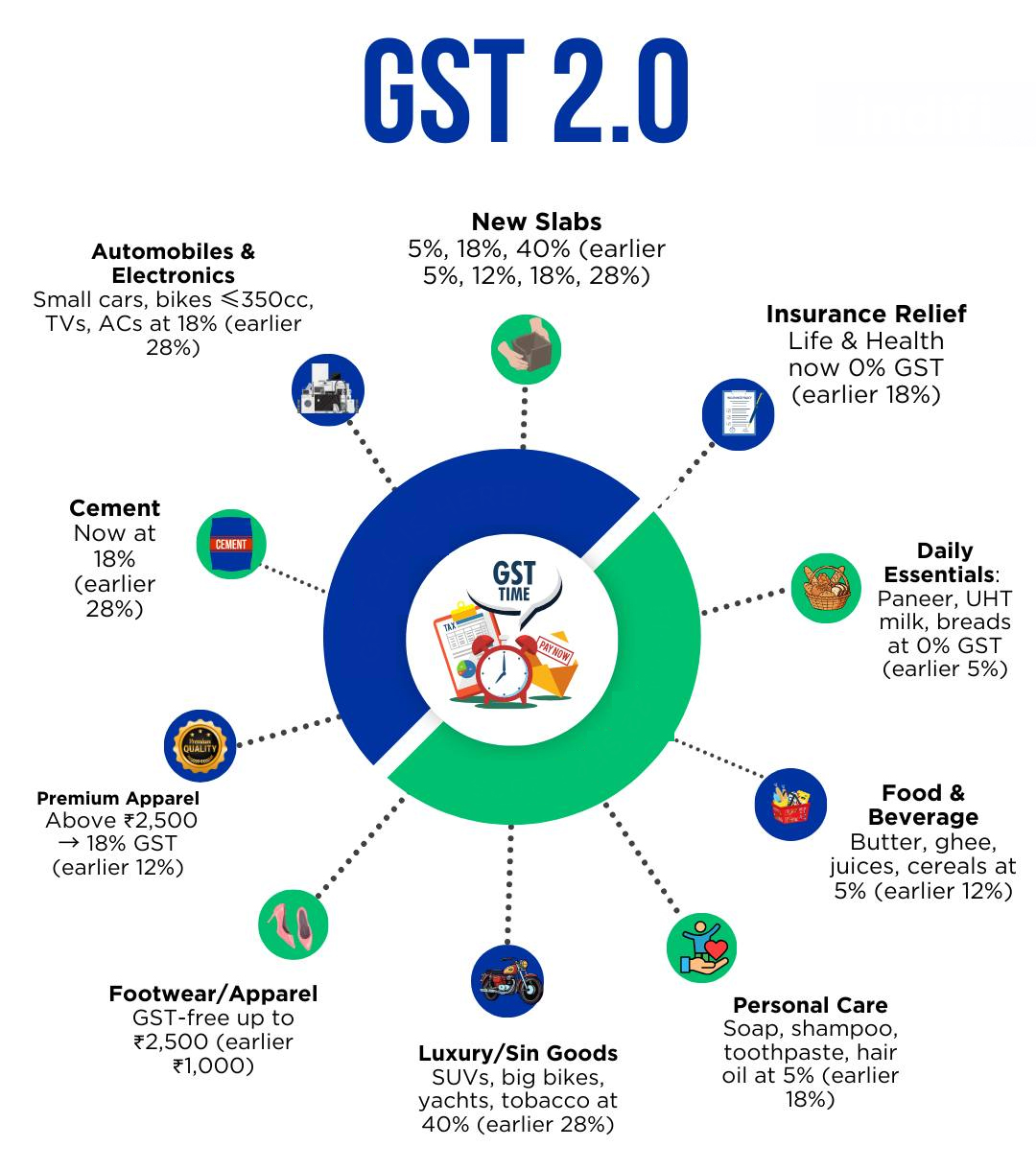

- 1. Unlike reductions in direct tax, which cover only a small segment of people, reforming the indirect tax system like GST is expected to have a broader impact by reaching a larger base and encouraging spending across income groups. GST 2.0 was announced on September 3, 2025, and came into effect on September 22, 2025, with the following features:

- 1. Unlike reductions in direct tax, which cover only a small segment of people, reforming the indirect tax system like GST is expected to have a broader impact by reaching a larger base and encouraging spending across income groups. GST 2.0 was announced on September 3, 2025, and came into effect on September 22, 2025, with the following features:

1. Reduction of tax slabs – from four rates to just two (5% and 18%)

2. A new rate of 40% was introduced for high-end products and sin goods

3. Ease compliance features

4. Exemption on insurance – individual life and health insurance policies

5. Enhance competitiveness for Indian businesses

Impact of GST 2.0:

-

- Consumers: Most consumers benefit from lower GST rates, especially in essential and frequently purchased categories such as FMCG. Since the FMCG consumer base is much larger than those who buy luxury or “sin” goods, the net impact for households is positive.

- Although a large share of GST revenue, nearly two-thirds, comes from lower- and middle-income households. These groups are more sensitive to price changes. Ensuring that lower GST rates truly translate into lower prices is essential.

- Although a large share of GST revenue, nearly two-thirds, comes from lower- and middle-income households. These groups are more sensitive to price changes. Ensuring that lower GST rates truly translate into lower prices is essential.

- Youth and Entrepreneurs: GST 2.0 supports sectors where young workers, artisans and startups form a major share. Lower input costs can encourage more small businesses to enter the market, adopt technology and expand operations.

- Insurance Policy Holders: Individuals buying life or health insurance are no longer taxed. However, insurance companies can no longer claim input tax credit on costs like brokerage and marketing. For now, this may limit how much of the tax benefit is passed on to customers, but in the long term, companies are expected to adjust and offer lower-priced products.

- Government and Businesses: The government may face short-term revenue losses due to lower rates. For businesses, especially small firms, the transition will require updating software systems and processes. Over time, however, higher compliance and increased consumption could compensate for early revenue gaps.

- The Role of Nudge Economics: The GST exemption on insurance is an example of using behavioural economics in policymaking. By lowering the cost of essential financial products, the government aims to steer citizens towards better long-term decisions without imposing strict regulations. The move also pushes insurance companies to innovate and eventually pass benefits to policyholders.

- Technical and Procedural Issues: The GSTN, the digital backbone of the system, still faces glitches during peak filing hours. Frequent format changes confuse taxpayers, especially smaller firms with limited resources.

- Consumers: Most consumers benefit from lower GST rates, especially in essential and frequently purchased categories such as FMCG. Since the FMCG consumer base is much larger than those who buy luxury or “sin” goods, the net impact for households is positive.

Way Forward:

-

- Several policy and structural reforms are necessary to effectively implement GST 2.0. First of all, strengthening the IT infrastructure is extremely important. The GSTN platform should be upgraded to handle larger data volumes, enable real-time invoice matching and make credit note processing more simple and transparent.

- Along with this, public awareness campaigns also play an important role. Consumers and businesses should be informed of the new tax structure through clear, simple, and nationwide communication programs, which will improve compliance and reduce confusion. It is also essential to establish a continuous review system to monitor refund delays, dispute resolution times, and other procedural bottlenecks through dashboards, data analytics, and feedback mechanisms.

- Inclusion and stimulating demand is also a key dimension of reform. Reduction in tax rates on essential goods and insurance will increase citizens' purchasing power, improving living standards and strengthening long-term financial security, especially for lower and middle-class families.

- Several policy and structural reforms are necessary to effectively implement GST 2.0. First of all, strengthening the IT infrastructure is extremely important. The GSTN platform should be upgraded to handle larger data volumes, enable real-time invoice matching and make credit note processing more simple and transparent.

Conclusion:

GST 2.0 marks a significant shift in India’s journey toward a simpler, fairer and more growth-oriented indirect taxation system. By focusing on affordability, business competitiveness and easier compliance, the new structure aims to make taxation a partner in economic transformation rather than an obstacle. The reform may face implementation challenges and short-term adjustments, but its broader intent is clear to support a youthful, aspirational economy with a tax system that encourages consumption, investment and innovation.

UPSC/PCS Main Question: GST 2.0 aims to simplify India's indirect tax system by reducing rate slabs and simplifying compliance. Do these changes address the structural weaknesses of GST 1.0? Critically evaluate. |