Context:

The Goods and Services Tax (GST), introduced in 2017, was one of the biggest tax reforms in India’s history. It unified the country’s complex web of 17 central and state levies into a “One Nation, One Tax” system. Over the years, GST has expanded the taxpayer base, reduced tax cascading, and provided stable revenues to both the Centre and states.

- On 15th August 2025, Prime Minister Narendra Modi announced the launch of next-generation GST reforms (GST 2.0) from the Red Fort. These reforms were later approved at the 56th meeting of the GST Council, chaired by Union Finance Minister Nirmala Sitharaman. GST 2.0 is designed to simplify the structure, reduce rates on essential and common-use items, address long-pending inverted duty structures, and enhance ease of doing business.

- The Council also took steps to make the system more citizen-friendly, focusing on farmers, MSMEs, small traders, and the middle class, while ensuring fiscal sustainability for states.

Key Features of GST 2.0

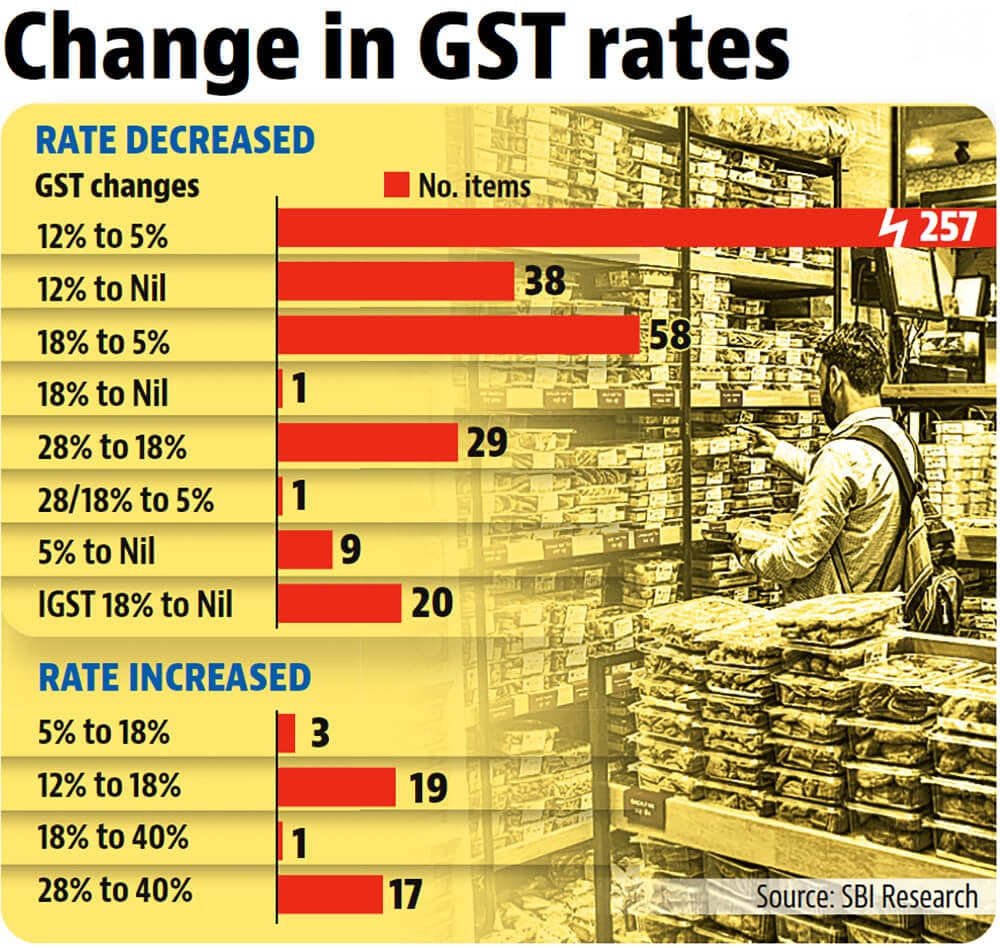

1. Rationalisation of Rates

-

-

- The current four-tier structure (5%, 12%, 18%, 28%) is replaced with two main slabs – 5% and 18%, plus a 40% demerit rate for super-luxury and sin goods.

- This simplifies classification, reduces disputes, and ensures fairness in taxation.

- The current four-tier structure (5%, 12%, 18%, 28%) is replaced with two main slabs – 5% and 18%, plus a 40% demerit rate for super-luxury and sin goods.

-

Major Rate Reductions

-

-

- Essential goods: UHT milk, paneer, and all Indian breads (chapati, paratha, parotta, etc.) reduced to NIL.

- Food items: Packaged namkeens, noodles, chocolates, coffee, sauces, butter, ghee, cornflakes, etc. reduced from 12–18% to 5%.

- Household items: Hair oil, soaps, shampoos, toothbrushes, bicycles, tableware, kitchenware reduced from 12–18% to 5%.

- White goods & automobiles: Air-conditioners, dishwashers, TVs (all sizes), small cars, motorcycles (≤350cc) reduced from 28% to 18%.

- Construction & transport: Cement reduced from 28% to 18%; buses, trucks, ambulances, and three-wheelers also shifted to 18%.

- Agriculture: Tractors, soil preparation machinery, harvesters reduced from 12% to 5%.

- Labour-intensive goods: Handicrafts, marble, granite, and leather goods brought down to 5%.

- Healthcare:

- 33 lifesaving drugs reduced from 12% to NIL.

- 3 critical drugs for cancer and rare diseases reduced from 5% to NIL.

- Other medicines brought down from 12% to 5%.

- Medical devices (bandages, diagnostic kits, glucometers, etc.) reduced from 12–18% to 5%.

- 33 lifesaving drugs reduced from 12% to NIL.

- Insurance: All individual life and health insurance policies exempted from GST.

- Hospitality & services: Hotel stays below ₹7,500/day reduced from 12% to 5%; gyms, salons, yoga centres reduced from 18% to 5%.

- Renewable energy: Devices and parts reduced from 12% to 5%.

- Essential goods: UHT milk, paneer, and all Indian breads (chapati, paratha, parotta, etc.) reduced to NIL.

-

2. Fixing Inverted Duty Structures

-

-

- Textiles: Manmade fibre reduced from 18% to 5%, yarn from 12% to 5%.

- Fertilizers: Sulphuric acid, nitric acid, ammonia reduced from 18% to 5%.

- These corrections will improve cash flows for small manufacturers and exporters.

- Textiles: Manmade fibre reduced from 18% to 5%, yarn from 12% to 5%.

-

3. Simplified Filing and Refunds

-

-

- Registration within 3 days for small and low-risk businesses.

- 90% upfront provisional refunds for exporters, including small exporters.

- End-to-end digital compliance with AI-driven monitoring to reduce fraud.

- E-invoicing system extended across sectors.

- Registration within 3 days for small and low-risk businesses.

-

4. Strengthening Fiscal Federalism

-

-

- States assured of stable revenues even after rate cuts.

- Rationalisation expected to boost consumption, widening the tax base.

- The net revenue implication estimated at ₹48,000 crore, termed fiscally sustainable by the Union Government.

- States assured of stable revenues even after rate cuts.

-

5. Dispute Resolution Mechanism

-

-

- GST Appellate Tribunal (GSTAT) to be operational by September 2025, hearings to begin by December 2025.

- GSTAT to also serve as the National Appellate Authority for Advance Ruling.

- This will enhance trust, transparency, and consistency in the tax regime.

- GST Appellate Tribunal (GSTAT) to be operational by September 2025, hearings to begin by December 2025.

-

About GST 2.0

The GST 2.0 reform marks a strategic and citizen-centric evolution of the tax regime. The new structure introduces:

-

- A simplified two-tier rate system: 5% (Merit rate) and 18% (Standard rate), with a special 40% demerit rate for luxury and sin goods like tobacco and pan masala.

- Wide-ranging rate reductions across essential goods, household items, food products, medical supplies, and MSME-related inputs.

- Exemptions on health and life insurance policies, making financial protection affordable for citizens.

- Digital-first compliance through e-invoicing, AI-driven risk detection, and faster refunds.

- Operationalisation of the GST Appellate Tribunal (GSTAT) to ensure robust dispute resolution.

- A simplified two-tier rate system: 5% (Merit rate) and 18% (Standard rate), with a special 40% demerit rate for luxury and sin goods like tobacco and pan masala.

Objectives of GST 2.0

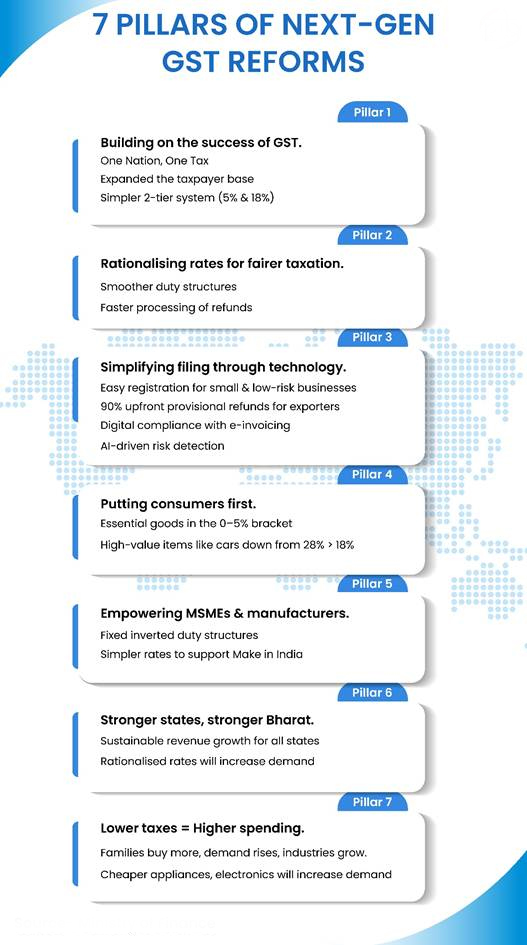

1. Simplify taxation through a two-slab system to reduce disputes and classification issues.

2. Make goods and services cheaper for the common man by cutting rates on essentials and daily-use items.

3. Empower MSMEs and manufacturers by fixing inverted duty structures and easing compliance.

4. Boost consumption and demand by reducing tax burdens, thereby fueling economic growth.

5. Strengthen fiscal federalism by ensuring stable and sustainable revenue for states.

6. Improve ease of doing business with digital systems, faster refunds, and simpler registration.

Significance of the Reforms:

1. For Common Citizens:

o Daily essentials, medicines, and household items become cheaper.

o Health and life insurance now more affordable.

o More disposable income leading to higher savings and consumption.

2. For Businesses & MSMEs:

o Simpler tax structure reduces compliance burden.

o Faster refunds improve liquidity.

o Correction of inverted duty structures supports manufacturing and exports.

3. For States:

o Boost in consumption increases overall GST collections.

o Revenue certainty strengthens fiscal federalism.

4. For the Economy:

o Lower costs for consumers fuel demand for aspirational goods.

o Increased demand for cars, appliances, electronics, and housing boosts manufacturing and job creation.

o Renewable energy sector benefits from lower input costs.

Wider Implications:

-

- Ease of Living: By reducing taxes on everyday goods and services, GST 2.0 directly impacts household budgets.

- Employment Generation: Labour-intensive sectors like textiles, handicrafts, and hospitality will see a rise in demand.

- Healthcare Access: Cheaper medicines and medical devices improve affordability, while GST exemption on insurance expands coverage.

- Make in India Push: Local production gets a boost through duty corrections and reduced manufacturing costs.

- Digital Governance: AI-driven compliance strengthens transparency and reduces tax evasion.

- Global Competitiveness: Simplified structures and lower costs make Indian products more competitive in global markets.

- Ease of Living: By reducing taxes on everyday goods and services, GST 2.0 directly impacts household budgets.

Conclusion:

GST 2.0 represents a bold and transformative step in India’s tax landscape. By cutting rates on essentials, rationalising slabs, fixing duty anomalies, and easing compliance, the reforms aim to benefit citizens, businesses, and states alike.

| Main question: Critically evaluate the role of the GST Council in ensuring cooperative and competitive federalism. In light of GST 2.0 reforms, has the Council lived up to its mandate? |