Introduction:

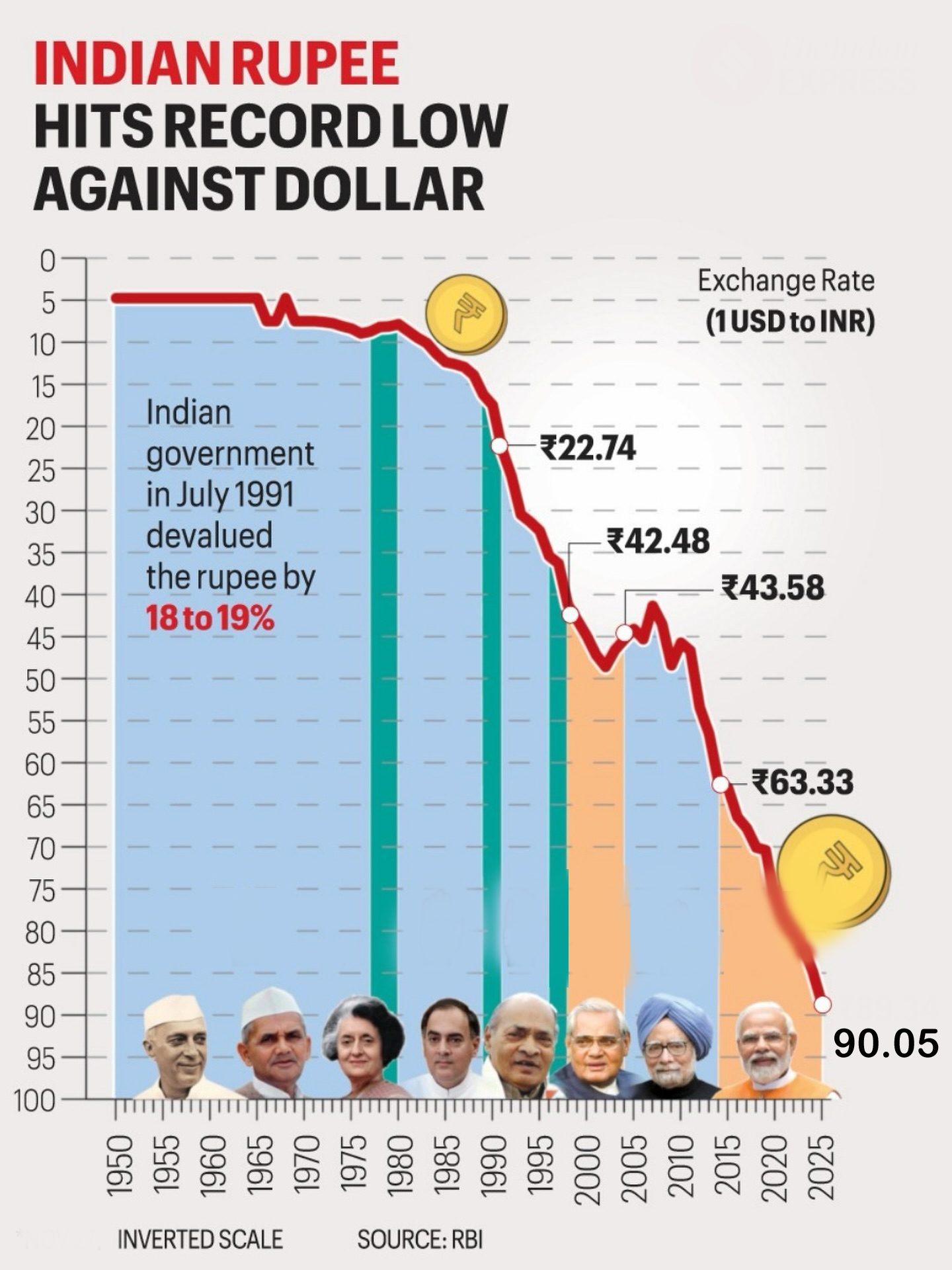

The Indian rupee slipping past the ₹90-per-dollar mark for the first time has become one of the most critical economic developments of the year. This is not just a market headline; it reflects deeper pressures building within the global and domestic economy. A currency breaching such a psychologically important level affects import costs, inflation, savings, household budgets, business decisions, and overall economic sentiment. It also raises difficult questions about India’s external fundamentals at a time when global uncertainties are already high.

-

- Although India remains among the world’s fastest-growing major economies, currency performance often responds more sharply to external balances and capital flows than to domestic growth alone. The rupee’s continued weakness, therefore, needs to be understood in a wider context of geopolitical tensions, trade challenges, and market expectations.

- Although India remains among the world’s fastest-growing major economies, currency performance often responds more sharply to external balances and capital flows than to domestic growth alone. The rupee’s continued weakness, therefore, needs to be understood in a wider context of geopolitical tensions, trade challenges, and market expectations.

Why This Level Matters:

-

- Crossing ₹90 per dollar has symbolic and practical implications. Financial markets often place automated stop-loss and hedging orders around major round numbers. Once breached, these levels trigger additional demand for dollars, worsening the fall.

- More importantly, a weaker rupee affects households directly. For families sending students abroad, a tuition fee of $100,000 rises by ₹5 lakh when the exchange rate moves from 85 to 90, a jump equivalent to more than twice India’s nominal per capita income. Overseas travel, remittances, and even everyday products with imported components suddenly feel more expensive.

- Crossing ₹90 per dollar has symbolic and practical implications. Financial markets often place automated stop-loss and hedging orders around major round numbers. Once breached, these levels trigger additional demand for dollars, worsening the fall.

Global Forces Behind the Rupee’s Weakness:

1. Strong US Dollar

The US Federal Reserve’s tight monetary policy and global investor preference for safe-haven assets have kept the dollar strong. Even modest global shocks push funds toward dollar-denominated assets, hurting emerging market currencies.

2. Geopolitical Uncertainty

Conflicts, supply-chain disruptions, and rising commodity prices have made global investors risk-averse. Tensions in West Asia and Europe are particularly relevant for India because they often raise the crude oil import bill.

3. Global Commodity Price Movements

Even when crude prices are not at peak levels, India’s 85% dependence on oil imports means any rise directly pressures the currency. Higher prices of metals, fertilizers, and food commodities also add to dollar demand.

Domestic Drivers of Depreciation

1. High Import Dependence

Energy, electronics, edible oils, fertilizers, and industrial inputs form a large part of India’s import basket. When global prices rise or domestic demand expands, dollar outflows increase.

2. Current Account Pressures

A widened current account deficit (CAD), driven by costly imports and stagnant exports, reduces the supply of dollars in the economy.

3. Capital Outflows

Foreign portfolio investors have been withdrawing funds from Indian markets in 2025, shifting money to developed markets offering higher yields. Each withdrawal requires converting rupees into dollars, weakening the currency further.

4. Limited RBI Intervention

The central bank has allowed the rupee to find its own level, intervening only to control disorderly movement. This approach preserves foreign exchange reserves but also signals to the market that the currency may slide further.

Why the Rupee’s Weakness Appears India-Specific:

-

- Interestingly, the US Dollar Index has not surged dramatically in recent months. This suggests that domestic factors—especially high dollar demand within India—are playing a bigger role.

- Corporates have been hedging more aggressively, importers have been front-loading payments, and foreign debt repayments have risen. Together, these add persistent pressure on the currency.

- Foreign investors, meanwhile, have reduced their exposure to emerging markets due to uncertain global monetary conditions. This combination of high dollar demand and low inflows has accelerated the rupee’s slide.

- Interestingly, the US Dollar Index has not surged dramatically in recent months. This suggests that domestic factors—especially high dollar demand within India—are playing a bigger role.

Impact on Commodity Prices:

The immediate fallout of a weaker rupee is seen in imported inflation. Even if global prices remain unchanged, Indian consumers pay more in rupee terms. Key sectors affected include:

1. Crude Oil and Fuel

Higher landed costs raise fuel prices, pushing transport and logistics costs upward. This has a cascading impact on food, freight, manufacturing, and retail prices.

2. Edible Oils

India is one of the world’s largest importers of palm and soybean oil. A weaker currency directly increases kitchen expenses and food inflation.

3. Gold and Silver

Jewellery purchases become costlier during festive and wedding seasons. India’s gold imports also widen the trade deficit, adding to currency pressure.

4. Industrial Metals

Copper, aluminium, and other metals become more expensive, increasing input costs for infrastructure, construction, and manufacturing industries.

Impact on Households and Students

A falling rupee affects families in visible and invisible ways:

-

- Foreign education gets significantly more expensive, especially when tuition, accommodation, and insurance are paid in dollars.

- Overseas travel costs rise, from visas and airfares to hotel stays and daily expenses.

- Imported goods and gadgets cost more, as many electronic items have high import components.

- Inflation may rise, as the RBI estimates a 5% rupee depreciation can add around 35 basis points to inflation.

- Foreign education gets significantly more expensive, especially when tuition, accommodation, and insurance are paid in dollars.

What Happens If the Rupee Weakens Further?

1. Imported Inflation Intensifies

Rising costs for fuel, food, and raw materials can strain household budgets.

2. Wider Current Account Deficit

Higher import bills stretch India’s external finances and may prompt more aggressive RBI intervention.

3. Higher Borrowing Costs

India’s external borrowing becomes costlier, affecting both government and corporate debt.

4. Investor Sentiment Weakens

Persistent currency pressure can deter FDI and portfolio inflows.

Despite these concerns, India’s strong domestic fundamentals—robust consumption, steady GDP growth, and healthy forex reserves—provide some cushioning.

Policy Measures Available:

1. Monetary Policy Tools

-

-

- Interest rate adjustments

- Liquidity management operations

- Interest rate adjustments

-

These can influence capital flows and inflation expectations.

2. RBI’s Forex Management

-

-

- Selling dollars to smooth volatility

- Allowing the currency to adjust gradually

- Using forward market operations to manage liquidity

- Selling dollars to smooth volatility

-

3. Government Measures

-

-

- Incentives to attract FDI

- Boosting export-oriented manufacturing

- Reducing import dependence through energy transition, semiconductor manufacturing, and electronics production

- Incentives to attract FDI

-

Long-term reforms in logistics, supply chains, and trade competitiveness will also reduce pressure on the rupee.

Conclusion

The rupee crossing ₹90 per dollar marks an important moment for India’s economy. Though depreciation is not unusual for an emerging market, the pace and timing of this fall highlight deeper structural challenges. Global geopolitical tensions, capital flow volatility, and trade imbalances have all contributed to the decline, while high import dependence magnifies the impact.

UPSC/PCS Main Question: Examine the major global and domestic factors behind the persistent depreciation of the Indian rupee in recent years. How do these factors affect India’s macroeconomic stability? |