Context-

In recent years, the discord between various State governments, notably Kerala and Karnataka, and the Union government in New Delhi has brought to the forefront a series of critical issues concerning fiscal federalism in India. As the 16th Finance Commission (FC) convenes, it faces the imperative task of rectifying historical disparities in vertical devolution through innovative and just measures. This comprehensive analysis looks into the complexities surrounding vertical devolution, examining the shrinking divisible pool, the proliferation of tied transfers, deviations from FC recommendations, and the imperative for reform.

Shrinking Divisible Pool: A Systemic Challenge

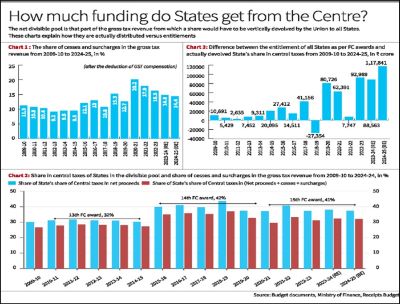

● A fundamental aspect of fiscal federalism is the equitable sharing of resources between the Union and the States. However, a troubling trend has emerged over the past decade – the shrinking divisible pool. The Union government has increasingly resorted to retaining a larger share of its proceeds outside the divisible pool, thereby diminishing the resources available for distribution among the States.

● The introduction of numerous cesses and surcharges has exacerbated this issue, complicating the fiscal landscape. Despite initial expectations that the Goods and Services Tax (GST) would streamline cesses, the proliferation of new cesses and surcharges has persisted. The lack of transparency surrounding cesses and surcharges, as evidenced by conflicting government data, underscores the opacity surrounding fiscal operations, necessitating urgent redressal.

● Disaggregated data reveals a staggering rise in the collection of cesses and surcharges, from ₹70,559 crore in 2009-10 to ₹7 lakh crore in 2024-25 (BE). Despite the statutory requirement to share the GST compensation cess with States, a significant portion of collected funds remains inaccessible to the States. Conflicting government data on the quantum of cesses and surcharges further complicates the assessment, raising concerns about transparency and accountability.

Rise in Tied Transfers: Impediments to Fiscal Autonomy

● Parallel to the shrinking divisible pool is the rise in tied transfers, which imposes onerous conditions on States, thereby impeding fiscal autonomy. Centrally sponsored schemes and central sector schemes often require significant financial contributions from State governments, exacerbating financial burdens. Conditionalities attached to grants further constrain States' ability to address localized priorities, perpetuating a patron-client relationship between the Union and States.

● Even ostensibly beneficial capital transfers often materialize as loans, burdening States with future repayment obligations. The Union government's penchant for usurping credit in centrally implemented projects, as evidenced by recent disputes over labelling, underscores the imbalance in the Union-State relationship, necessitating a recalibration of fiscal dynamics.

The CAG Indictments: Breaches of Fiscal Integrity

● Critical scrutiny by the Comptroller and Auditor General (CAG) has revealed glaring breaches of fiscal integrity concerning cess and surcharge collections. Instances of non-transfer or short transfer of funds to designated reserves underscore the mismanagement of fiscal resources and the erosion of trust in fiscal institutions. The diversion of funds from the divisible pool to meet other financial obligations of the Union government constitutes a systemic failure, demanding stringent corrective measures.

Deviations from FC Recommendations: A Strained Fiscal Compact

● Despite assurances of adherence to FC recommendations, empirical evidence paints a starkly different picture. Persistent deviations from FC stipulations regarding the share of net proceeds allocated to States underscore a profound constitutional impropriety. Analysis reveals that the Union government consistently falls short of the FC-stipulated percentages, exacerbating vertical inequalities and undermining the principles of fiscal federalism.

● Comparative analysis reveals that the States' share of central taxes consistently lags behind FC recommendations, with cumulative shortfalls amounting to ₹5.61 lakh crore between 2009-10 and 2024-25 (BE). This substantial shortfall underscores a glaring constitutional impropriety and necessitates urgent redressal.

● The cumulative shortfall over successive FC periods highlights the urgent need for recalibration and reform, signaling a departure from entrenched patterns of fiscal centralization.

Conclusion

In conclusion, rectifying irregularities in vertical devolution is indispensable for fostering a resilient and equitable fiscal compact in India. As the 16th FC assumes its mandate, it must prioritize the restoration of fiscal integrity, transparency, and equity in resource allocation. This necessitates a multifaceted approach encompassing the publication of accurate estimates of net proceeds, the provision of compensatory grants to States, and legislative measures to curb the proliferation of cesses and surcharges.

Moreover, fostering genuine cooperative federalism requires untethering transfers to States from restrictive conditionalities, thereby empowering States to address local priorities autonomously. The survival of fiscal federalism hinges on the steadfast commitment of stakeholders to rectify systemic irregularities and uphold the principles of equity and transparency in resource allocation.

As India navigates a complex and dynamic fiscal landscape, the imperative for reform is clear. The 16th FC must seize the opportunity to redefine the contours of fiscal federalism, ushering in an era of inclusivity, accountability, and resilience. Only through concerted action and unwavering commitment can India realize its vision of a truly federal and equitable fiscal framework, reflective of its diverse and dynamic polity.

|

Probable Questions for UPSC Mains Exam-

|

Source- The Hindu