Context:

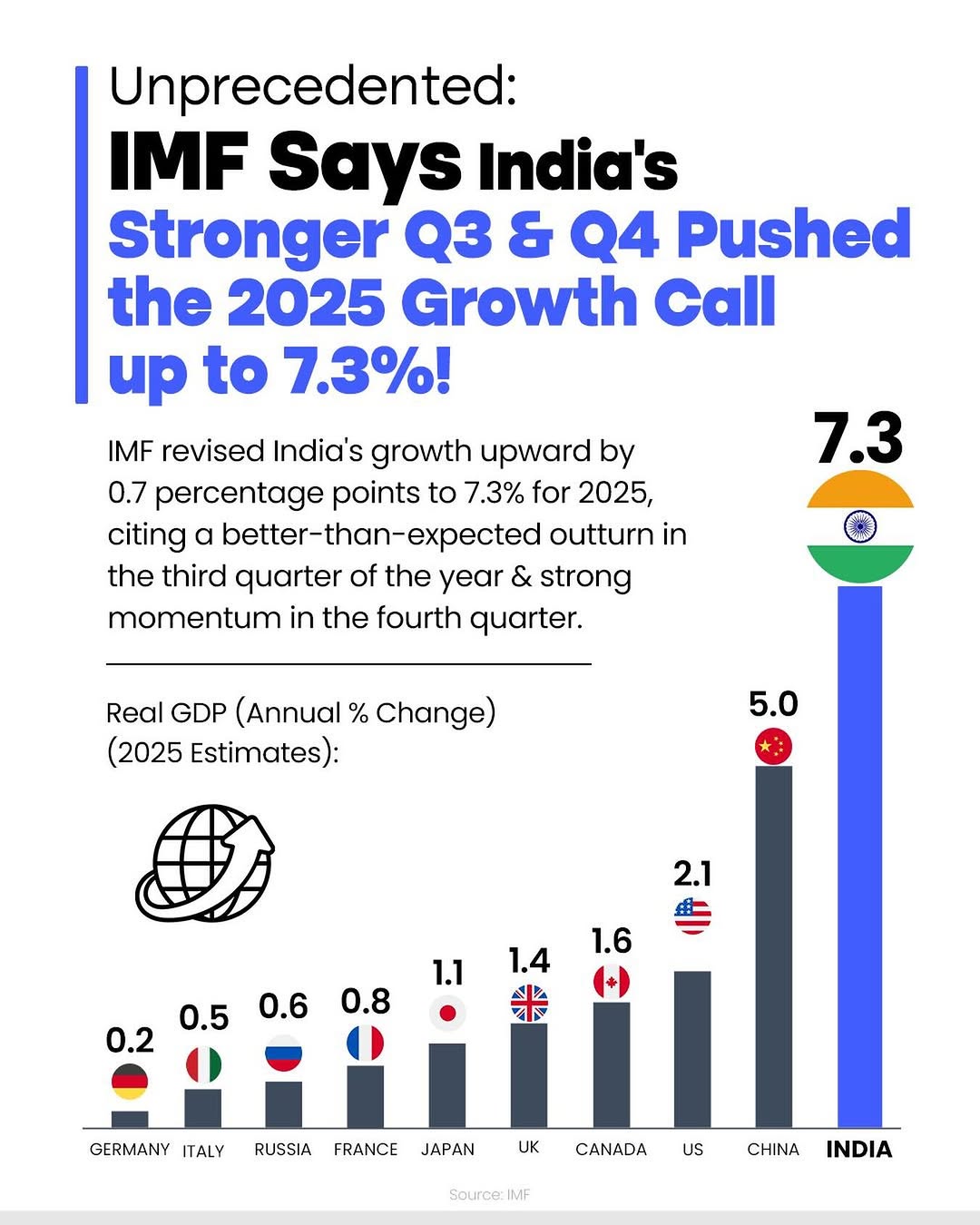

Recently, the International Monetary Fund (IMF) raised India’s GDP growth forecast for FY26 to 7.3 per cent, an upward revision of 0.7 percentage points from its October 2025 projection. For FY27, growth is projected at 6.4 per cent, reflecting sustained—though moderating—economic momentum. These estimates were released in the IMF’s World Economic Outlook (WEO) Update, January 2026.

Key Highlights of the IMF’s Revised Forecast:

Stronger-than-Expected Growth in FY26

-

-

-

- Robust third-quarter performance and sustained momentum into Q4 FY26 underpinned the upward revision.

- India’s National Statistical Office (NSO) reported GDP growth of around 8 per cent in the first half of FY26.

- Robust third-quarter performance and sustained momentum into Q4 FY26 underpinned the upward revision.

-

-

Outlook for FY27 and FY28

-

-

-

- Growth is projected at 6.4 per cent for both FY27 and FY28.

- This moderation reflects the fading of cyclical and temporary growth drivers, signalling a transition from high growth to a more sustainable medium-term trajectory.

- Growth is projected at 6.4 per cent for both FY27 and FY28.

-

-

Why India’s Growth Outlook Improved?

-

-

-

- Domestic Demand and Consumption: A large domestic market and resilient services demand continue to support economic stability.

- Investment and Industrial Activity: Renewed investor confidence, rising industrial output, and sustained infrastructure investment underpin growth.

- Strong Q3 and Q4 Momentum: Positive performance in the latter half of FY25 has strengthened short-term growth prospects.

- Domestic Demand and Consumption: A large domestic market and resilient services demand continue to support economic stability.

-

-

Comparative Global Growth Context:

-

-

-

- Global growth is projected at 3.3 per cent in 2026, moderating slightly to 3.2 per cent in 2027.

- India is expected to remain among the fastest-growing major economies, outperforming peers such as the United States and China.

- Global growth is projected at 3.3 per cent in 2026, moderating slightly to 3.2 per cent in 2027.

-

-

Policy and Structural Implications:

-

-

-

- India as a Global Growth Engine: The upward revision reinforces India’s growing importance in the global economy and strengthens investor confidence.

- Inflation and Monetary Policy: Inflation is expected to converge towards the Reserve Bank of India (RBI) target range of 4 ± 2 per cent, providing greater monetary policy flexibility.

- Structural Reforms and Sustainability: Continued reforms in labour markets, infrastructure, the digital economy, and the ease of doing business are essential to sustaining long-term growth.

- India as a Global Growth Engine: The upward revision reinforces India’s growing importance in the global economy and strengthens investor confidence.

-

-

Challenges and Risks Ahead:

-

-

-

- Geopolitical tensions and global trade uncertainties could adversely affect exports and investment flows.

- Slower growth in advanced economies may dampen external demand.

- Inflationary pressures could re-emerge due to volatility in global commodity prices.

- Geopolitical tensions and global trade uncertainties could adversely affect exports and investment flows.

-

-

About the IMF:

The International Monetary Fund, headquartered in Washington, D.C., is a multilateral financial institution with 191 member countries. Established in 1944, it promotes global monetary cooperation, financial stability, international trade, and sustainable economic growth. The IMF provides policy advice, technical assistance, financial support, and conducts economic surveillance, functioning as a global economic watchdog and lender of last resort.

Conclusion:

The IMF’s upward revision of India’s FY26 growth forecast to 7.3 per cent reflects strong macroeconomic fundamentals, resilient domestic demand, and favourable short-term momentum. Although growth is expected to moderate in FY27–28, stable inflation and sustained structural reforms can support durable expansion, presenting both opportunities and challenges for inclusive and long-term development.