Context:

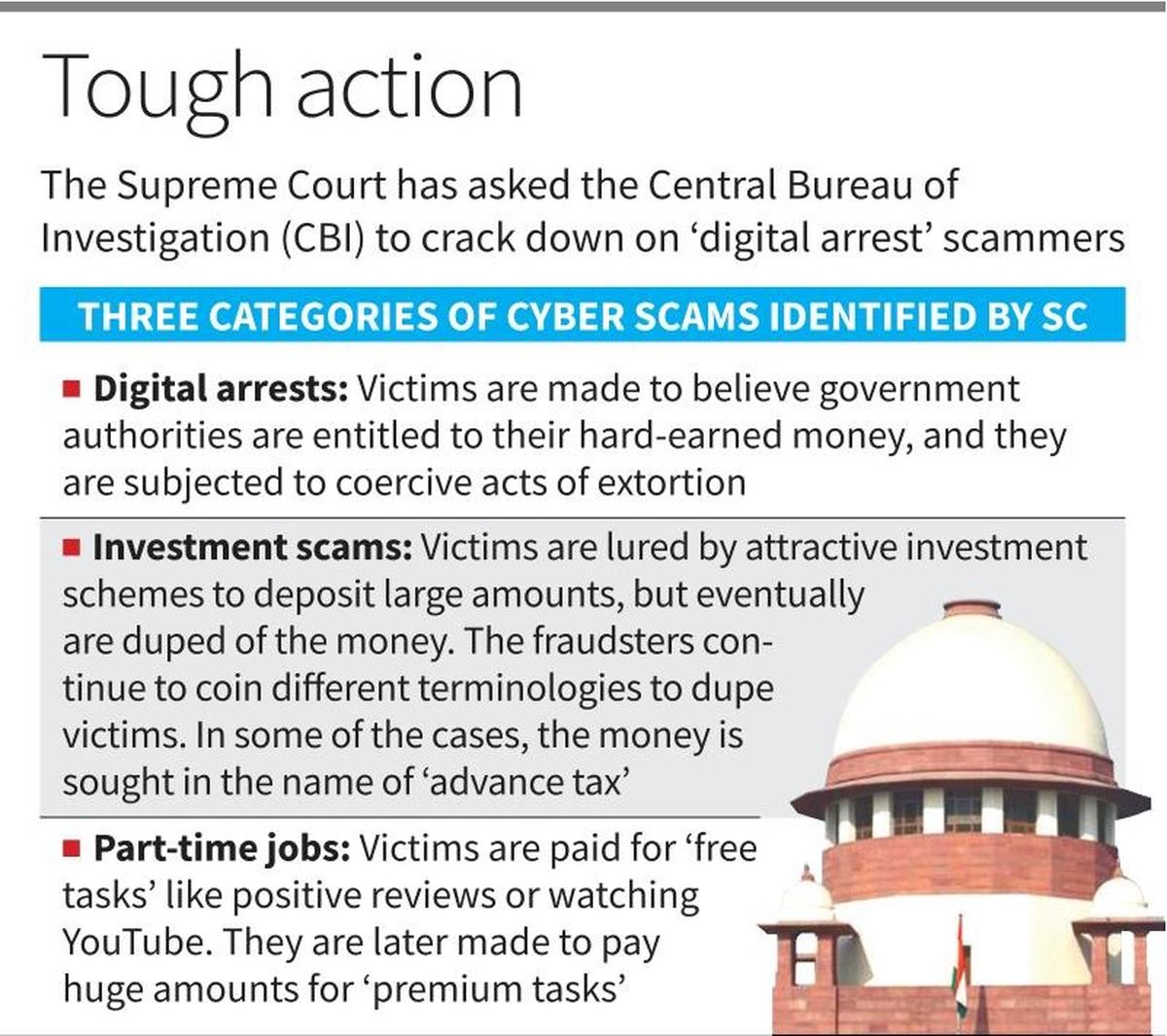

The Supreme Court recently ordered the CBI to take over investigations into digital arrest scams across India.

About Digital Arrest:

A digital arrest is a form of online extortion in which fraudsters:

-

-

- Impersonate officials from agencies like the CBI, ED, or Police;

- Accuse victims of being involved in criminal or financial fraud cases;

- Conduct fake interrogations over video calls;

- Threaten the victims with arrest, imprisonment, or asset seizure unless they transfer money.

- Impersonate officials from agencies like the CBI, ED, or Police;

-

Once victims comply, the fraudsters disappear, often after extracting large sums via cryptocurrency, wire transfers, or digital wallets.

Over ₹3,000 crore has already been lost by victims, mainly senior citizens.

Why Digital Arrests are Rising:

1. Explosion of Digital Transactions: Increased online payment usage widens opportunities for fraud.

2. Low Cyber Awareness: Many users lack knowledge about digital safety and verification processes.

3. Technological Sophistication: Use of AI-generated voices, deepfakes, and realistic video simulations.

4. Weak Global Enforcement: Southeast Asian scam hubs exploit jurisdictional loopholes.

5. Psychological Targeting: Criminals exploit public fear of law enforcement and authority

Supreme Court’s Key Directions:

CBI Given a Free Hand:

· CBI to lead the investigation into digital arrest scams across India.

Override of State Consent

· Court directly asked States to grant CBI consent under Section 6, DSPE Act, which is rare and allowed only in exceptional circumstances.

CBI to Form a Special Multi-State Team

· Identify police officials from States.

· Include domain experts in cyber forensics, finance, and digital transactions.

· Conduct pan-India coordinated investigation.

Interpol Coordination

· CBI must work with Interpol to trace:

o International cybercrime networks,

o Global money laundering routes,

o Safe havens of fraudsters abroad.

RBI to Be Involved

· SC issued notice to RBI.

· RBI must explain how AI/ML technologies can be used to detect:

o Money layering,

o Mule accounts,

o Suspicious banking patterns.

Cybercrime Coordination Centers

· States and UTs must:

o Establish regional cybercrime coordination centres,

o Link them with the Indian Cybercrime Coordination Centre (I4C),

o Strengthen data compilation and preventive mechanisms.

Government & Institutional Response:

|

Initiative |

Description |

|

Indian Cyber Crime Coordination Centre (I4C) |

Coordinates with banks, telecoms, and fintech firms to track cybercrime patterns. |

|

Blocking Spoofed Calls |

Systems developed with telecom service providers (TSPs) to block fake international numbers. |

|

National Cyber Crime Reporting Portal |

Citizens can report scams online at cybercrime.gov.in. |

|

CERT-In Guidelines |

Advises public to verify calls, avoid sharing personal data, and not install suspicious apps. |

|

Inter-Ministerial Committee (May 2024) |

Formed to tackle transnational cybercrime networks operating from Southeast Asia. |

Conclusion:

The digital arrest epidemic exposes the dark side of India’s digital revolution — where technology designed for efficiency becomes a weapon of coercion. The Supreme Court’s direction signals an urgent need for coordinated action between government, law enforcement, judiciary, and citizens.