Date : 24/07/2023

Relevance - GS Paper 2 – International Relations

Keywords: Rupee-Rouble trade agreement, Nord Stream 2 gas pipeline, alternative payment mechanism

Context –

In the wake of the Russian invasion of Ukraine in February of the previous year, Indian refiners have actively sought and purchased discounted Russian oil. As a result, Russia has now taken the top position as India's primary crude oil supplier, contributing to approximately 40% of India's total crude imports. Notably, India's imports of Russian crude have experienced consistent month-on-month growth for ten consecutive months as of June.

The Transformation of India’s Oil Trade with Russia

- India's oil trade with Russia has undergone a remarkable transformation, as reported by the Directorate General of Commercial Intelligence and Statistics (DGCI&S). Since April 2022, India's imports of oil from Russia have surged by over tenfold.

- Notably, this growth has been particularly steady since December 2022, coinciding with the G7's decision to enforce a price cap of $60-per-barrel on seaborne Russian crude oil. This cap likely played a significant role in boosting India's oil imports from Russia during this period.

Factors Led to the Growth in Indian Import of Russian Oil

Western Sanctions on Russian Oil

- The EU stopped importing Russian coal and banned refined oil imports.

- The US and UK banned all Russian oil and gas imports.

- Germany stopped the opening of the Nord Stream 2 gas pipeline from Russia.

- In December 2022, the EU and G7 set a maximum price of $60 a barrel of Russian crude oil.

Huge Discounts Offered by Russia

- Russia heavily relied on countries like India, China, Turkey, and Bulgaria for oil sales since the imposition of sanctions imposed by western nations.

- Russia offered huge discounts on crude oil to interested countries. India used the opportunity to its advantage.

The Mystery of Actual Discounts: Russia and Other Suppliers

- Indian refiners have taken advantage of affordable Russian oil, but the exact discounts offered by Russia remain undisclosed due to the lack of transparency in their pricing of oil cargoes.

- Indian refiners purchase oil on a 'delivered' basis, where the price includes freight, insurance, and the oil cost itself.

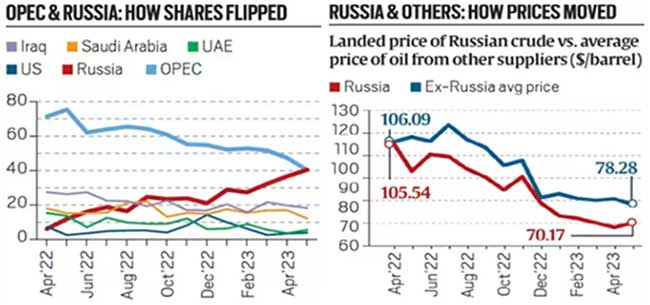

- To gauge the discounts, a comparison is made between the average landed price of Russian crude and the average price of oil imported from other suppliers.

- Western sanctions have led to a significant increase in freight and insurance costs for Russian oil, potentially resulting in higher discounts on the oil price and lower discounts on the landed price (inclusive of freight and insurance costs).

Change in Market Shares of India’s Top Oil Suppliers in Recent Months

Russia’s Gain at the Expense of other Suppliers

- During the 14 months leading up to April 2023, there has been a significant shift in India's crude oil supplier market shares compared to the previous fiscal year (FY 2021-22). Notably, Russia experienced a remarkable surge in market share, rising from a mere 2% in FY 2021-22 to an impressive 24.2% in the recent 14-month period.

- On the other hand, many other major crude oil suppliers witnessed a decline in their market shares during the same period. Iraq, Nigeria, and the US, in particular, saw the most notable decreases in their market shares, indicating that Russia gained market share at the expense of these suppliers.

Decline in OPEC’s Share in India’s Oil Imports

- The Organization of the Petroleum Exporting Countries (OPEC), which previously held a dominant position in India's oil import basket, experienced a significant decline in cumulative market share. As India's imports of Russian oil surged, OPEC's market share dropped dramatically from 75.3% in May 2022 to 40.3% in May 2023.

- Notably, several major suppliers to India, including Iraq, Saudi Arabia, the UAE, Kuwait, Nigeria, and Angola, are members of the OPEC cartel.

- During the period from April 2022 to May 2023, Russia's share in India's oil imports experienced remarkable growth, soaring from 6% to 40.4%, further contributing to the decline of OPEC's overall market share in India.

How has India Benefited from Discounted Russian Oil?

Significant Savings by Indian Refiners

- Over the course of the 14 months leading up to May 2023, Indian refiners made substantial savings in foreign exchange by increasing their purchases of discounted Russian oil. The total savings amounted to at least $7.17 billion.

- During the period from April 2022 to May 2023, India's total oil imports were valued at $186.45 billion. However, if Indian refiners had paid the average price for crude from all other suppliers combined, the total import bill would have reached $193.62 billion.

- The significant increase in buying discounted Russian oil contributed to the overall cost savings for India and had a notable impact on the country's foreign exchange reserves.

Emergence of India as a Major Supplier of Refined Petroleum Products

- India has positioned itself as a significant exporter of petrol and diesel, with some of it refined from Russian crude, to various destinations, including Europe.

- Notably, India's petroleum product exports to the EU have experienced a substantial increase of 20.4 percent year on year during the period from April to January, reaching 11.6 million tonnes. This surge in exports has resulted in Indian refiners benefiting from "robust margins," indicating a favorable economic situation for them.

Emerging Challenge for India in Russian Oil Import

Volatile Discount Levels

- The discounts offered on Russian oil experienced fluctuations in recent times. Initially, in May 2022, the discount levels surged but contracted significantly in June. Subsequently, the discounts rose again and remained stable for the next four months.

- However, industry sources report that the discounts have now eroded considerably over the past few weeks, with Russia's flagship crude even surpassing the G7 price cap. The discounts on Russian crude have reduced substantially to just $4 per barrel from the previous peak levels of 25-30$ per barrel.

- If this trend persists, Indian refiners may find Russian oil less appealing in the upcoming months due to reduced discount opportunities. This could prompt them to explore other oil sources for better pricing and economic benefits.

Payment Woes for India Refiners

- Indian refiners are encountering challenges when it comes to settling payments for Russian oil cargoes, primarily due to western sanctions.

- A recent instance involved the Indian Oil Corp, which faced difficulties making payments in traditional currencies. As a workaround, they resorted to using Yuan for payment due to shipping complications, as the State Bank of India (SBI) declined to process the payment due to sanctions imposed on the involved shipping agency.

YOU MUST KNOW***

What are India's concerns related to the trade imbalance with Russia?

- In the fiscal year 2020-21, India's imports from Russia amounted to USD 17.23 billion, while India's exports to Moscow were relatively lower, valued at only USD 992.73 million. This resulted in a negative trade balance of USD 16.24 billion between the two countries during that period. However, despite the trade imbalance, Russia's share in India's overall trade has shown significant growth, reaching 3.54% in 2020-21, up from 1.27% in the previous year.

- Interestingly, over the past 25 years, Russia's share in India's total trade has generally remained below 2%, despite reaching 2.1% back in 1997-98. However, in the first quarter of fiscal year 2023-24, India faced a trade deficit of $14.7 billion with Russia.

- Given these economic dynamics, a key priority for India is to promote the broader adoption of the rupee in international transactions and settlements. This initiative could have potential implications in reducing trade imbalances and further enhancing economic ties between India and Russia.

What is the Rupee-Rouble Trade agreement?

- The Rupee-Rouble trade arrangement serves as an alternative payment mechanism, allowing settlements in Indian Rupees instead of Dollars or Euros. This concept was initially formulated in 1953 as part of the Indo-Soviet trade agreement. According to this agreement, all transactions between India and the then Soviet Republic USSR could be conducted using Indian Rupees.

- To facilitate this arrangement, the State Bank of the U.S.S.R. was designated to hold one or more accounts with authorized commercial banks in India, enabling dealings in foreign exchange. Additionally, if deemed necessary, the State Bank of the USSR could maintain another account with the Reserve Bank of India to facilitate smoother transactions. This arrangement helped foster economic cooperation between India and the former Soviet Republic and has continued to play a role in shaping trade relations between the two nations.

Conclusion

India has chosen not to yield to Western pressure in isolating Russia and, instead, has taken the path of bolstering trade relations with its longstanding ally. This strategic decision has yielded multiple advantages, including the ability to mitigate inflationary pressures while also achieving cost savings.

Nonetheless, the recent reduction in Russian discounts has led to a shift in the dynamics for Indian refiners. In response to the narrowing discounts, they may face the necessity of increasing their oil supplies from alternative sources. This situation could prompt a reassessment of India's oil import strategies and potentially lead to diversifying their energy sources in order to maintain a competitive edge in the face of evolving market conditions.

Probable Questions for UPSC Mains Exam –

- Explain the recent transformation in India's oil trade with Russia, with Russia now being the primary crude oil supplier, accounting for 40% of India's imports. Discuss the factors behind this shift and its implications on India's energy security and economic relations with other oil suppliers. (10 Marks,150 words)

- Analyze the significance of the Rupee-Rouble trade agreement in India's trade relations with Russia, particularly in light of the recent increase in oil imports. Assess the challenges and opportunities presented by this alternative payment mechanism and suggest measures to strengthen trade ties between the two nations. (15 Marks, 250 words)

Source – Indian Express