Date : 24/11/2023

Relevance: GS Paper 3 – Environment and Ecology

Keywords: IISD, SOEs, COP28, MDB

Context-

In the year 2022, governments worldwide allocated a staggering $1.7 trillion in public funds to support fossil fuels, a new analysis by the International Institute for Sustainable Development (IISD) revealed. This financial backing encompassed subsidies, investments by state-owned enterprises (SOEs), and lending from public financial institutions. Simultaneously, the financial support directed towards renewable energy generation, clean energy grid integration, and battery storage witnessed an increase, though insufficient to align with the commitment made at the 26th Conference of the Parties (COP26) to limit global warming to 1.5°C.

Fossil Fuel Subsidies vs. Renewable Energy Support:

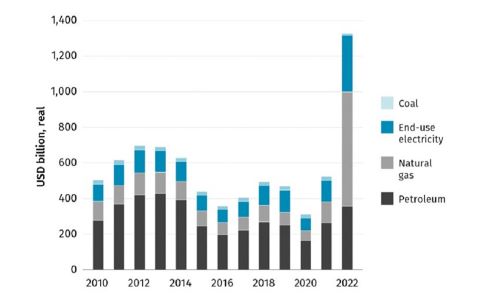

The analysis highlighted a stark disparity in financial allocations, with only $486 billion directed towards renewable energy in 2022. This fraction pales in comparison to the substantial $1.3 trillion funneled into fossil fuel subsidies, revealing a glaring contradiction to the promises made at COP26. Despite commitments to phase down unabated coal power and eliminate inefficient fossil fuel subsidies, the data painted a picture of expanding support for fossil fuels globally.

Leading Contributors to Fossil Fuel Subsidies:

China, Saudi Arabia, and Indonesia emerged as the top contributors to fossil fuel subsidies, providing $266 billion, $129 billion, and $72 billion, respectively. India, ranking fourth globally, allocated $346 billion, equivalent to over 10 percent of its GDP, revealing the extensive nature of financial support for fossil fuels. The paper noted that the actual figures might be higher, as the data primarily relied on the International Monetary Fund's definition of "explicit subsidies."

European Countries' Unusual Stance:

Amid an energy crisis with soaring natural gas prices, several European countries, including Germany, France, and Italy, supported consumer prices for fossil fuels for the first time in 2022. This unexpected move raised questions about the alignment of actions with climate goals, as financial in

Governmental Control and State-Owned Enterprises:

State-Owned Enterprises (SOEs), controlled by governments, reached an eight-year high in monetary support in 2022, totaling $350 billion. Despite being ideally positioned to spearhead emissions reduction initiatives, only 13 percent of annual reports from G20 countries indicated SOE investments in renewable energy.

Global Stimulus for Dirty Fuel:

International financing for fossil fuels, including aid, export credit support, and concessions, averaged $30 billion annually from 2020-2022, provided by G7 governments and Multilateral Development Banks (MDBs). In contrast, MDB financing for clean energy stood at $26 billion in 2022, with Central and Western Europe receiving the majority due to the European Investment Bank's focus within the European Union.

Renewable Energy Investments and Recommendations:

Global investment in clean energy, while on the rise, still lagged significantly behind the fossil fuel sector. The International Renewable Energy Agency stressed the need to triple global renewable energy capacity by 2030, requiring $1,300 billion in investment. The report recommended setting a deadline to eliminate fossil fuel subsidies, with developed countries targeted by 2025 and developing countries by 2030. Additionally, it called for coordinated efforts on carbon pricing, emphasizing the introduction of a carbon price floor to raise ambition and prevent trade distortions or the shifting of carbon emissions internationally.

Conclusion

As the report unfolds a week before COP28, its findings underscore the urgent need for a global shift in financial priorities. Governments worldwide must align their actions with the commitments made at COP26 and expedite efforts to eliminate fossil fuel subsidies. The substantial gap in investment between fossil fuels and renewable energy demands immediate attention, emphasizing the crucial role of governmental push in filling this void. The recommendations, if implemented, can pave the way for a more sustainable and climate-resilient future. As the world grapples with the consequences of climate change, the choices made in financial allocations today will determine the trajectory of our planet for generations to come.

About COP 28

COP28, the 28th United Nations Climate Change Conference of the Parties, is slated for November to December 2023. This global summit brings together representatives from nearly 200 nations to engage in discussions and negotiations on worldwide climate policies and initiatives.

The significance of COP28 lies in its mission to address pressing challenges related to climate change. This includes efforts to diminish greenhouse gas emissions, adapt to the consequences of climate change, and secure financial resources for effective climate action. The conference serves as a pivotal platform for countries to establish targets, exchange successful strategies, and make commitments to combat climate change collectively.

In essence, COP28 holds a vital role in advancing international collaboration and coordination to confront the climate crisis and work towards achieving the objectives outlined in the Paris Agreement. Notably, Sultan Ahmed Al Jaber has recently been selected as the new President of COP28.

Probable Questions for UPSC mains Exam-

- Discuss the implications of the $1.3 trillion global financial support for fossil fuels in 2022, contradicting COP26 commitments. What policy measures can bridge this gap, especially concerning leading contributors like China, Saudi Arabia, and India? (10 marks, 150 words)

- Evaluate the consequences of European countries supporting consumer prices for fossil fuels in 2022 amid an energy crisis. How can COP28 address such contradictions and ensure a harmonized approach for a sustainable future, considering State-Owned Enterprises and global stimulus for dirty fuel? (15 marks, 250 words)

Source- DTE