Relevance: GS-3: Indian Economy and issues relating to planning, mobilisation, of resources, growth, development.

Key Phrases: Digital Banking Units, Fintech ecosystem, Neobank, RBI guidelines, Nubank, Traditional banks, Artificial intelligence, Securities & Exchange Board of India, Insurance and Regulatory Development Authority of India, RBI Outsourcing Regulations.

Why in News?

- The Digital Banking Units latest norms, however, this would disrupt the fintech ecosystem.

Context:

- With a Neobank being the 100th entrant to India’s unicorn club, it poses further creative disruption in the Indian fintech ecosystem. However, the introduction of Digital Banking Units (DBUs) in the 2022 Budget and the RBI guidelines regarding the same has created an upheaval in the market.

- The DBU rules allow only scheduled commercial banks with past digital banking experience to expand into digital units as separate banking outlets. It could also be perceived as a precursor to digital bank licences. Thus, fintechs with no physical branches and banking licences, such as Neobanks, are out rightly precluded/ excluded.

Neobanks

- Neobanks are digital banking facilitators serving their customers via online platforms rather than conventional physical branches.

- Such fintech companies do not have their own banking licences, relying on their banking partners via corporate collaborations to provide licensed core banking services and over-the-top financial services.

- The poster boy of neobanks is ‘Nubank’ that initially offered credit cards in Brazil. It did not have a banking licence until 2017, much like the present Indian players. Once it acquired the licence, it became a full-stack digital bank offering a plethora of services.

- It is established that neobanks are a viable business model providing core banking services rather than collaborating with regulated entities.

- Neobanks, in particular, take the front-end of financial services to a much higher level by increasing the speed of services and reducing friction. They improve returns and transparency for customers while lowering the customer acquisition cost for their partner banks.

FinTech

- Financial technology, also known as FinTech, is an economic industry composed of companies that use technology to make financial services more efficient.

Do you know?

- The 100th unicorn of India is a Bengaluru-based neobank platform Open, that raised fresh funds in May, 2022 as part of its Series D round, taking its valuation to $1 billion.

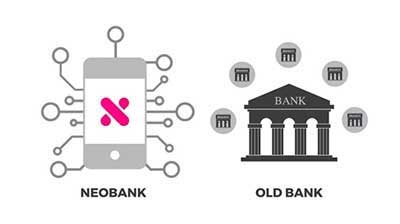

Neobanks vs Traditional banks

- Neo-banks are disrupting the traditional banking system by leveraging technology and artificial intelligence (AI) to offer a range of personalised services to customers.On the other hand, traditional banks follow an Omni-channel approach i.e. having both physical (through branches and ATMs) and digital banking presence to offer a multitude of products and services.

- Right from customer acquisition to traditional banking services such as remittances, money transfers, utility payments and personal finance, neo-banks offer a wide range of offerings to customers across retail and Small-to-Medium Enterprise (SME) categories.

- Basically, neo-banks apply a demand based approach to a particular banking area and tailor their products and services in a manner that makes banking simpler and convenient to the end consumers.

Service offered by Neobanks:

- These digital banking facilitators are preferred largely for

- seamless on-boarding;

- intuitive and user-friendly platforms;

- one-tap availability and

- transparency.

- They offer a convergence of financial and non-financial services into a blended ecosystem.

- Neobanks in India presently work on two prominent models

- Payment gateways

- Payment banks.

- They also serve non-retail customers like MSMEs with white-label solutions. It entails mobile-first financial services such as money transfers, lending, invoicing software, cash management, payment processing, etc.

Advantages of Neobanks

- Low costs: Fewer regulations and the absence of credit risk allow neobanks to keep their costs low. Products are typically inexpensive, with no monthly maintenance fees.

- Convenience: These banks offer customers the majority (if not all) of banking services through an app.

- Speed: Neobanks allow customers to set up accounts quickly and process requests speedily. Those that offer loans may skip the usual time-consuming application processes in favour of innovative strategies for evaluating your credit.

- Transparency: Neobanks are transparent and strive to provide real-time notifications and explanations of any charges and penalties incurred by the customer.

- Easy-to-use APIs: Most neobanks provide easy-to-deploy and operate APIs (Application Programming Interface) to integrate banking into the accounting and payment infrastructure.

- Deep insights: Most neobanks provide dashboard solutions with highly enhanced interfaces and easy to understand and valuable insights for services such as payments, payables and receivables, and bank statements.

Neobanks in other countries:

- The UK had a headstart in neobanking owing to the early introduction of uniform banking guidelines across Europe.

- The US offers separate fintech licences.

- It is permissible in Canada in a regulatory way.

- Many Asian economies like Singapore, China, Malaysia, Hong Kong, etc., have also adopted digital banking licensing regimes and internet-only bank guidelines.

India's top Neobanks

- RazorpayX

- Jupiter

- Niyo

- Open

- EpiFi

Regulation of Neobanks in India:

- Neobanks provide products that come under the regulatory framework of

the three financial regulators

- Reserve Bank of India;

- Securities & Exchange Board of India(SEBI) and

- Insurance and Regulatory Development Authority of India(IRDAI).

- One may note that while there is no specific restriction on operations of neobanks, they are not directly subjected to compliances under RBI’s licensing regime.

- The RBI regulates the banking services, credit facilities, loans, domestic money transfers, utility bill payments, and prepaid card services provided by neobanks.

- SEBI governs the investment advisory products offered by neobanks.

- Similarly, IRDAI regulates the corporate agents, insurance web aggregator, and insurance policy services offered by neobanks.

- The partnership with regulated entities model is broadly governed by

three RBI regulations:

- RBI Outsourcing Regulations (2021)

- Business Correspondent (BCs) Guidelines (2014)

- Master Direction on Digital Payment Security Controls (2021)

- The applicability of the guidelines is based on the nature of services offered by the neobanks.

- However, the BCs’ standards are relatively outdated and do not take into account the changes in relationships between financial institutions and their BCs. The notion of a BC has evolved from one of a physical entity delivering financial products to one of a digital entity. In addition, the range of products offered has exceeded the ambit covered under the extant regime.

Conclusion:

- The increasing traction of neobanks and their interaction with financial entities warrant that the extant regime be revisited. The Indian framework needs to fulfil the needs of regulated entities to perform services like settlements and fund management while fintech and neobanking partners handle the technological interface and user experience.

- The present situation of legal ambiguity and room for speculation decrease the confidence of retail consumers who account for a major chunk of the Indian market. It also deprives the country of tapping into vast opportunities tech-backed neobanks may have to offer.

- The 2022 DBU guidelines seem to have furthered the uncertainty, leaving neobanking and fintech as a grey area. It is imperative that the law acts as an enabler and not a disruptor.

Source: The Hindu BL

Mains Question:

Q. “Neobanks can serve demographics that are under-catered to by main street banks". Examine.