Relevance: GS-2: Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora. Important International institutions, agencies and fora- their structure, mandate.

Key phrases: Energy Crisis , LNG , Regasification , NORD 2 Pipeline , Energy Geopolitics

Context

- Europe is short of natural gas — dangerously short. Recently Commerzbank published data showing the current stockpile of natural gas across the European Union were less than half full i.e. about 47% of full capacity as compare to the normal stockpile 60% of full capacity at this point of the year i.e. winters

Facts

- In Europe the natural gas is most important source of energy. Gas demand, is stronger each winter owing to its role in domestic heating.

- Gas is selling on European commodity markets for 10 times the price it goes for in the United States.

- The average European household faces electricity and gas bills of €1,850 ($2,100) in 2022, up from €1,200 in 2020, according to Bank of America.

- The transition to cleaner energy such as wind and solar has had the effect of pushing up demand for gas. Natural gas is often viewed by the industry as a medium-term “bridging fuel” between the eras of hydrocarbons and renewables.

- Europe dependent on imported gas and Russia supplying 40% or more of those imports

What is Natural Gas and LNG?

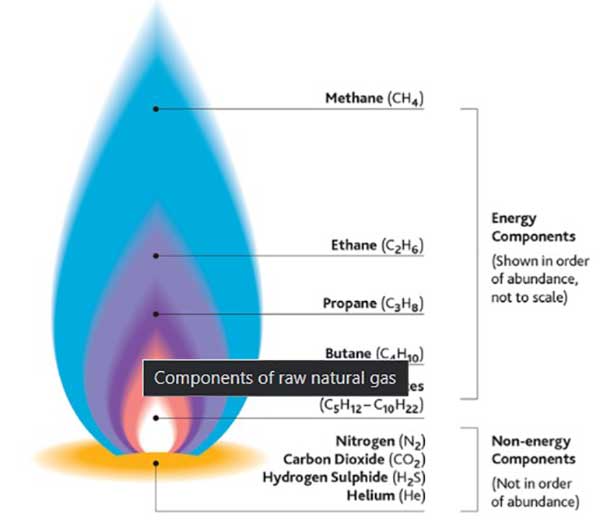

- Natural gas is a mixture of gases which are rich in hydrocarbons. (methane, which makes up 70-90% of natural gas) Natural gas reserves are deep inside the earth near other solid & liquid hydrocarbons beds like coal and crude oil.Liquefied Natural Gas (LNG) is a natural gas that is cooled down to liquid form and shrunk to 1/600th of its original volume.

- The liquid is often exported in huge ships containing heavily insulated tanks that keep the gas in a liquid state at approximately -162 Celsius.

How did Europe get into this crisis?

- One was a cold winter that drained gas reserves, which are used to generate electrical power and typically replenished in summer. That didn’t happen this year.

- Hot weather drained more gas than usual through demand for air conditioning.

- Less wind meant less renewable electricity, leading generators to reach for gas fuel.

- Earthquakes in the Netherlands (as mentioned above).

- Limited supplies of LNG, an expensive option that can be delivered by ship instead of pipeline, were snapped up by customers in Asia i.e. China’s attempt to clean up its air

- On top of that, Europe for years has pushed for day-to-day spot pricing, instead of long-term contracts.

- Russian-controlled gas giant Gazprom has fulfilled those long-term contracts but hasn’t pumped additional gas beyond that. The customers who have those contracts pay much less for gas than other buyers.

- Vladimir Putin’s power politics

Do you know?

- United States has emerged as an energy superpower. It’s now the world’s biggest oil producer, pumping almost twice as much as the runner-up, Saudi Arabia.

- The United States has become the world’s top gas producer, delivering as much as 50 percent more than second-place Russia.

- In 2022, the U.S. will become the world’s largest exporter of LNG.

Linkage between climate change, fast-growing economies and the current crisis

- The European Union’s “Green Deal” seeks to make Europe carbon-neutral by 2050 and reduce emissions by at least 55% by 2030.

- Europe’s attempts to be a global leader on climate change have arguably fed into the wider changes in the market. They have pushed the fast-growing economies of Asia to move away from coal, only to find that countries such as China and India are now rivals for the same supplies of LNG that Europe has come to rely on from countries such as the US and Qatar.

- The rapid growth of the LNG industry means seaborne cargoes have now created something more akin to a global market similar to oil.

- Every year China connects up to 15m homes in its coastal cities to the gas grid — that’s like adding a Netherlands and a Belgium worth of demand every year, so when it gets cold in China the gas price goes up in the UK and Germany.

Impact of Shortage of Natural Gas

- The record prices being paid by suppliers in Europe and shortfalls in gas supply across the continent have resulted in steeper bills. Prices of gas were four times higher in December than they were at the beginning.

- The European Commission, the EU’s executive arm, cited spiraling energy costs as a drag on the pandemic recovery because higher bills will take money away from consumer spending and business investment.

- Some energy intensive industries have started to slow production, denting the optimism around the post-pandemic economic recovery.

- Analysts have speculated that electricity could be rationed — perhaps for some industrial customers at first — if things get really bad.

- An energy apocalypse — a total loss of electricity or heat if gas reserves are drawn to zero and can’t be substituted — would likely cause deaths among poor and vulnerable populations, like what happened in Texas when a winter storm knocked out power, leading to more than 200 deaths.

Do you know?

- Germany is Gazprom’s main foreign buyer.

- In 2021, an estimated 50-75% of its gas imports came from Russia. Germany’s gas storage capacity is the largest in the EU, and Gazprom owns many of the underground facilities.

What is Nord Stream 2 pipeline? How is it significant?

- Gazprom, the Russian state-controlled supplier of natural gas to Europe has invested billions into building the 1,234-kilometer (765-mile) pipeline to Germany i.e. Nord Stream 2 pipeline.

- It runs under the Baltic Sea and is ready for use. But it is yet to receive its operating license from Germany.

- It would allow Russia to sell gas directly to a major customer and circumvent a pipeline through Ukraine, which is facing open hostilities from Russia since 2014 after annexation of Crimea peninsula by the latter.

- Even before the 2014 hostilities, Moscow had launched efforts to diversify gas supply routes to the European Union, saying the Ukrainian system is dilapidated and accusing the country of siphoning gas.

- Supply of gas through Nord Stream 2 pipeline will result in loss of almost $2 billion to Ukraine, which its gets at present as annual transit fees

Reasons for delay in nod for Nord Stream 2 pipeline

- The German government has blamed a few last-minute regulatory hurdles for the delay. German regulators suspended the approval process because of an issue with the pipeline operator’s status under German law. But it is believed that the Ukraine crisis has piled pressure on Berlin to delay the authorization.

- Nord Stream 2 faces resistance from the U.S. and several European countries including Poland and Ukraine, which say it will further increase Russia's leverage over the continent and reduce transit fees earned by Ukraine for gas to pass through existing pipelines.

Is Russia exploiting the situation?

- Russia had earlier stated that it had to fill its own gas reserves after the last cold winter season and they did not have any spare Russian gas to export until it finishes filling its own domestic storage for winter.

- But even after Russia filled up its domestic storage in November, 2021 there was little change on the European side.

- Currently the only way for Russia to help make up the gas shortage in Europe this winter would be to pump more gas through Ukraine.

- By underlining Europe’s dependence on Russian gas, Putin and Gazprom may hope for more lenient EU market regulation of Nord Stream 2.

Energy geopolitics

- Europe was already struggling with an energy crunch when Russia's state-controlled Gazprom slashed natural gas deliveries to the bloc in October, sending soaring prices higher still.

- Moscow, which supplies about 40 per cent of Europe's imported gas, is accused of using its energy exports as leverage in a dispute over Ukraine, through which much of the Russian gas transits.

- Earlier Belarus had threatened to cut off gas supplies to Europe. With the EU threatening more crippling sanctions, Lukashenko threatened to cut off Russian gas supplies to Europe that pass through a pipeline in Belarus. It’s unlikely that Lukashenko would be able to fulfill his threat, given his political dependence on Russia and Moscow’s desire to maintain the reputation of a reliable supplier.

- Russia is believed by the West to be planning a full-scale invasion of Ukraine, after the Kremlin amassed more than 100,000 troops at its border with the Eastern European country over the past two months.

- If Russia were to cut off natural gas supplies during a military conflict or in retaliation for any future Western sanctions, European inventories might run extremely low.

- Be it by design or default, the shortfalls have put a powerful weapon into Putin’s hands.

- If the weather turns cold in Europe in January and February—if prices rise; if absolute shortages close businesses or black out homes—then Putin could be in a position to scoff at Joe Biden and NATO no matter what actions he takes against Ukraine.

Effects on India:

- To help ease demand for gas to heat and power homes and businesses, last month some 10 cargoes of liquefied natural gas (LNG) that were destined for Asia were diverted to Europe.

- The sharp rise in global coal prices came as a boon for domestic suppliers such as Coal India. As the supply crunch in the key overseas markets grew and prices soared, the demand for coal from domestic sources climbed. Coal India and other producers increased output, yet supply remains quite tight.

- Over 70% of India’s power is generated from burning coal while the share of natural gas is just about 5%. Thus, rising natural gas prices had a limited impact on the cost of power generation in India.

- India, however, suffered a scare in August when the inventory of coal with power plants reached critically low levels, as demand surged about 11%. The situation was resolved by diverting coal away from non-power uses. The power demand is set to climb higher next month when more restrictions are eased, including those on cinema halls and multiplexes. While efforts are on to provide an uninterrupted supply of coal to power plants, non-power users are likely to suffer.

- Indian households were more affected by the rise in prices of petroleum products as consumption of cooking gas, petrol and diesel grew. The total demand for petroleum products was about 11% higher in August.

Way forward to deal with the crisis and the associated challenges

- Nord Stream 2 gas pipeline from Russia to Germany would help to calm Europe's energy crunch.

- Emergency fixes to the shortfalls are available. Market forces have already summoned some two dozen tankers of U.S. liquid natural gas to Europe.

- Reopening of functional nuclear facilities in general and that of Germany in particular.

- Temporarily ramping up coal power stations

- LNG as an option though it is not as cheap as pipeline gas but it’s cheaper than energy insecurity. The LNG option would definitely benefit USA, the world's largest exporter of LNG (thanks to the shale gas boom)

- According to the International Energy Agency, the new supply from US with 20% increase in production won't be enough to bail out Europe if Putin turns off the taps.

- Though Europe has the capacity to process or regasifiy the imported liquid gas, it would be difficult to deliver it to end users as the distribution infrastructure is not tailored for a significant shift to LNG.

- Hydrogen can be used to supplement the existing gas supply by using a mix of hydrogen and gas in existing gas networks, or by using electricity generators rated for both hydrogen and gas. Hydrogen also provides an alternative to gas in many industrial processes like steel production and cement. As it provides an alternative fuel to gas, hydrogen adds diversity to the existing energy market.

Source: Hindu Frontline