Relevance: GS-3: Indian Economy, mobilization of resources, growth, development and employment.

GS-2: Government policies and interventions for development in various sectors

Key phrases: corporate tax, Income tax act 1961, direct tax, economy, FDI, Foreign companies, investment.

Why in News?

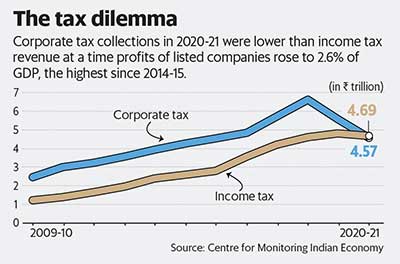

- Given that the Union Budget is round the corner, discussions relating to taxation have come to the fore. In this context, we examine the real effects of the corporate tax cut implemented in September 2019. We find that the tax cut resulted in an economically meaningful 7 per cent additional investments by beneficiary firms.

Corporate tax in India:

- The Taxation Laws (Amendment) Bill, 2019 caused a reduction in the base corporate tax rate, that is, from 30 percent to 22 per cent for the existing businesses which led to revenue inference of INR 1.45 Lakh Crores. While, in case of new manufacturing firms that have been established post 1st October, 2019 and prior to 31st March, 2023, the base corporate tax was reduced from 25 per cent to 15 per cent.

- According to reports, the corporate tax rates in India stand the lowest among other nations across the globe and the impact will be visible in the Indian economy in the upcoming years. This strategic action could possibly enhance the comparative adversaries of India’s corporation tax rates with other Asian nations.

- The new corporate tax rates in India is much lower than USA (27%), Japan (30.62%), Brazil (34%), and Germany (30%) and for the new firms the tax rate is similar as of Singapore (17%).

Corporation Tax

- Corporate tax is the tax which is levied on the income of the domestic and foreign companies that arose in India. It is levied on both the public and private companies registered under the Companies Act of 2013. The rate at which the tax is imposed as per the provisions of the Income Tax Act, 1961 is known as the Corporate Tax Rate.

Why did the government cut corporate tax rate?

- The corporate tax cut is part of a series of steps taken by the government to tackle the slowdown in economic growth. The most immediate reason behind the tax cut may be the displeasure that various corporate houses had shown against the government’s policies.

- Many investors, for instance, were spooked by the additional taxes on them that were announced by the government during the budget and began pulling money out of the country. The government hopes that the new, lower tax rates will attract more investments into the country and help revive the domestic manufacturing sector which has seen lacklustre growth.

What impact it had on the economy?

- The corporate tax cut did play an important role in the revival of the private capital expenditure that is ongoing. Although the tax cut was not announced as a Covid response measure, it seems to have played an important role in ensuring corporate sector resilience to the crisis.

- Tax cuts could stimulate corporate investments in a credit-constrained environment. In other words, in a situation where firms have valuable project ideas but are unable to get funding from financial markets, increasing the net cash flow in the hands of the firms may lead to higher investments.

- Tax cuts putted more money in the hands of the private sector which led more incentive to produce and contribute to the economy.

- The cut in taxes made India more competitive on the global stage by making Indian corporate tax rates comparable to that of rates in East Asia.

- The tax cut, however, is expected to cause a yearly revenue loss of ₹1.45 lakh crore to the government which is struggling to meet its fiscal deficit target.

- At the same time, if it manages to sufficiently revive the economy, the present tax cut can help boost tax collections and compensate for the loss of revenue.

- The steep corporate tax cut in 2019 and pandemic-driven cost-cutting boosted the bottomline of India Inc by 105 per cent in FY21 over FY20, even though the topline declined 5 per cent.

- The tax cut has contributed 19 per cent to the topline of these companies during the pandemic with cement, tyre and consumer durables gaining in excess of 50 per cent.

- More importantly, 15 sectors led by refineries, steel, fertilisers, textiles, pharma, IT, mining, etc reduced their loan funds in the range of 6-64 per cent or to the tune of Rs 2.09 lakh crore in FY21, which again boosted their bottomline.

- The data of Department for Promotion of Industry and Internal Trade shows that the total FDI inflows in the first two quarters of 2019, before the corporate tax rate cuts, was $26.1 billion. In the last two quarters, FDI equity inflows stood at $23 billion. Clearly, the corporate tax rate cut has not led to any out-of-turn spurt in FDI.

Way forward:

- Tax cut simply as a concession to corporate houses rather than as a structural reform that could boost the wider economy.

- Current economic slowdown is due to the problem of insufficient demand which cannot be addressed just through tax cuts and instead advocate greater government spending to boost the economy.

- Lacklustre demand faced by sectors like automobiles is merely a symptom of supply-side shocks such as the goods and services tax that have affected various businesses and caused job losses. If so, tax cuts and other supply-side reforms can indeed help the economy recover from its slump.

- However, the government will also need to simultaneously enact along with these tax cuts other structural reforms that reduce entry barriers in the economy and make the marketplace more competitive. The government could, for instance, extend the tax cuts to smaller businesses.

Source: The Hindu BL

Mains Question:

Q. Do you agree that a reduction in the base corporate tax rate by the Taxation Laws (Amendment) Act, 2019 has enhanced private investment in Indian economy? Illustrate.

UPSC CSE MAINS 2021 GS-3 Question: