Date : 13/09/2023

Relevance – GS Paper 3 - Indian Economy

Keywords – UNCTAD, OECD, WTO, PMMY

Context

The integration of digital technologies is vital for enhancing the competitiveness of Micro, Small, and Medium Enterprises (MSMEs).

India's MSME Sector:

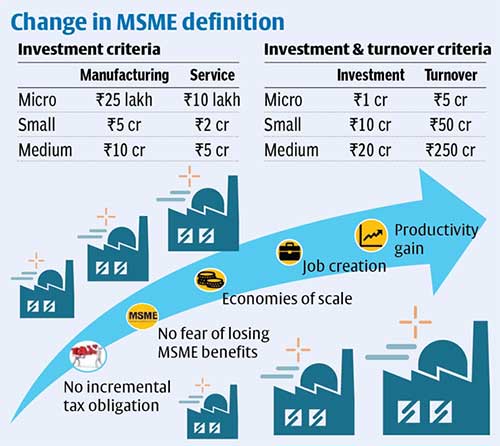

- Micro, Small, and Medium Enterprises (MSMEs) in India are categorized based on their investment size.

- These MSMEs make a substantial contribution, accounting for around 30 percent of the country's GDP.

- This sector plays a pivotal role in driving socio-economic development, particularly in semi-urban and rural areas, fostering entrepreneurship.

India's Global Digital Impact:

- India has outpaced advanced economies in terms of the speed and extent of digital transformations, both domestically and in exports.

- In 2016-17, India exported digitally delivered services worth $89 billion, as per a UNCTAD 2018 report.

- The OECD noted that India's share of global estimated digital trade exports surged by approximately 400 percent, growing from 1 percent in 1995 to nearly 4 percent in 2018.

MSMEs and Digital Services:

- With the projected growth of internet subscribers in India to reach 800 million by the end of 2023, small businesses are increasingly integrating digital services into their operations.

- These services include e-commerce platforms, social media for marketing and communication, and digital payment applications, among others.

- Indian MSMEs are also adopting digital service inputs like smartphone-based marketing and communication services to expand their market reach and strengthen customer relationships.

Challenges Faced by MSMEs:

1. Duty Moratorium:

- In 1998, the World Trade Organization (WTO) adopted a Declaration on global electronic commerce, which included a two-year moratorium on customs duties for cross-border electronic transmissions.

- This moratorium has been consistently renewed every two years, with the current extension set to expire on March 31, 2024.

- India has benefited from this moratorium, as it has facilitated services exports and imports.

- If the moratorium ends, it could disrupt various routine cross-border data transmissions, including semiconductor design information, software-as-a-service, and digital content like music, movies, books, and entertainment.

- The imposition of new tariffs on digital services could also disrupt supply chains and hinder the growth of MSMEs.

2. Rising NPAs of MSMEs:

- According to the Reserve Bank of India (RBI), bad loans among MSMEs now account for 9.6 percent of gross advances, compared to 8.2 percent in 2020.

- The MSME sector was severely affected by the pandemic, with many businesses either shutting down or facing financial distress due to the nationwide lockdown.

3. Non-availability and Delays in Funding:

- MSMEs face challenges such as mounting losses, debts, and difficulties in accessing financial support from the government.

- Banks have been hesitant to provide funding to MSMEs, and many of them rely on Non-Banking Financial Companies (NBFCs) for financing, which have also experienced liquidity issues since September 2018.

4. Lack of Formalization:

- A significant portion of manufacturing MSMEs in India, approximately 86 percent, operate without proper registration.

- Out of the 6.3 crore MSMEs, only around 1.1 crores are registered under the Goods and Services Tax (GST) regime, and the number of income tax filers is even lower.

The need for Tech enablement

Marketplaces and digital platforms play a dual role for MSMEs. Firstly, they provide a gateway to new markets, expanding their reach and customer base. Additionally, these platforms offer access to advanced technologies like cloud-based applications, automation, data analytics, and business intelligence. These tech tools empower MSMEs with deep insights into market trends and customer behaviors, enabling faster and informed decision-making, leading to increased sales and revenue.

While many MSMEs have embraced digitalization for local markets, it also opens doors to the global arena through borderless marketplaces. This international expansion enhances scalability and allows businesses to optimize their resources and costs. These online platforms, whether marketplaces, e-commerce platforms, or social media, offer features such as websites, rating systems, feedback mechanisms, payment tools, conversation tools, and trust certificates. These attributes quickly build credibility in the market, democratizing business opportunities for MSMEs regardless of their demographics.

In today's landscape, digital proficiency is imperative for businesses seeking to weather disruptions, build resilience, and strategically transform themselves. The importance of digitalization will only continue to grow. To harness the full advantages of online platforms, MSMEs need to enhance their commitment to digital strategies or assign dedicated resources to manage online marketing, customer interactions, platform engagement, and regulatory compliance.

Leveraging Digital Infrastructure for MSMEs’ Growth

While adopting newer technologies is essential for small and medium enterprises (MSMEs) to seize opportunities in today's evolving business landscape, technology alone cannot transform them into drivers of growth for India. MSMEs grapple with longstanding issues such as inadequate and untimely access to credit and financial resources. These challenges stem from the lack of sufficient collateral and low credit scores, forcing them to resort to unsecured loans with high interest rates. This not only affects the economic viability of their businesses but also hinders their expansion and adoption of new technology, leading to demotivation.

Hence, the emergence of digital financial services offers not only solutions to these hindrances but also promotes financial inclusion. India's digital commerce ecosystem is becoming increasingly interconnected and interoperable, creating a robust digital infrastructure that enhances the value of other digital services and fosters innovation. Government initiatives like Atmanirbhar Bharat Abhiyan, the allocation of Rs 15,700 crore in the Union Budget 2022-23, extension of the 'One District One Product' (ODOP) scheme to cover 7,500 new products, the Udyam Registration portal, and the launch of ONDC are steps toward building a strong digital infrastructure. Similarly, marketplaces like IndiaMART and GeM act as catalysts, facilitating MSMEs and further boosting this sector's growth.

Despite India's improved ranking in the World Bank's Ease of Doing Business Index, MSMEs in India require more comprehensive national-level support. They need a more favorable legal, regulatory, and administrative environment to thrive. E-commerce platforms and online marketplaces can serve as pivotal intermediaries for digital financial services by integrating payment and credit services into their interfaces and aggregating detailed data on MSMEs. This data allows them to gain insights into the risk profiles of specific groups and develop tailored financial products to address their unique requirements. Additionally, the government must expedite its efforts to assist this segment and promote the innovation of new technologies that offer personalized digital solutions and enable access to credit, given the intricate nature of the sector.

Government Initiatives Supporting MSMEs in India:

1. Pradhan Mantri MUDRA Yojana (PMMY):

- PMMY offers loans of up to Rs. 10 lakh through various Member Lending Institutions (MLIs) like banks, Non-Banking Financial Companies (NBFCs), Micro Financial Institutions (MFIs), and others.

- Loans are categorized into 'Shishu' (up to Rs. 50,000), 'Kishore' (above Rs. 50,000 and up to Rs. 5 lakh), and 'Tarun' (above Rs. 5 lakh and up to Rs. 10 lakh) to cater to the different growth stages and funding needs of borrowers.

2. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE):

- This scheme offers collateral-free credit to micro and small enterprises by providing a credit guarantee mechanism.

3. Stand Up India:

- It provides financial support to entrepreneurs from scheduled castes (SC), scheduled tribes (ST), and women to establish new enterprises.

4. Harmonizing Value Chains:

- The government aims to integrate India's value chains with global ones and streamline logistics to attract international companies into including India in their value chains.

5. Quality Assurance:

- The government is committed to elevating quality standards by setting global benchmarks, aligning Indian standards with international ones, and meeting the rising consumer demands for quality.

6. Comprehensive Economic Partnership Agreement (CEPA):

- CEPA facilitates MSMEs in India and the UAE to capitalize on the District as an export hub initiative.

- This initiative identifies unique products from various districts, promoting local products and stimulating local economies.

Way Forward

To facilitate the growth of small businesses in India and enable them to expand their customer base, policymakers should enact measures that simplify, rather than complicate and raise the cost of, accessing digital services, including international ones.

In line with the External Affairs Minister's proposal at the B20 Summit for a "more diversified and democratic" form of re-globalization, maintaining the moratorium on duties can support the emergence of Global South nations as producers.

Probable Questions for Mains Exam –

- India's MSME sector is considered a key driver of economic growth and socio-economic development. Discuss the role of digital technologies in enhancing the competitiveness of MSMEs and how government initiatives like Pradhan Mantri MUDRA Yojana are supporting their growth. (15 marks, 250 words)

- The extension of the moratorium on customs duties for cross-border electronic transmissions has been a topic of debate. Evaluate the potential impact on India's MSMEs if this moratorium were to expire, and suggest policy measures to mitigate these effects. (10 marks, 150 words)

Source – The Hindu Business Line