Brain-booster

/

07 Aug 2022

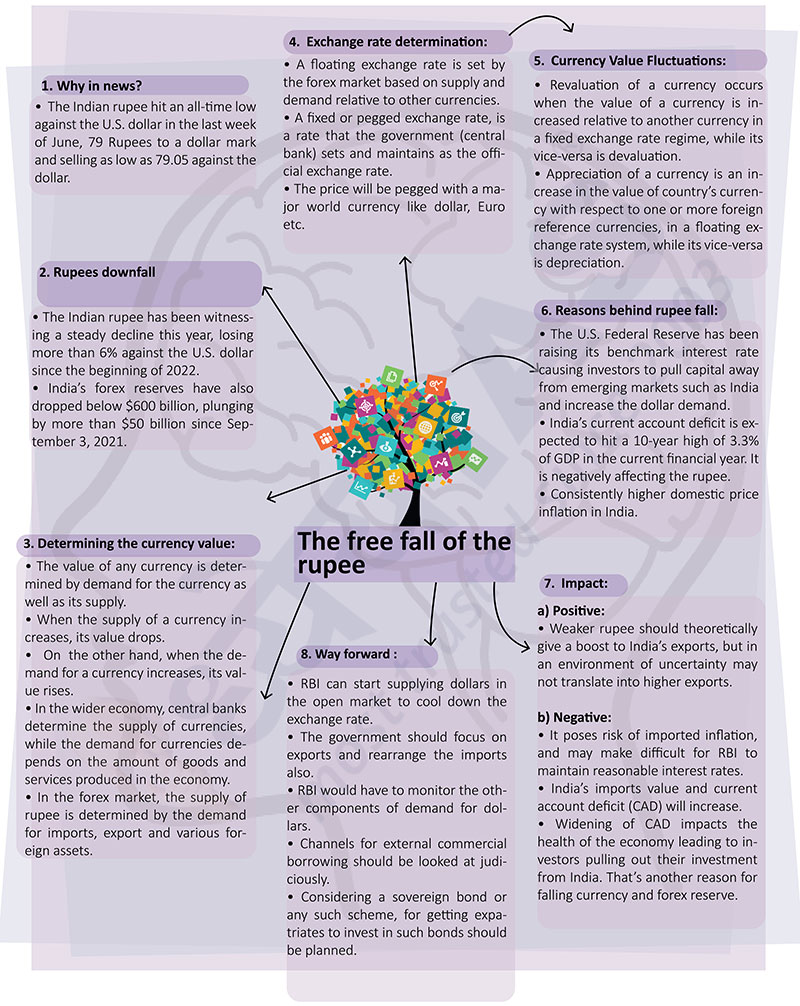

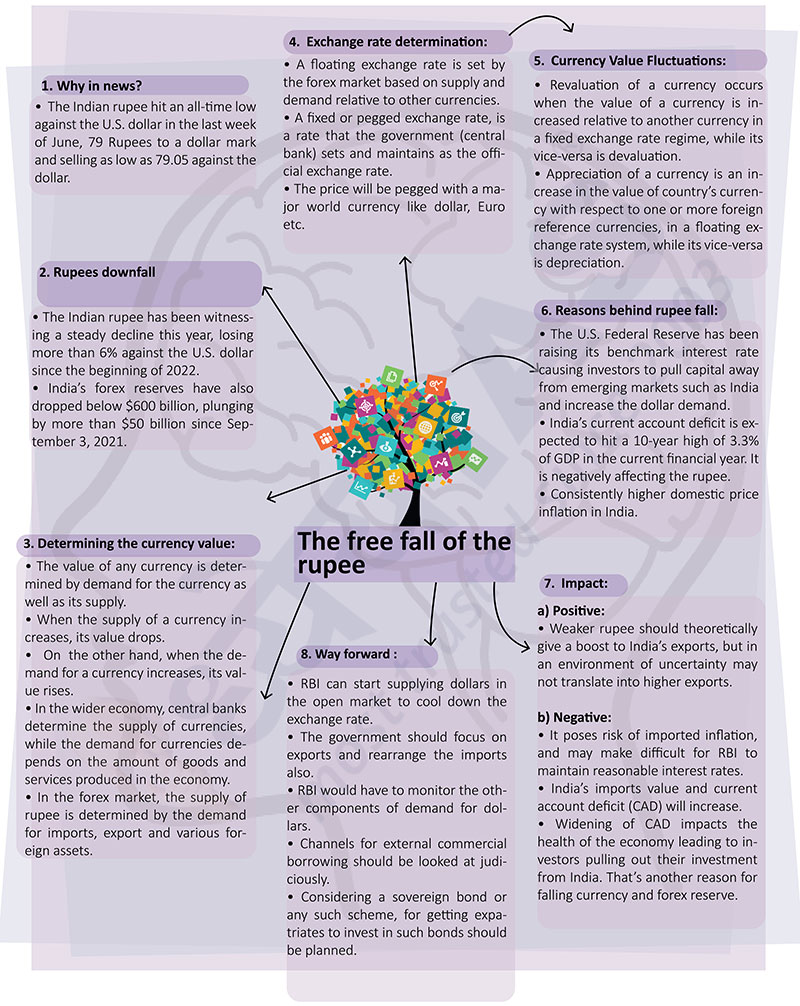

Brain Booster for UPSC & State PCS Examination (Topic: The free fall of the rupee)

Why in news?

- The Indian rupee hit an all-time low against the U.S. dollar in the last

week of June, 79 Rupees to a dollar mark and selling as low as 79.05

against the dollar.

Rupees downfall

- The Indian rupee has been witnessing a steady decline this year, losing

more than 6% against the U.S. dollar since the beginning of 2022.

- India’s forex reserves have also dropped below $600 billion, plunging by

more than $50 billion since September 3, 2021.

Determining the currency value:

- The value of any currency is determined by demand for the currency as

well as its supply.

- When the supply of a currency increases, its value drops.

- On the other hand, when the demand for a currency increases, its value

rises.

- In the wider economy, central banks determine the supply of currencies,

while the demand for currencies depends on the amount of goods and services

produced in the economy.

- In the forex market, the supply of rupee is determined by the demand for

imports, export and various foreign assets.

Exchange rate determination:

- A floating exchange rate is set by the forex market based on supply and

demand relative to other currencies.

- A fixed or pegged exchange rate, is a rate that the government (central

bank) sets and maintains as the official exchange rate.

- The price will be pegged with a major world currency like dollar, Euro

etc.

Currency Value Fluctuations:

- Revaluation of a currency occurs when the value of a currency is

increased relative to another currency in a fixed exchange rate regime,

while its vice-versa is devaluation.

- Appreciation of a currency is an increase in the value of country’s

currency with respect to one or more foreign reference currencies, in a

floating exchange rate system, while its vice-versa is depreciation.

Reasons behind rupee fall:

- The U.S. Federal Reserve has been raising its benchmark interest rate

causing investors to pull capital away from emerging markets such as India

and increase the dollar demand.

- India’s current account deficit is expected to hit a 10-year high of

3.3% of GDP in the current financial year. It is negatively affecting the

rupee.

- Consistently higher domestic price inflation in India.

Impact:

a) Positive:

- Weaker rupee should theoretically give a boost to India’s exports, but

in an environment of uncertainty may not translate into higher exports.

b) Negative:

- It poses risk of imported inflation, and may make difficult for RBI to

maintain reasonable interest rates.

- India’s imports value and current account deficit (CAD) will increase.

- Widening of CAD impacts the health of the economy leading to investors

pulling out their investment from India. That’s another reason for falling

currency and forex reserve.

Way forward :

- RBI can start supplying dollars in the open market to cool down the

exchange rate.

- The government should focus on exports and rearrange the imports also.

- RBI would have to monitor the other components of demand for dollars.

- Channels for external commercial borrowing should be looked at

judiciously.

- Considering a sovereign bond or any such scheme, for getting expatriates

to invest in such bonds should be planned.