Brain-booster

/

03 Apr 2023

Brain Booster for UPSC & State PCS Examination (Topic: SWAMIH Investment Fund)

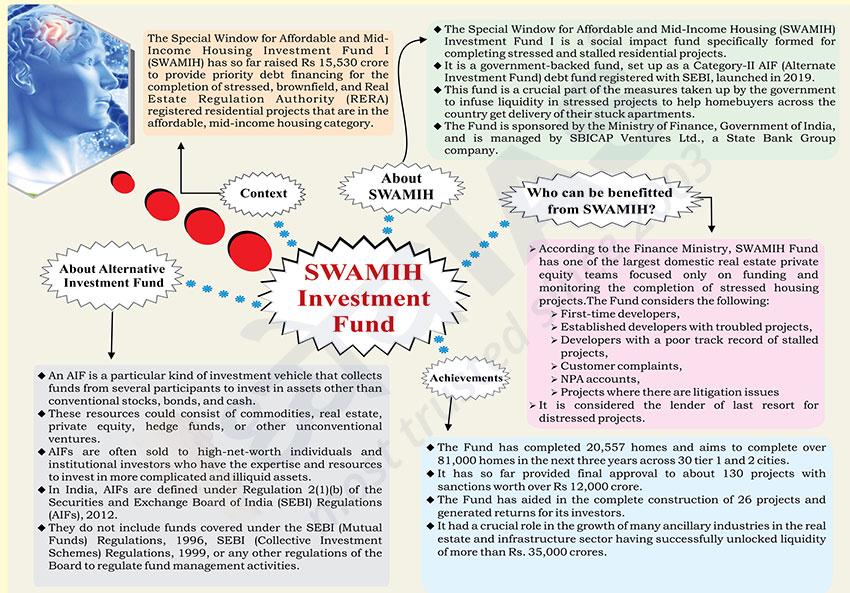

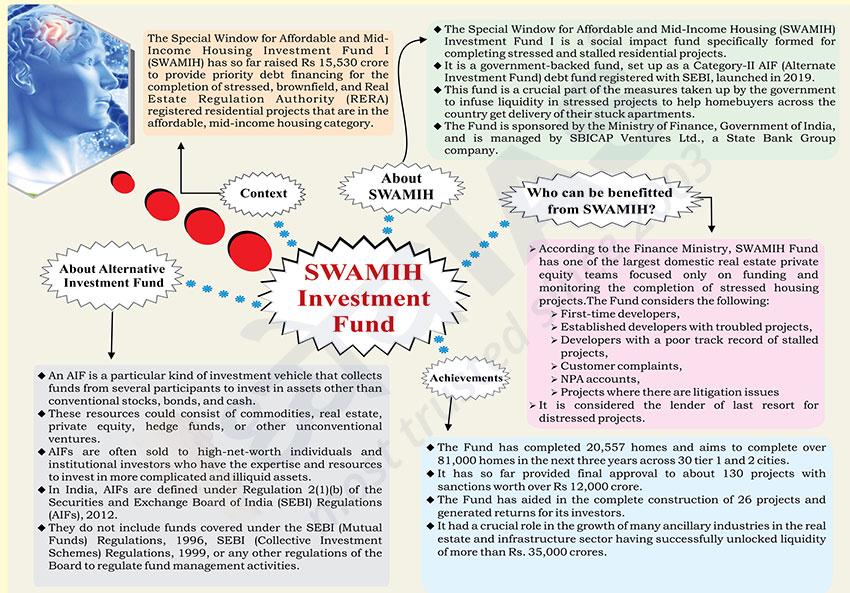

Context

- The Special Window for Affordable and Mid-Income Housing Investment Fund

I (SWAMIH) has so far raised Rs 15,530 crore to provide priority debt

financing for the completion of stressed, brownfield, and Real Estate

Regulation Authority (RERA) registered residential projects that are in the

affordable, mid-income housing category.

About SWAMIH

- The Special Window for Affordable and Mid-Income Housing (SWAMIH)

Investment Fund I is a social impact fund specifically formed for completing

stressed and stalled residential projects.

- It is a government-backed fund, set up as a Category-II AIF (Alternate

Investment Fund) debt fund registered with SEBI, launched in 2019.

- This fund is a crucial part of the measures taken up by the government

to infuse liquidity in stressed projects to help homebuyers across the

country get delivery of their stuck apartments.

- The Fund is sponsored by the Ministry of Finance, Government of India,

and is managed by SBICAP Ventures Ltd., a State Bank Group company.

Who can be benefitted from SWAMIH?

- According to the Finance Ministry, SWAMIH Fund has one of the largest

domestic real estate private equity teams focused only on funding and

monitoring the completion of stressed housing projects.The Fund considers

the following:

- First-time developers,

- Established developers with troubled projects,

- Developers with a poor track record of stalled projects,

- Customer complaints,

- NPA accounts,

- Projects where there are litigation issues

- It is considered the lender of last resort for distressed projects.

Achievements

- The Fund has completed 20,557 homes and aims to complete over 81,000

homes in the next three years across 30 tier 1 and 2 cities.

- It has so far provided final approval to about 130 projects with

sanctions worth over Rs 12,000 crore.

- The Fund has aided in the complete construction of 26 projects and

generated returns for its investors.

- It had a crucial role in the growth of many ancillary industries in the

real estate and infrastructure sector having successfully unlocked liquidity

of more than Rs. 35,000 crores.

About Alternative Investment Fund

- An AIF is a particular kind of investment vehicle that collects funds

from several participants to invest in assets other than conventional

stocks, bonds, and cash.

- These resources could consist of commodities, real estate, private

equity, hedge funds, or other unconventional ventures.

- AIFs are often sold to high-net-worth individuals and institutional

investors who have the expertise and resources to invest in more complicated

and illiquid assets.

- In India, AIFs are defined under Regulation 2(1)(b) of the Securities

and Exchange Board of India (SEBI) Regulations (AIFs), 2012.

- They do not include funds covered under the SEBI (Mutual Funds)

Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999,

or any other regulations of the Board to regulate fund management

activities.