Brain-booster

/

05 Dec 2022

Brain Booster for UPSC & State PCS Examination (Topic: SEBI Framework for Online Bond Providers)

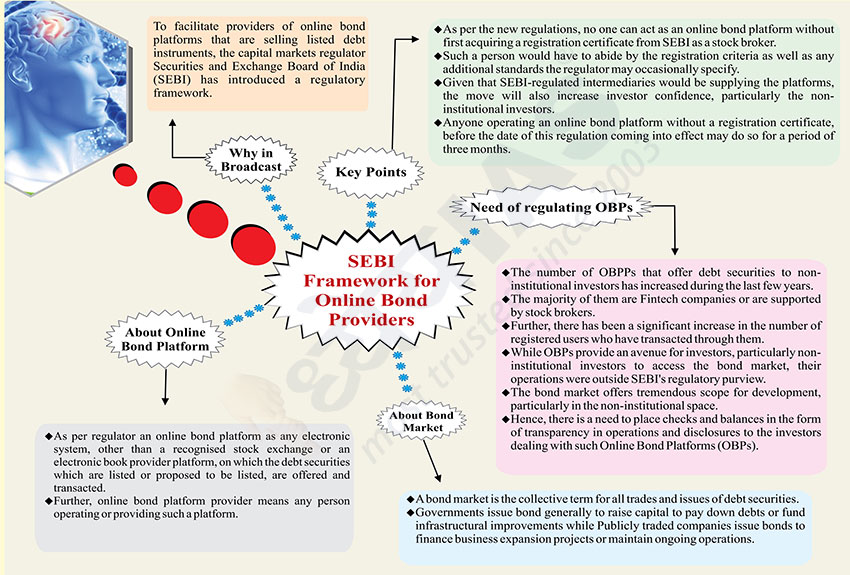

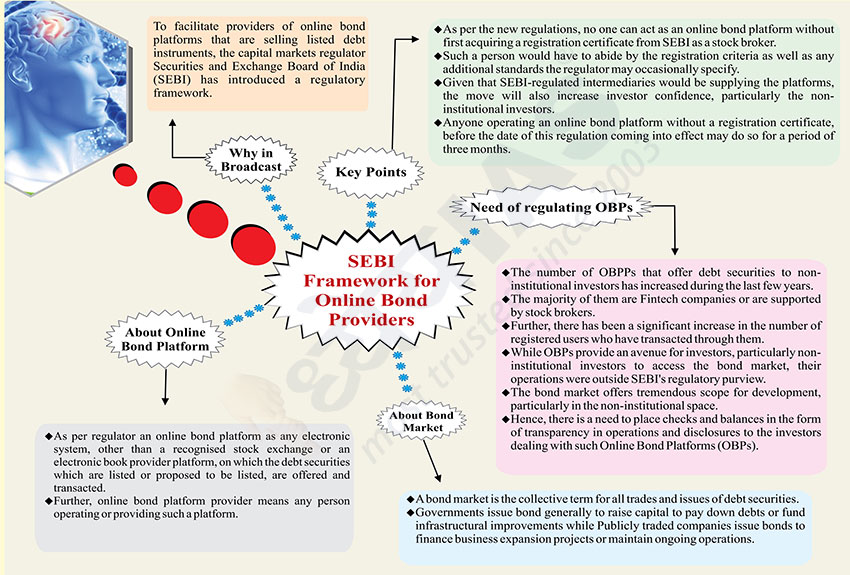

Why in Broadcast?

- To facilitate providers of online bond platforms that are selling listed

debt instruments, the capital markets regulator Securities and Exchange

Board of India (SEBI) has introduced a regulatory framework.

Key Points

- As per the new regulations, no one can act as an online bond platform

without first acquiring a registration certificate from SEBI as a stock

broker.

- Such a person would have to abide by the registration criteria as well

as any additional standards the regulator may occasionally specify.

- Given that SEBI-regulated intermediaries would be supplying the

platforms, the move will also increase investor confidence, particularly the

noninstitutional investors.

- Anyone operating an online bond platform without a registration

certificate, before the date of this regulation coming into effect may do so

for a period of three months.

Need of regulating OBPs

- The number of OBPPs that offer debt securities to noninstitutional

investors has increased during the last few years.

- The majority of them are Fintech companies or are supported by stock

brokers.

- Further, there has been a significant increase in the number of

registered users who have transacted through them.

- While OBPs provide an avenue for investors, particularly

noninstitutional investors to access the bond market, their operations were

outside SEBI's regulatory purview.

- The bond market offers tremendous scope for development, particularly in

the non-institutional space.

- Hence, there is a need to place checks and balances in the form of

transparency in operations and disclosures to the investors dealing with

such Online Bond Platforms (OBPs).

About Bond Market

- A bond market is the collective term for all trades and issues of debt

securities.

- Governments issue bond generally to raise capital to pay down debts or

fund infrastructural improvements while Publicly traded companies issue

bonds to finance business expansion projects or maintain ongoing operations.

About Online Bond Platform

- As per regulator an online bond platform as any electronic system, other

than a recognised stock exchange or an electronic book provider platform, on

which the debt securities which are listed or proposed to be listed, are

offered and transacted.

- Further, online bond platform provider means any person operating or

providing such a platform.