Brain-booster

/

15 Feb 2022

Brain Booster for UPSC & State PCS Examination (Topic: GST Compensation)

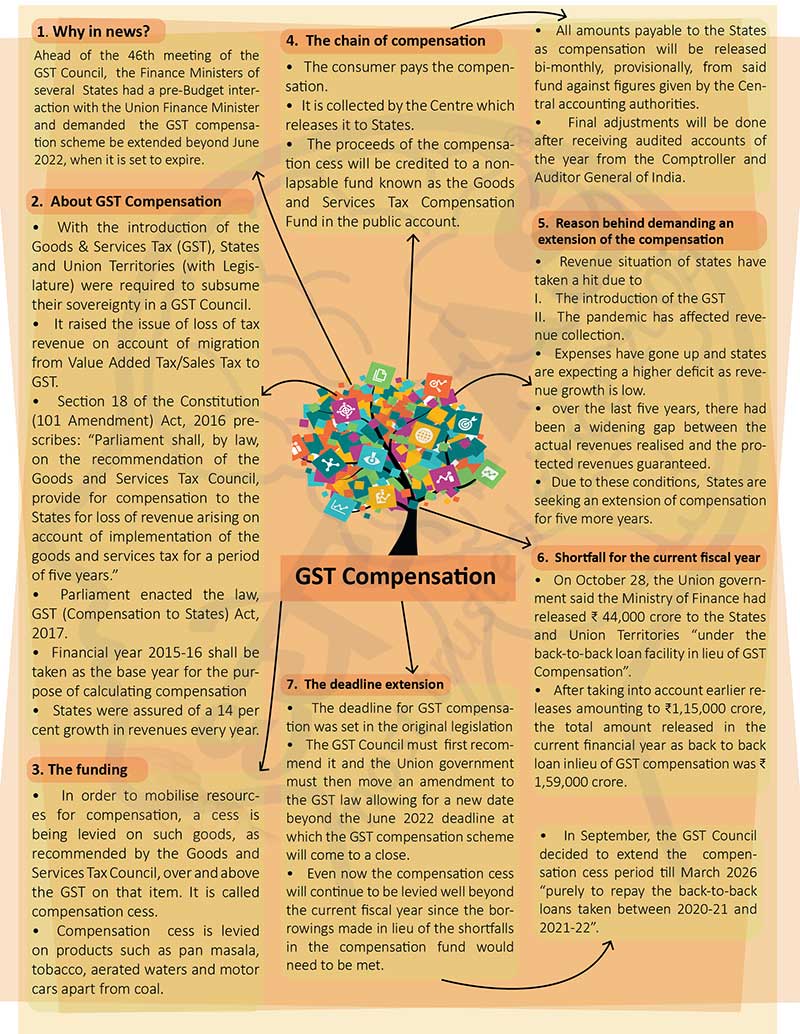

Why in news?

- Ahead of the 46th meeting of the GST Council, the Finance Ministers of

several States had a pre-Budget interaction with the Union Finance Minister

and demanded the GST compensation scheme be extended beyond June 2022, when

it is set to expire.

About GST Compensation

- With the introduction of the Goods & Services Tax (GST), States and

Union Territories (with Legislature) were required to subsume their

sovereignty in a GST Council.

- It raised the issue of loss of tax revenue on account of migration from

Value Added Tax/Sales Tax to GST.

- Section 18 of the Constitution (101 Amendment) Act, 2016 prescribes:

“Parliament shall, by law, on the recommendation of the Goods and Services

Tax Council, provide for compensation to the States for loss of revenue

arising on

account of implementation of the goods and services tax for a period of five

years.”

- Parliament enacted the law, GST (Compensation to States) Act, 2017.

- Financial year 2015-16 shall be taken as the base year for the purpose

of calculating compensation

- States were assured of a 14 per cent growth in revenues every year.

The funding

- In order to mobilise resources for compensation, a cess is being levied

on such goods, as recommended by the Goods and Services Tax Council, over

and above the GST on that item. It is called compensation cess.

- Compensation cess is levied on products such as pan masala, tobacco,

aerated waters and motor cars apart from coal.

The chain of compensation

- The consumer pays the compensation.

- It is collected by the Centre which releases it to States.

- The proceeds of the compensation cess will be credited to a nonlapsable

fund known as the Goods and Services Tax Compensation Fund in the public

account.

- All amounts payable to the States as compensation will be released

bi-monthly, provisionally, from said fund against figures given by the

Central accounting authorities.

- Final adjustments will be done after receiving audited accounts of the

year from the Comptroller and Auditor General of India.

Reason behind demanding an extension of the compensation

- Revenue situation of states have taken a hit due to

- The introduction of the GST

- The pandemic has affected revenue collection.

- Expenses have gone up and states are expecting a higher deficit as

revenue growth is low.

- over the last five years, there had been a widening gap between the

actual revenues realised and the protected revenues guaranteed.

- Due to these conditions, States are seeking an extension of compensation

for five more years.

Shortfall for the current fiscal year

- On October 28, the Union government said the Ministry of Finance had

released ₹ 44,000 crore to the States and Union Territories “under the

back-to-back loan facility in lieu of GST Compensation”.

- After taking into account earlier releases amounting to ₹1,15,000 crore,

the total amount released in the current financial year as back to back loan

inlieu of GST compensation was ₹ 1,59,000 crore.

The deadline extension

- The deadline for GST compensation was set in the original legislation

- The GST Council must first recommend it and the Union government must

then move an amendment to the GST law allowing for a new date beyond the

June 2022 deadline at which the GST compensation scheme will come to a

close.

- Even now the compensation cess will continue to be levied well beyond

the current fiscal year since the borrowings made in lieu of the shortfalls

in the compensation fund would need to be met.

- In September, the GST Council decided to extend the compensation cess

period till March 2026 “purely to repay the back-to-back loans taken between

2020-21 and 2021-22”.