Brain-booster

/

21 Oct 2023

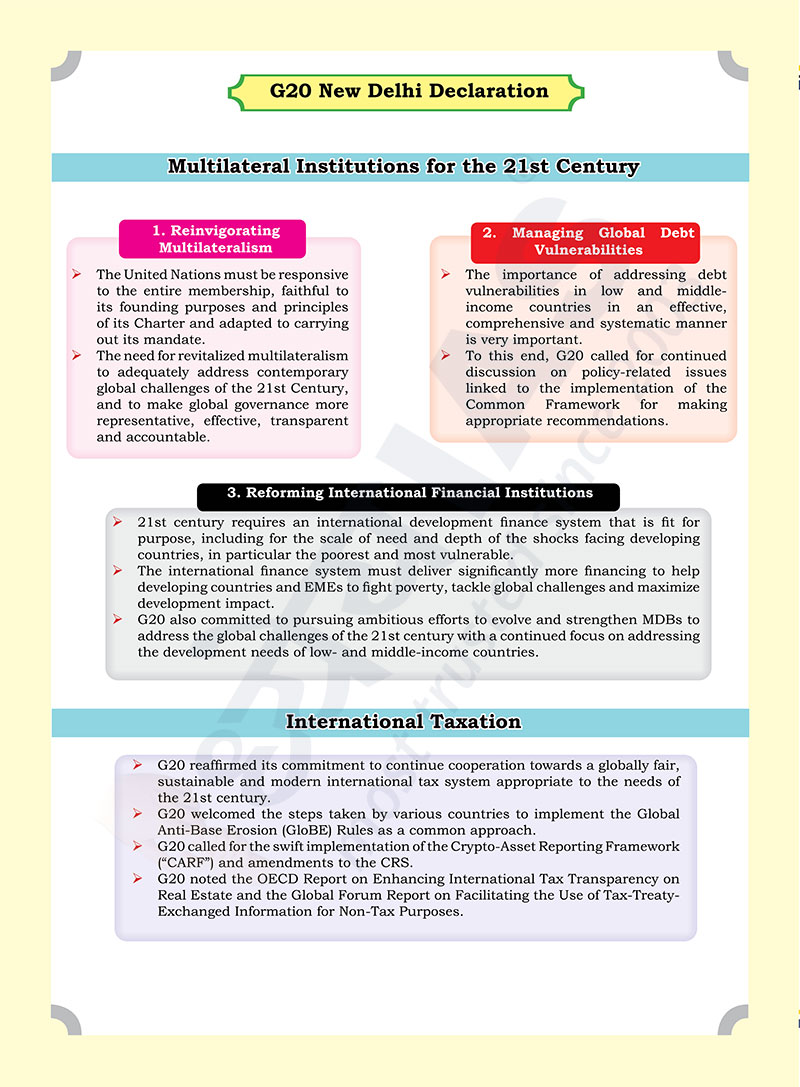

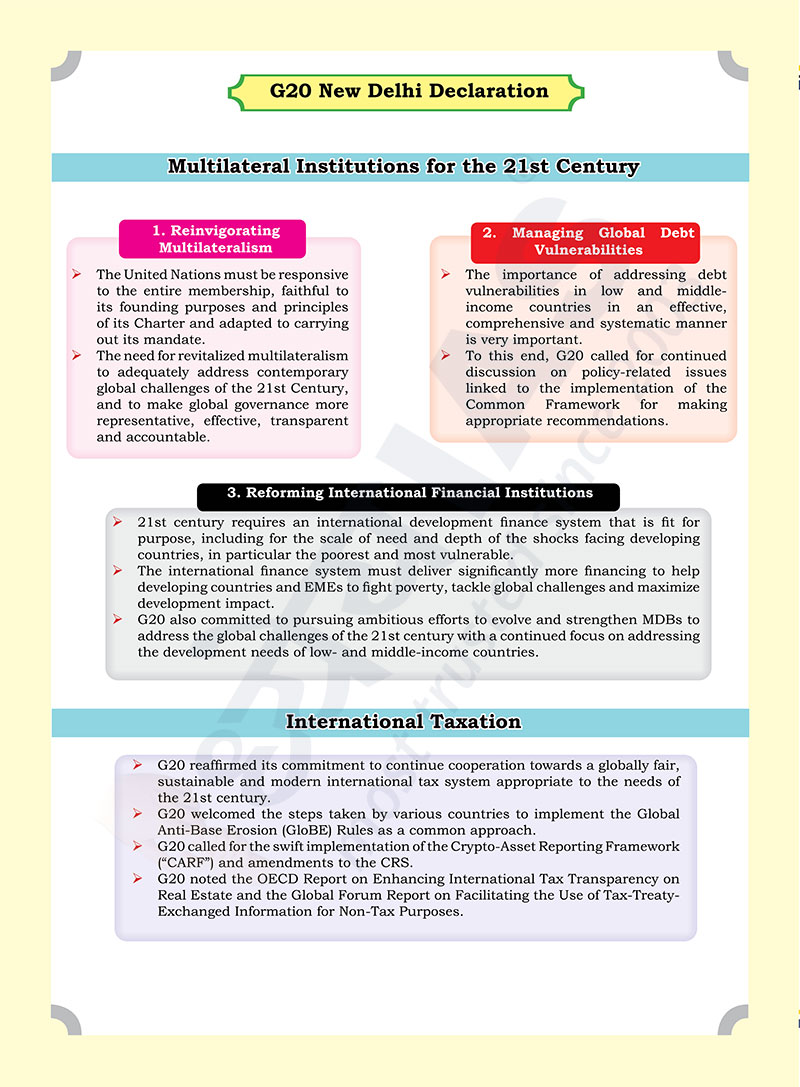

Brain Booster for UPSC & State PCS Examination (Topic: G20 New Delhi Declaration : Multilateral Institutions for the 21st Century)

1. Reinvigorating Multilateralism

- The United Nations must be responsive to the entire membership, faithful

to its founding purposes and principles of its Charter and adapted to

carrying out its mandate.

- The need for revitalized multilateralism to adequately address

contemporary global challenges of the 21st Century, and to make global

governance more representative, effective, transparent and accountable.

2. Managing Global Debt Vulnerabilities

- The importance of addressing debt vulnerabilities in low and

middleincome countries in an effective, comprehensive and systematic manner

is very important.

- To this end, G20 called for continued discussion on policy-related

issues linked to the implementation of the Common Framework for making

appropriate recommendations.

3. Reforming International Financial Institutions

- 21st century requires an international development finance system that

is fit for purpose, including for the scale of need and depth of the shocks

facing developing countries, in particular the poorest and most vulnerable.

- The international finance system must deliver significantly more

financing to help developing countries and EMEs to fight poverty, tackle

global challenges and maximize development impact.

- G20 also committed to pursuing ambitious efforts to evolve and

strengthen MDBs to address the global challenges of the 21st century with a

continued focus on addressing the development needs of low- and

middle-income countries.

International Taxation

- G20 reaffirmed its commitment to continue cooperation towards a globally

fair, sustainable and modern international tax system appropriate to the

needs of the 21st century.

- G20 welcomed the steps taken by various countries to implement the

Global Anti-Base Erosion (GloBE) Rules as a common approach.

- G20 called for the swift implementation of the Crypto-Asset Reporting

Framework (“CARF”) and amendments to the CRS.

- G20 noted the OECD Report on Enhancing International Tax Transparency on

Real Estate and the Global Forum Report on Facilitating the Use of

Tax-Treaty-Exchanged Information for Non-Tax Purposes.