Brain-booster

/

05 Feb 2023

Brain Booster for UPSC & State PCS Examination (Topic: Financial Services Institutions Bureau)

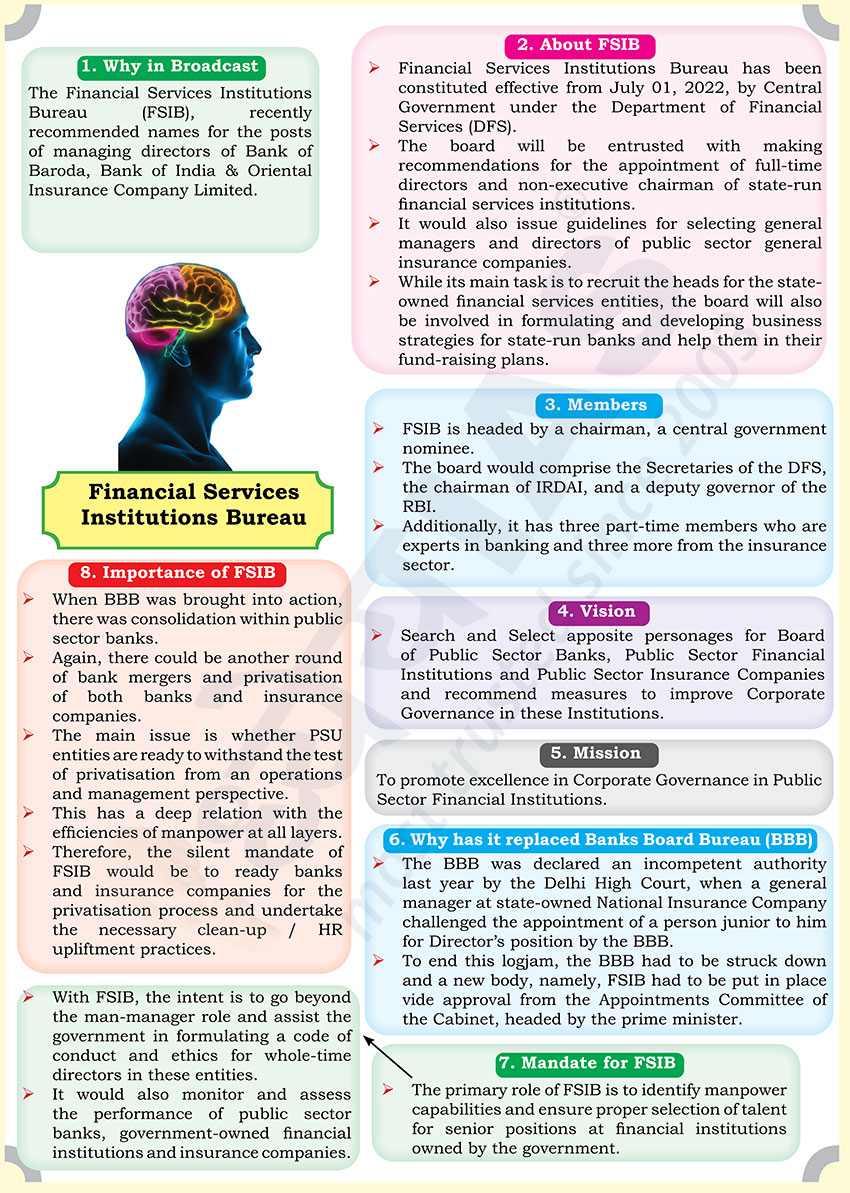

Why in Broadcast?

- The Financial Services Institutions Bureau (FSIB), recently recommended

names for the posts of managing directors of Bank of Baroda, Bank of India &

Oriental Insurance Company Limited.

About FSIB

- Financial Services Institutions Bureau has been constituted effective

from July 01, 2022, by Central Government under the Department of Financial

Services (DFS).

- The board will be entrusted with making recommendations for the

appointment of full-time directors and non-executive chairman of state-run

financial services institutions.

- It would also issue guidelines for selecting general managers and

directors of public sector general insurance companies.

- While its main task is to recruit the heads for the stateowned financial

services entities, the board will also be involved in formulating and

developing business strategies for state-run banks and help them in their

fund-raising plans.

Members

- FSIB is headed by a chairman, a central government nominee.

- The board would comprise the Secretaries of the DFS, the chairman of

IRDAI, and a deputy governor of the RBI.

- Additionally, it has three part-time members who are experts in banking

and three more from the insurance sector.

Vision

- Search and Select apposite personages for Board of Public Sector Banks,

Public Sector Financial Institutions and Public Sector Insurance Companies

and recommend measures to improve Corporate Governance in these

Institutions.

Mission

- To promote excellence in Corporate Governance in Public Sector Financial

Institutions.

Why has it replaced Banks Board Bureau (BBB)

- The BBB was declared an incompetent authority last year by the Delhi

High Court, when a general manager at state-owned National Insurance Company

challenged the appointment of a person junior to him for Director’s position

by the BBB.

- To end this logjam, the BBB had to be struck down and a new body,

namely, FSIB had to be put in place vide approval from the Appointments

Committee of the Cabinet, headed by the prime minister.

Mandate for FSIB

- The primary role of FSIB is to identify manpower capabilities and ensure

proper selection of talent for senior positions at financial institutions

owned by the government.

- With FSIB, the intent is to go beyond the man-manager role and assist

the government in formulating a code of conduct and ethics for whole-time

directors in these entities.

- It would also monitor and assess the performance of public sector banks,

government-owned financial institutions and insurance companies.

Importance of FSIB

- When BBB was brought into action, there was consolidation within public

sector banks.

- Again, there could be another round of bank mergers and privatisation of

both banks and insurance companies.

- The main issue is whether PSU entities are ready to withstand the test

of privatisation from an operations and management perspective.

- This has a deep relation with the efficiencies of manpower at all

layers.

- Therefore, the silent mandate of FSIB would be to ready banks and

insurance companies for the privatisation process and undertake the

necessary clean-up / HR upliftment practices.